Highlights:

- Certification issuance at monthly record high: USD6bn

- Debut Certified Climate Bonds from Auckland Council, KBC and NAB’s Low Carbon Shared Portfolio platform

- Largest solar securitisation to date issued by Vivint Solar (US)

- 18 debut issuers from 9 countries in June

- Fannie Mae published Green MBS deals for April and May: USD3.7bn

Stop Press! Webinar - The Green Bond Pledge– Joint US Briefing with CDP. What Issuers, cities and Municipalities need to know. Thursday 26th July. 12:00 PM EDT/09:00 AM PDT/17:00 PM BST Register here.

Go here to see the full list of new and repeat issuers in June.

June at a glance

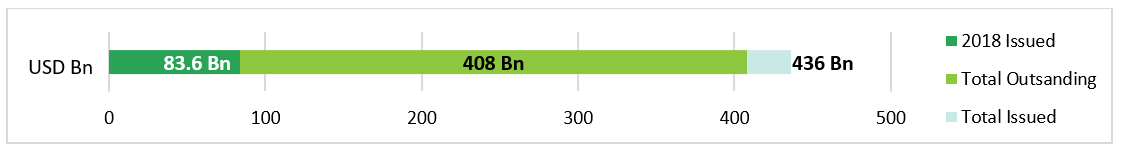

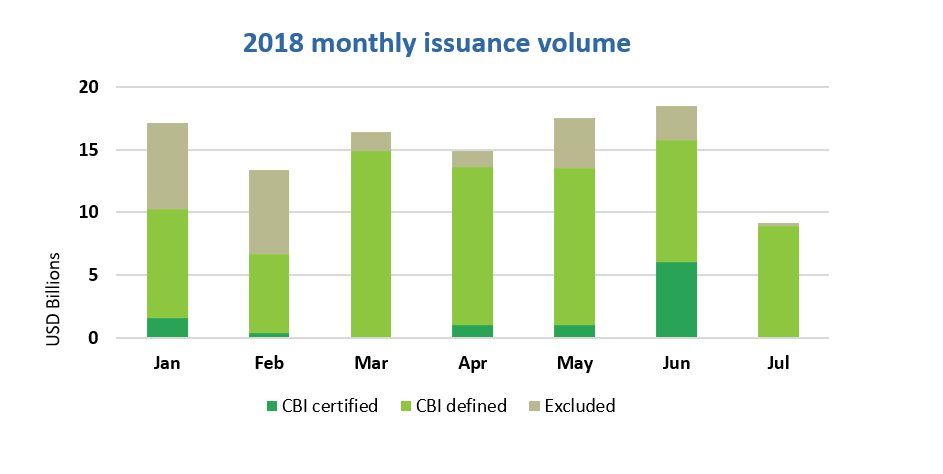

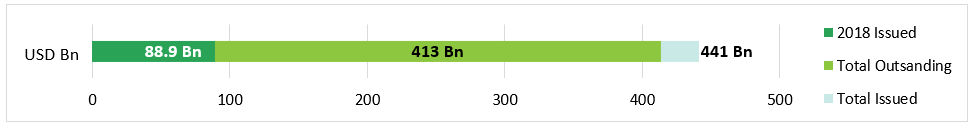

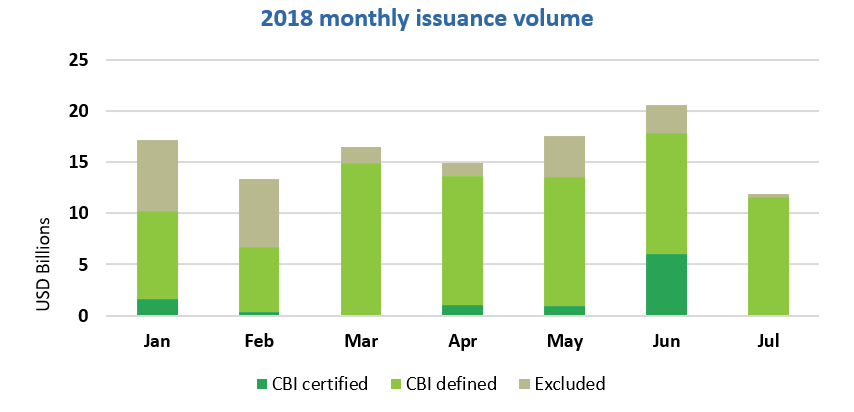

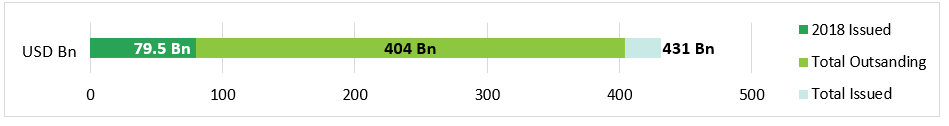

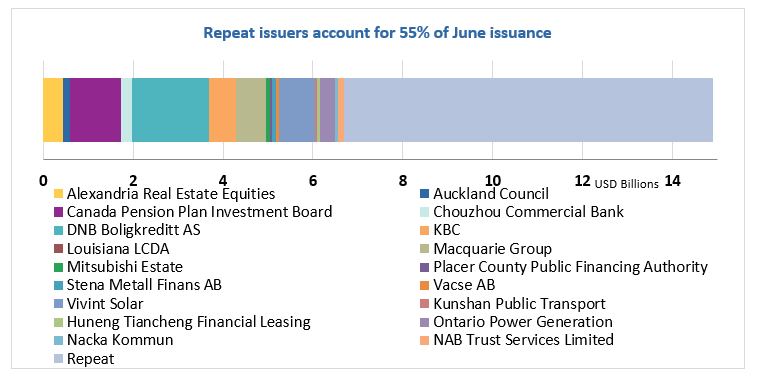

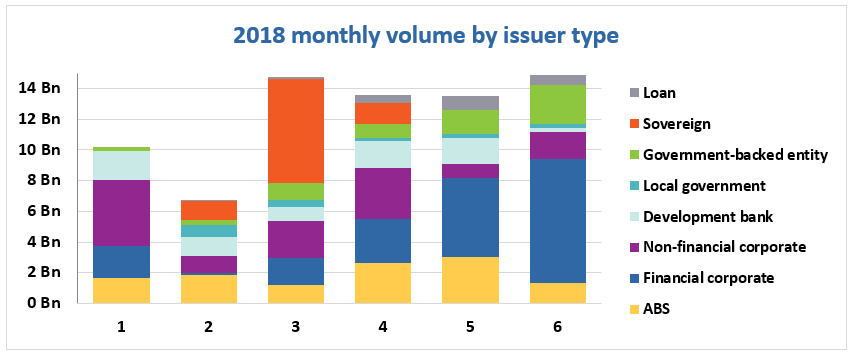

Green bond issuance in June totalled USD14.9bn, bringing year to date volume to almost USD80bn or half of the record 2017 issuance of USD161bn. The monthly issuance represents a 12% increase year-on-year, and Fannie Mae’s Green MBS deals from June have yet to be included.

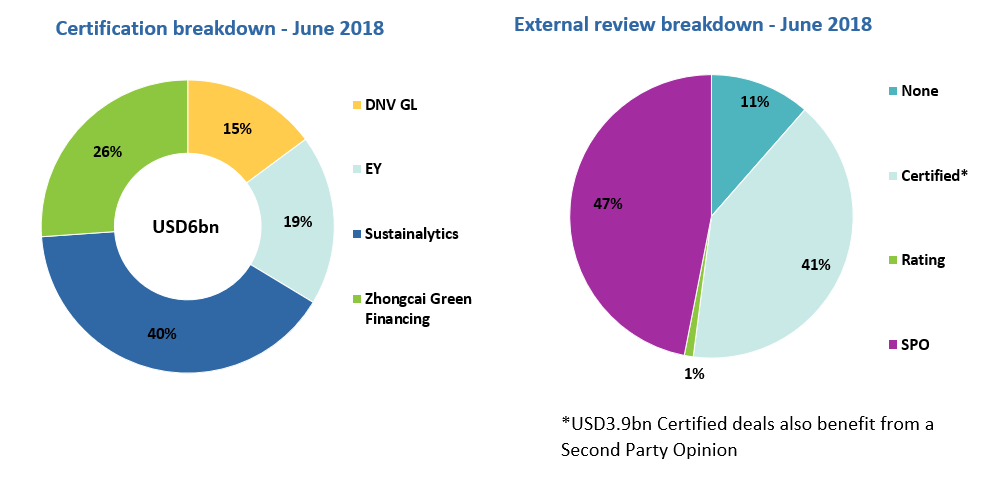

Certified issuance reached a new monthly high at USD6bn – 40% of June volumes – with debut Certified Climate Bonds coming from Auckland Council (New Zealand), KBC (Belgium) and NAB Trust Services Limited (Australia). Sustainalytics verified the majority of deals (40%), followed by Zhongcai Green Financing (26%). Overall, 89% of June deals benefited from an external review, and 73% of the reviews included a Second Party Opinion.

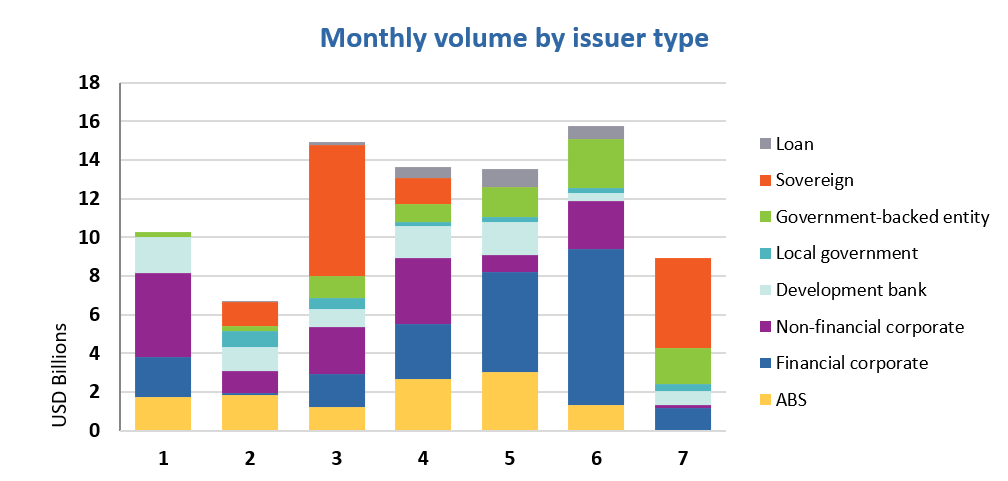

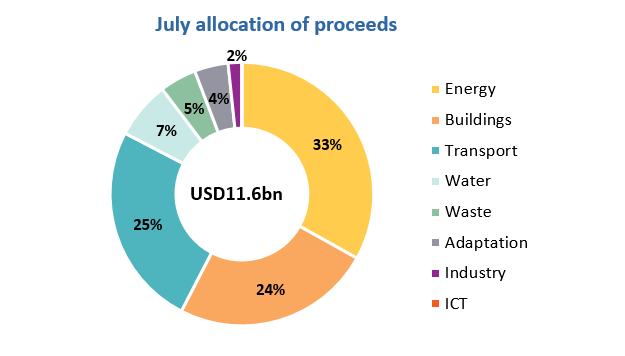

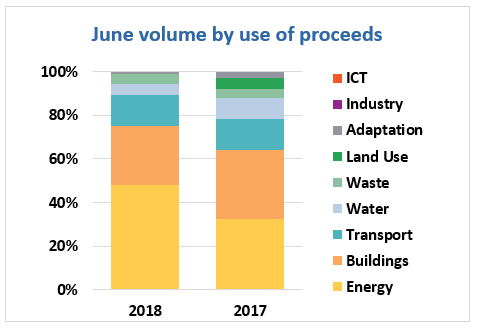

Over half the issuance came from financial corporates. Top issuer was the world’s No.1 bank, ICBC from China, accounting for 16% of monthly volume, followed by DNB Boligkreditt (12%) and TenneT Holdings (10%). Energy keeps topping use of proceeds allocations at 48%, with Buildings and Transport at 26% and 14% respectively.

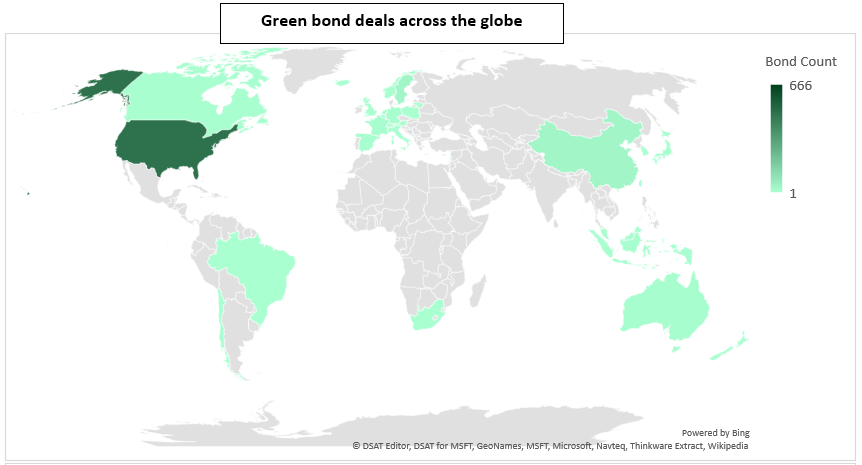

China has continued to lead the country rankings, representing 26% of monthly issuance compared to 8% in 2017. The remaining issuance came from Developed Markets, with over a third of volumes coming from the US, Norway and Australia combined.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issuer deal sheet in the online bond library.

Certified Climate Bonds

Auckland Council (NZD200m/USD136m), New Zealand, issued a debut senior secured green bond – the first green bond from New Zealand local government and second in short order from the Shaky Isles following a Certified transaction from Contact Energy.

The Auckland retail bond is also New Zealand’s first green bond to obtain a Pre-Issuance Certification under the Climate Bonds Standard. It is secured by a charge over all current and future rates revenues of the Council, on a pari pasu basis with other Council bonds.

The bond proceeds will be used for rail infrastructure electrification, particularly passenger trains, that meet the Climate Bonds Standard Low Carbon Transport Criteria. However, the Green Bond Framework includes a wider range of eligible sectors, including renewable energy, low carbon buildings and upgrades meeting at least standards such as NABERSNZ excellent, low carbon transport (buses, bus rapid transit, commuter rail, hybrid cars with a GHG emissions threshold of 75 gCO2/passenger), water and waste management, sustainable forestry, adaptation and energy efficiency projects related to the categories.

EY provided the Pre-Issuance Verification Report.

Auckland Council’s bond takes New Zealand’s green bond market total to USD1.5bn, with 100% Certified issuance.

KBC (EUR500m/USD582m), Belgium, issued a 5-year Certified Climate Bond, becoming the first Belgian financial corporate to enter the green bond market. The inaugural deal obtained certification under the Solar, Wind, Marine Renewable Energy, Low Carbon Buildings (Residential) Criteria of the Climate Bonds Standard. Proceeds will finance solar, onshore and offshore wind, as well as loans for new residential properties in the Flemish region. To be eligible, properties must comply with the requirements of the Flemish Region’s building code from 2014 or later (specifically, E-level ≤ 60) and the first loan drawdown must have occurred after 1 January 2016.

In Belgium, new or renovated buildings have to fulfil Energy Performance requirements and the most important requirement is the E-Level. This is defined as the annual primary energy consumption of the property divided by a reference consumption. The lower the E-Level, the more efficient the property. The minimum required by law in Belgium is E-Level<100, so an E-Level of <60 is quite efficient.

Eligible categories under the Green Bond Framework include geothermal energy, sustainable biomass and waste to energy, low carbon transport, waste management and recycling, water management and sustainable land use. On the property side, it allows for green energy loans for retail clients, where at least 50% of home improvements enhance energy performance, and for loans on commercial real estate, where the property is in the top 15% in terms of energy performance for the country, or buildings have obtained at least LEED Gold, REEAM Very Good or HQE Excellent certification.

Sustainalytics provided the Pre-Issuance Verification Report.

NAB Trust Services Limited (AUD200m/USD148m), Australia, issued notes secured on the NAB Low Carbon Shared Portfolio. The closed-end investment vehicle holds up to 70-75% of a pool of eight AUD-denominated loans. The loans were originated by NAB to fund seven existing wind and large-scale solar projects in Australia and partially sold down to the investment vehicle. The underlying assets are eligible projects under the Climate Bonds Standard Solar and Wind Criteria and were verified for inclusion in the NAB Climate Bond portfolio. NAB retains and has committed to hold the remaining portion of the loans to ensure alignment of interest with investors.

The underlying assets backing the NAB LCSP Notes were verified by DNV GL, who provided the Pre-Issuance Verification Report.

NAB has continued the best international practice approach of 100% Climate Bonds Certification that characterises multiple green bond issuance from Australia’s banking sector. Well done!

New issuers

Alexandria Real Estate Equities (USD450m), a US REIT, issued a debut senior unsecured green bond with a 5.6-year tenor. Proceeds will finance new, existing or upgraded buildings that have are expected or have obtained a minimum LEED Gold certification.

Climate Bonds view: Obtaining external reviews and establishing a reporting process is best practice in the market and it would be good to see issuers measuring up.

Huneng Tiancheng Financial Leasing (CNY400m/USD62m), China, issued a 3-year green private placement. Proceeds will be used to finance and refinance purchases of wind turbines which are going to be leased to several wind farm operators in China.

Climate Bonds view: Financial leases are often used by businesses for expensive equipment, providing a finance solution for small and medium sized companies operating large scale low carbon projects. We support the use of green bonds by financial leasing companies to fund the purchase of green assets such as wind turbines or solar panels in their arrangements with actual operators (lessees).

Kunshan Public Transport (CNY280m/USD42m), China, issued a 4-tranche debut green ABS (longest dated bond: 3 years). The deal features three senior tranches totalling CNY260m and a subordinated tranche of CNY20m. China Chengxin Credit Rating Company awarded the deal a G-1 green rating (review not publicly available). The issuer will use bus fare receivables from more than 200 routes as underlying collateral for the deal and all proceeds will be allocated to the purchase of low carbon emission buses and fleet operations.

Climate Bonds view: This is the 3rd green ABS issued by a bus operator in China. Wuxi Communication Industry Group and Guiyang Public Transportation issued the same type of deal to upgrade local fleets.

Mitsubishi Estate (JPY10bn/USD91m), Japan, issued a 5-year green bond, which benefits from a Sustainalytics Second Party Opinion and achieved a GA1 Green Bond Assessment from R&I (Japan). Proceeds will finance the construction of the Tokyo Tokiwabashi Project Tower-A, which will comprise mainly offices, stores and parking. The project is expected to receive a 4 or 5 star rating under the DBJ Green Building Certification.

Climate Bonds view: A 4-star DBJ Green Building Certification is on the high end of the certification scale. Targeting top-level energy performance would be a further benefit.

Nacka Kommun (SEK500m/USD57m), Sweden, issued a 4-year green bond, which benefits from a CICERO Second Party Opinion (not publicly available). The municipality’s Green Bond Framework lists a range of eligible categories including renewable energy assets, clean transport, waste and water management, adaptation and energy efficiency measures that reduce energy consumption by at least 25%. For new buildings, the eligibility criteria are: certification of at least Miljöbyggnad Silver, BREEAM/BREEAM in-use Very Good or the Nordic Swan Ecolabel, or at least 25% lower energy consumption per m2 compared to current regulations. Building upgrades need to target at least 35% reduction in energy consumption KWh/m2/year to qualify.

Climate Bonds view: This is the second Swedish municipality to enter the green bond market in 2018. Local governments now account for USD2.5bn or 17% of the country’s total green bond issuance.

Ontario Power Generation (CAD450m/USD339m), Canada, issued a 30-year debut green bond, which benefits from a Sustainalytics Second Party Opinion. The deal will finance the construction of new run-of-river hydro projects or upgrades/modernisations/maintenance of existing hydro.

Specific eligible projects identified by the issuer include:

- Refinancing the construction of the Peter Sutherland Sr. Generating Station – 28 MW hydroelectric station on New Post Creek (Ontario);

- Refurbishing the Ranney Falls Generating Station to add a 10MW unit, expected to become operational in Q4 2019.

The Green Bond Framework also includes solar and wind under the renewable energy category, transportation efficiency and electrification, industrial efficiency eco-efficient products. Nuclear technologies and fossil fuel-based power generation are explicitly excluded from the eligibility criteria.

Climate Bonds view: The power density and GHG emissions for the new Peter Sutherland Sr. Generating Station have not been disclosed at this stage. We will keep monitoring the impact reporting for this information in the future.

Placer County Public Financing Authority (USD40m), California, issued a two-tranche USD35m green US Muni bond and a USD5m green private placement, all with a 20.3-year tenor. According to the prospectus, bond proceeds will be used to refinance outstanding loans and revenue bonds financing the County’s mPower Placer Program. The program is the equivalent of a PACE program and aims at financing renewable energy, energy efficiency and water conservation improvements in residential and commercial buildings.

Climate Bonds view: This is the first US Muni using green bonds to finance its PACE program. We hope to see more municipalities following suit to scale up PACE loan availability.

Svenska Handelsbanken (EUR500m/USD583m), Sweden, issued a 5-year senior unsecured green bond, which benefits from a CICERO Second Party Opinion. Proceeds can be allocated to renewable energy, clean transport, waste and water management, green buildings or sustainable forestry. Green buildings can qualify if certified at Miljöbyggna Silver, BREEAM-SE Very Good, BREEAM-in-use Very Good, LEED Gold, Svaven or better, or if they have 15% lower energy use than required by the applicable national building code. The eligibility requirement for large-scale forestry (>1500ha) is FSC or PEFC certification, while small-scale forestry (50-1500ha) needs to be compliant with the Swedish Forestry Act.

Climate Bonds view: For forestry related assets, we take into account the sustainability of both small and large holdings. The Climate Bonds Forestry Criteria– still in public consultation – acknowledge that smallholders may not be able afford an external certification and set out specific requirements to demonstrate compliance with the mitigation and resilience components of the Criteria.

The Forestry Stewardship Council (FSC) definition of small and low intensity managed forests (SLIMF) in Sweden is holdings of up to 1000 hectares. The issuer’s definition of small forestry holder exceeds this threshold. However, the Swedish Forestry Act provides us with sufficient assurance of the sustainable management of the holdings. In the future, we would like to see eligibility criteria for smallholders without FSC/PEFC certifications including specific requirements on soil health, water management, fire management, riparian areas protection, biodiversity management, species selection and chemical use, as set out in the public consultation document of the Forestry Criteria.

Vivint Solar (USD811m), USA, issued a two-tranche USD466m solar ABS backed by a portfolio of 47,860 leases and PPAs. The portfolio consists of 95% Power Purchase Agreements (PPA) and 5% lease agreements by aggregate discount solar asset balance (ADSAB) of Host Customer Solar Assets. On the same day, the issuer issued USD345m privately placed solar asset-backed notes.

Climate Bonds view: This is the largest solar securitisation to date. Solar ABS issuance in 2018 to date already represents 80% of 2017 volumes. We hope to see more solar deals coming to market.

Deals issued before June 2018

BKS Bank (EUR3m/USD3.2m), Austria, issued a debut green bond with a 6.2-year tenor in February 2017. This makes it the first Austrian commercial bank to enter the green bond market.

The bond proceeds were earmarked for a loan from BKS Bank to power company Hasslacher Energie GmbH to finance the replacement of an existing small hydropower plant on the Liesser river in the state of Carinthia, Austria. The new plant increased the power output from 1MWh to 1.8MWh and has a higher energy performance. It became operational in 2017 and generates around 10GWh annually. According to RUF’s SPO, Hasslacher Energie has also implemented measures to minimize the environmental impacts of the project, such as management of erosion risk, residual water flow and biodiversity conservation.

Climate Bonds view: Modernising existing hydropower assets has lower potential of triggering negative environmental impacts compared to the construction of new assets. The SPO provides some assurance on the measures undertaken by Hasslacher Energie to limit environmental risks. However, the issuer does not set out a reporting process aimed at disclosing the actual impacts of the projects. In the future, we would like to see more details regarding the power density or emissions (gCO2/kWh) of the asset.

Envision Energy Overseas Capital Co. Ltd. (USD300m), China, issued a 3-year green bond in April 2018. There is limited information describing the use of proceeds. However, Envision Energy is the 2nd largest Chinese wind turbine manufacturer, so the assumption is the proceeds will be used for wind turbines.

Climate Bonds view: We include this issuance in our database based on the assumption that proceeds will be allocated to relevant green assets. However, we will keep looking for more details on allocations.

Greenworks Lending (USD75m), USA, issued a C-PACE ABS in September 2017. The privately placed securitisation is exclusively backed by US commercial PACE assets. C-PACE programs allow financing of energy efficiency improvements for a variety of property types, including office buildings, manufacturing facilities and hospitals. The improvements include a mix of energy-efficiency and renewal energy upgrades, including solar-panel installations.

Climate Bonds view: This is the first, and so far only, C-PACE securitisation. PACE take up has been mainly for residential.

Nanjing Metro (CNY1.2bn/USD188m), China, issued an 11-tranche green ABS in May 2018. Lianhe Equator provided the Assurance report (not publicly available). The originator, Nanjing Metro Resources Development Co., is wholly owned by Nanjing Metro and operates as a property developer and manager. The ABS is secured on rents and receivables from commercial properties along the metro lines and from shops and advertisements in stations. All proceeds will be used to finance metro construction in Nanjing City.

Climate Bonds view: We are happy to see the first metro operator from mainland China using a land value capture model to finance the metro projects. It follows Hong Kong’s MTR Rail + Property model where MTR receives exclusive property development rights around stations/lines and is able to finance rail and public finance projects by leasing or selling the land at an enhanced value.

Sogn Og Fjordane Energi (SEK500m/USD62m), Norway, issued a 10-year green bond in May 2018. CICERO provided the Second Party Opinion. Proceeds are slated to finance hydro, wind and related infrastructure, as well as energy efficiency enhancements to grid infrastructure, including connection of renewable energy to distribution networks, upgrades to the national distribution networks and smart grids. As noted in CICERO’s SPO, since renewable energy makes up 98% of Norway’s electricity mix, investing in grid infrastructure does not raise the risk of fossil fuel lock-in.

Climate Bonds view: We agree with CICERO in regard to grid-related investments. For hydro assets, it would be good to see examples of identified eligible projects and their power density ratio or emissions (gCO2/kWh).

> Climate Bonds has convened a Technical Working Group to develop low energy transmission, distribution and storage criteria for green bond investment. More information available here.

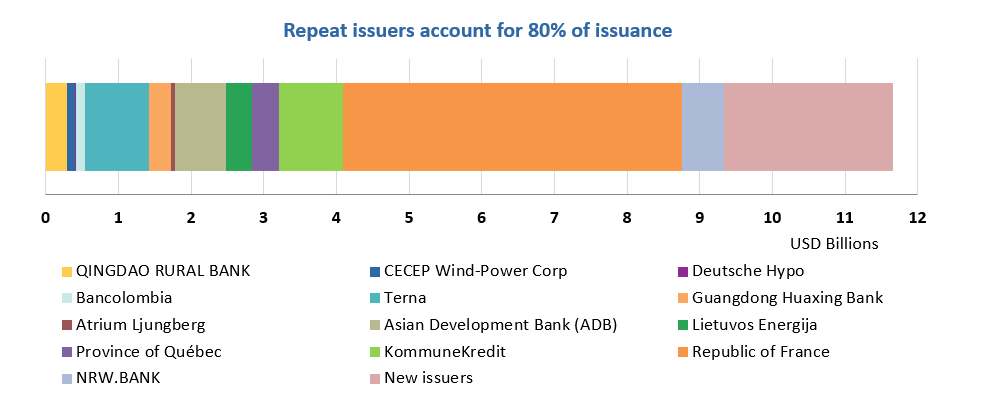

June repeat issuers

- EIB: AUD250m/USD186m

- Iberdrola: EUR750m/USD867m

- IFC: PHP4.8bn/USD90m

- ICBC: HKD2.6bn/USD331m; USD400m (two tranches)

- Kungsleden AB: SEK200m/USD23m

- LBBW Landesbank Baden-Wuerttemberg: EUR500m/USD581m

- New York State Housing Finance Agency (Certified Climate Bond): USD117m

- NRW.BANK: EUR500m/USD580m

- Renew Financial: USD152m (two tranches)

- Republic of France (tap): EUR4bn/USD4.7bn

- Solar Mosaic (four tranches): USD318m

- Vasakronan: SEK300m/USD34m

- Vellinge Municipality: SEK150m/USD17m

Repeat deals prior to June 2018

- Asian Development Bank: HKD100m/USD13m (30 April 2018)

- Atrium Ljungberg: SEK250m/USD28m (3 May 2018)

- Deutsche Hypo: EUR50m/USD62m (30 January 2018)

- Fannie Mae: USD3.7bn (April-May 2018)

- Humlegarden Fastigheter AB: SEK700m/USD79m (28 May 2018)

- Jernhusen AB: SEK1bn/USD119m (17 April 2018)

- Mitsubishi UFG: JPY10bn/USD93m (17 April 2018)

June trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

Issuer Name | Amount issued | Issue date | Reason for exclusion/ pending |

Jiaxing Xiang Jia Dang Development Investment Group Co.,Ltd. | CNY580m/USD92.4m | 19/04/2018 | Working capital |

Anji County Urban Construction Investment Group Co | CNY500m/USD78.6m | 02/05/2018 | Working capital |

Huangshan Chengtou Group Co.,Ltd | CNY850m/USD134.2m | 27/04/2018 | Working capital |

Tibet Investment | CNY1bn/USD153.7m | 29/12/2017 | Not aligned |

Linhai Rural Commercial Bank | CNY100m/USD15.9m | 29/03/2018 | Working capital |

Taiwan Power | TWD2.4bn/USD80.5m | 07/05/2018 | Not aligned |

Taiwan Power | TWD5.6bn/USD186.7m | 05/12/2017 | Not aligned |

Taiwan Power | TWD2.7bn/USD90m | 05/12/2017 | Not aligned |

CPC Corporation Taiwan | TWD2.8bn/USD93m | 13/09/2017 | Not aligned |

BKS BANK AG | EUR5m/USD5.3m | 07/02/2017 | Sustainability/Social bond |

Nantong Economic and Technological Development Zone Corp | CNY700m/USD102.7m | 21/06/2017

| Insufficient information

|

EXIM Bank of China | CNY2bn/USD304.6m | 22/12/2017 | Not aligned |

New York State Housing Finance Authority | USD84m | 26/06/2018

| Sustainability/Social bond |

Evergreen Marine Corp | TWD2bn/USD | 27/06/2018 | Not aligned |

Oriental Energy | CNY600m/USD | 21/06/2018 | Not aligned |

Hera SpA | EUR200m/USD235.9m | 17/05/2018 | Not aligned (sustainability-linked revolving credit facility) |

MTR | HKD348m/USD44m | 28/06/2018 | Pending |

Green bonds in the market

- KommuneKredit: closing 5 July

- Raiffeisen Bank International AG: closing 5 July

- Province of Quebec: closing 6 July

- Sarana Multi Infrastruktur (SMI): closing 6 July

- Lietuvos Energija: closing 10 July

- North American Development Bank: closing 24 July

Investing News

Colombia’s Supreme Court has ruled that Colombia's Amazon is an "entity subject of rights", which means that the rainforest has been granted the same legal rights as a human being.

Following the recommendations of the Green Finance Taskforce, the UK will set up a Green Finance Institute in London.

Egypt’s Financial Regulatory Authority and IFC started a formal dialogue on green bond guidelines to develop the country’s green bond market.

In early June, the IFC and Bank of Lao PDR, the central bank of Laos, introduced concepts on credit policy aiming to support the development of the country’s sustainable finance.

Fidelity Investments rolled out its Fidelity Sustainability Bond Index fund.

Macquarie Capital is launching the Green Investment Group in North America with the aim of financing the development of renewable energy schemes and pooling together smaller projects to attract investments from institutional investors.

The United Nations aviation agency approved new standards needed to implement the 2016 global agreement to limit emissions from international flights.

Green Bond Gossip

Ireland is looking into issuing sovereign green bonds later this year.

Kenya Pooled Water Fund is planning a green bond this year to fund Kenyan water utilities.

Encevo Group published a Green Schuldschein Framework and it benefits from Sustainalytics’ Second Party Opinion.

Microsoft is working with Greenwich Financial to structure a whole new breed of renewable energy financing.

The Fiduciary Duty in the 21st Century programme will collaborate with the PRI and Finance for Tomorrow to develop a French roadmap for sustainable finance, which will be published in November 2018 at the UNEP FI's Global Round-Table and Finance for Tomorrow's Climate Finance Day.

Reading and Reports

Mckinsey’s article “The new rules of competition in energy storage” estimates the potential cost reductions in energy storage and explores opportunities for the energy market.

MSCI’s analysis suggests that the “E” and “S” aspects in ESG hold an important role in differentiating performers among companies with robust financial traits.

Commerzbank published a white paper “The Belt & Road Initiative: Changing the behaviour and perceptions of corporate China”, which examines how China’s Belt and Road Initiative is influencing trends in Chinese outbound M&A, exports, financing and risk management.

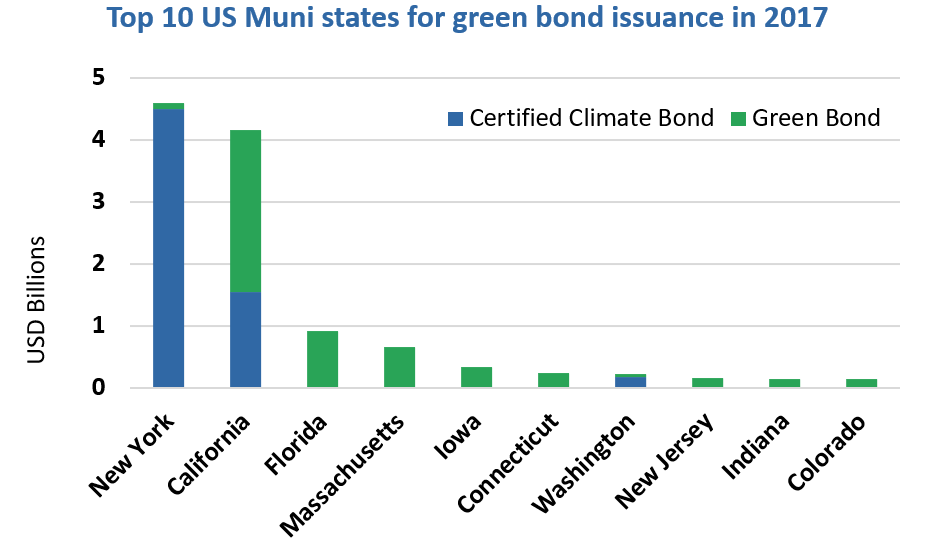

Liz Farmer writing in Governing gives a good run down of green developments in the US muni scene.

Speaking in Da-Nang at GEF-6 Vietnamese Prime Minister Nguyễn Xuân Phúc has emphasized Vietnam’s commitment to achieving both Paris NDC goals and the SDG 2030 Agenda as part of national development plans.

Moving Pictures

Catch up with our recent Indonesia Green Infrastructure Investment Opportunities report - presentation and audio are available - don't miss it!

Innovations in energy generation – a selection from LinkedIn

Take 45 seconds to have a look at the world’s first electric jet.

Watch how Coppe Subsea’s machine turns waves into energy.

This vertical turbine in Istanbul generates energy by harnessing wind created by passing vehicles.

See how Pavegen’s tiles turn footsteps into electricity.

Learn how skyscrapers could soon be generating power with see-through solar cells.

‘Till next time,

Climate Bonds

Financial Times

Financial Times AM Watch,

AM Watch,  Environmental Finance,

Environmental Finance,  Live Mint,

Live Mint,  In an effort to support the development of a domestic green bond market in Nigeria, CBI alongside

In an effort to support the development of a domestic green bond market in Nigeria, CBI alongside  Xinhua

Xinhua BNN Bloomberg,

BNN Bloomberg,