MARKET NEWS

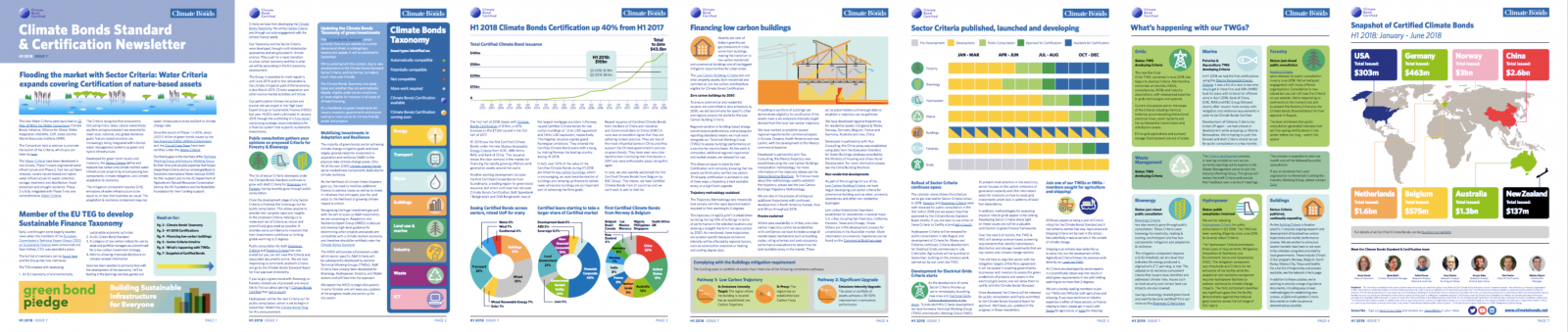

Bloomberg Opinion, How the World’s Governments Are Approaching Earth-Friendly Investing, Nathaniel Bullard and Daniel Shurey

![]()

Article analyses tactics of governments, in different regions of the world, aimed at scaling up green finance.

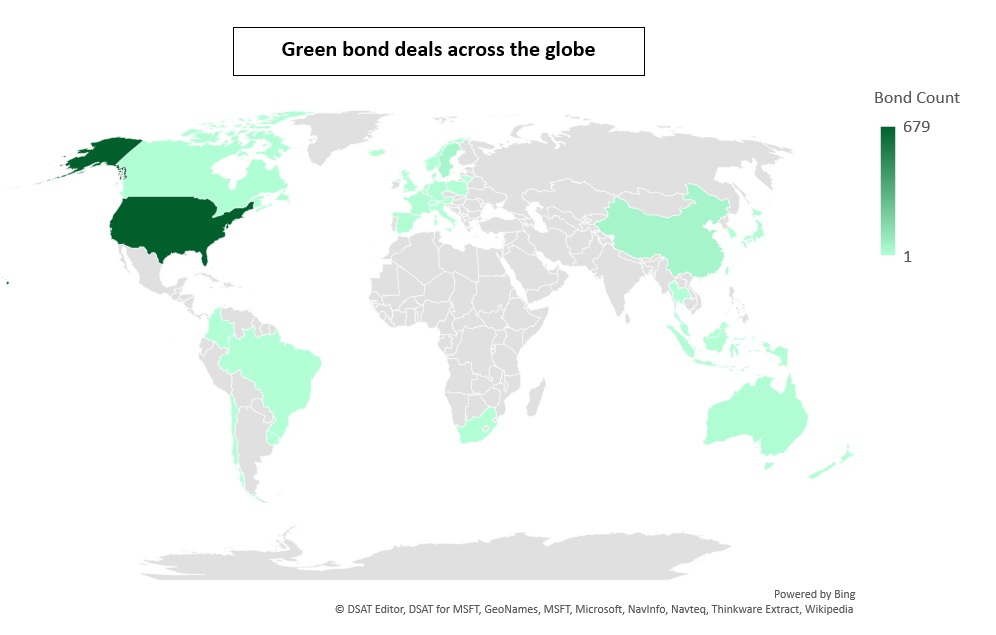

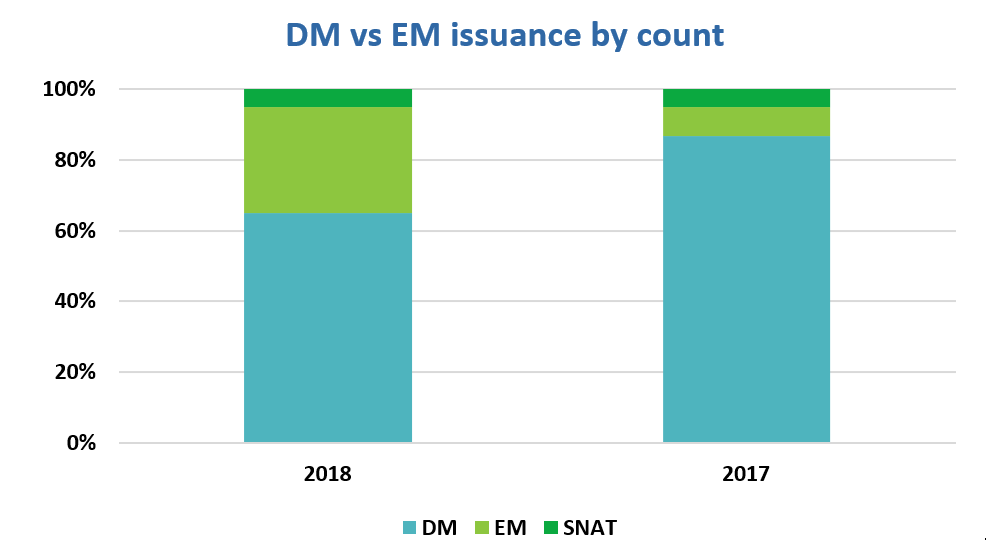

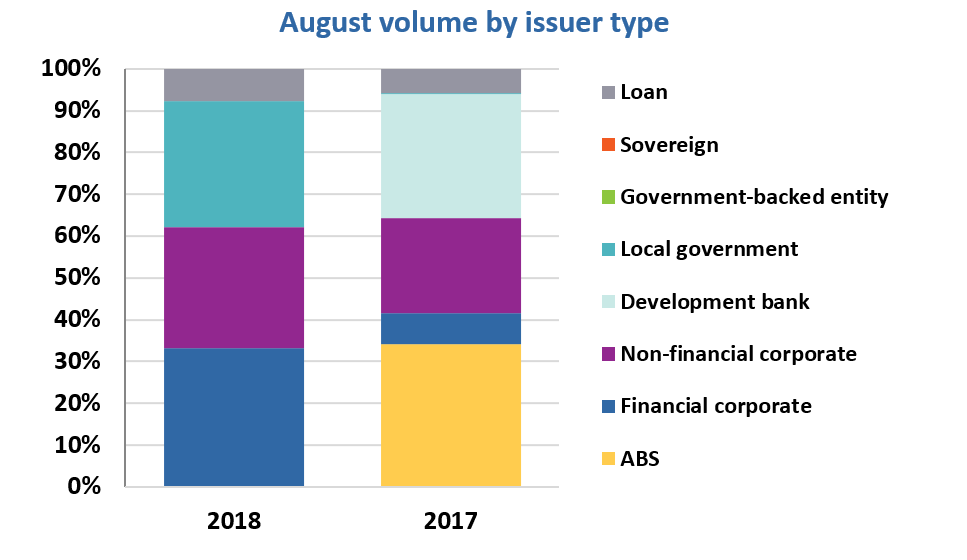

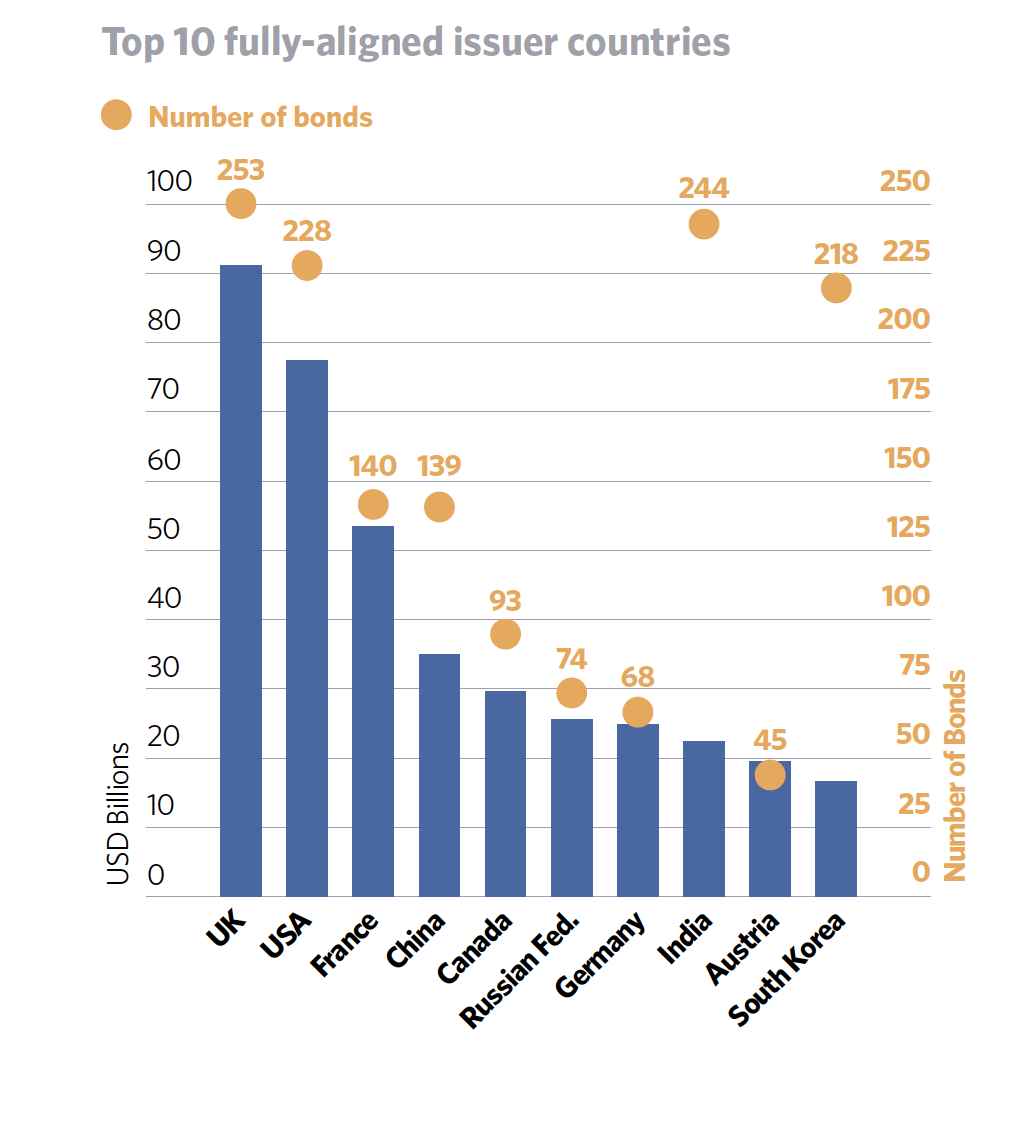

Whether it is national carrots and sticks or local motivations, government-led green bond initiatives are mobilizing billions of dollars every year. In this regard, green bonds are following a path trod by clean energy a decade ago, when many governments around the world took similar approaches to intervention with the renewable energy market.

Bloomberg, Green-Bond Sales Surge Toward Record as Borrowers Burnish Brand, Shelly Hagan

US green bonds are on the rise. Author looks at reasons why corporates decide to issue.

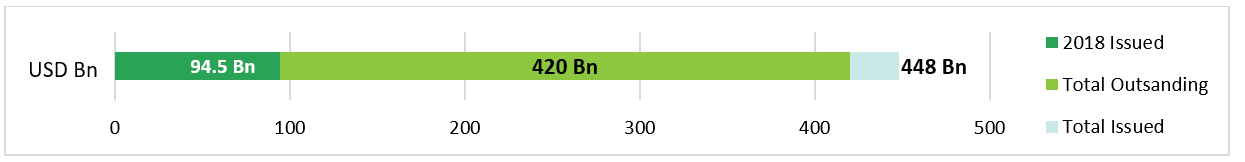

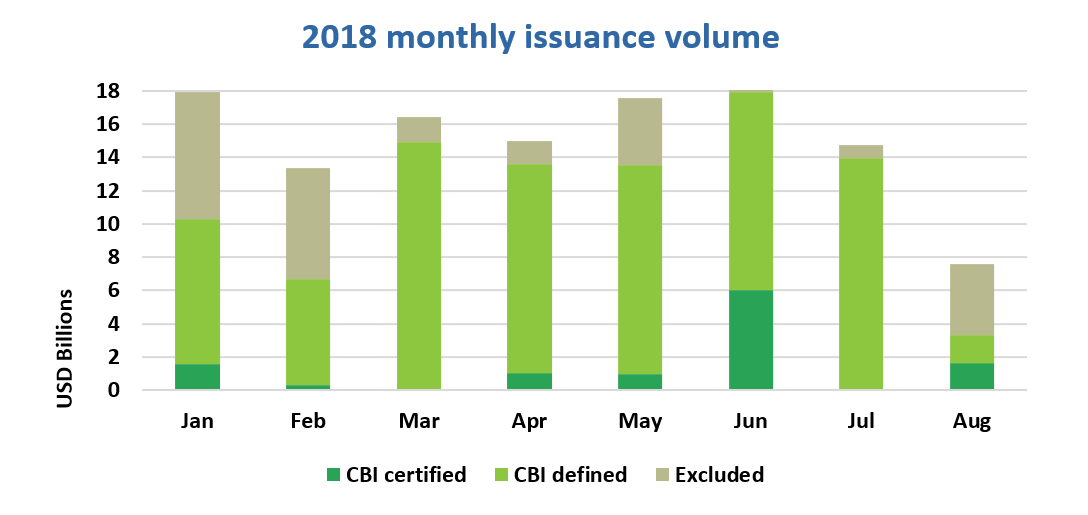

Sales of green bonds by U.S. companies in 2018 have already topped last year and are on pace for a record, according to data from the Climate Bonds Initiative.

Bloomberg Opinion, Green-Bond Market Needs to Get Tough to Blossom, Brian Chappatta

Reflecting on the first decade of green bonds market, author expresses an opinion that certification of green bonds should be compulsory.

The Climate Bonds Initiative is the closest thing to a gatekeeper for the industry. Through its Climate Bonds Standard and Certification Scheme, it provides the option — but not the requirement — for green-bond issuers to verify that they adhere to a set of principle. (…)

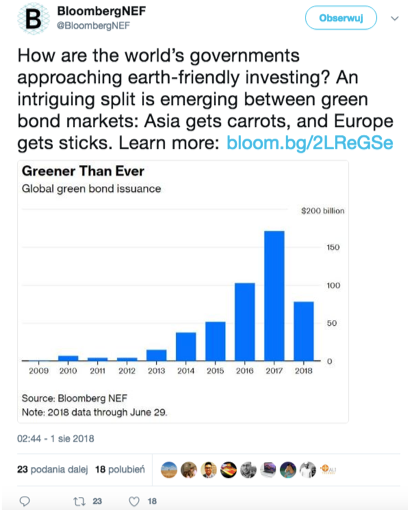

The Bond Buyer, For green bond issuers, the purpose is vital, Paul Burton

![]() Author dives into US municipal green bonds market after speaking with experts from the investor side as well as academia.

Author dives into US municipal green bonds market after speaking with experts from the investor side as well as academia.

Green bonds, said Wurgler, are slightly larger than average at the CUSIP level and with slightly longer maturity; they are more likely federally taxable, tracing to issuance around 2010; they are typically new-money revenue bonds associated with specific projects; and a subset, around 7%, has certification from Climate Bonds Initiative or other third parties.

FT Alphaville, An environmental run on the bank, Thomas Hale

Thomas Hale looks at an example of reputational damage and subsequent withdrawal of deposits experienced by banks that participated in the financing of environmentally-harmful Dakota Access Pipeline. He thinks that this aspect of environmental activism is one of the important factors behind a rapid growth of the green finance market.

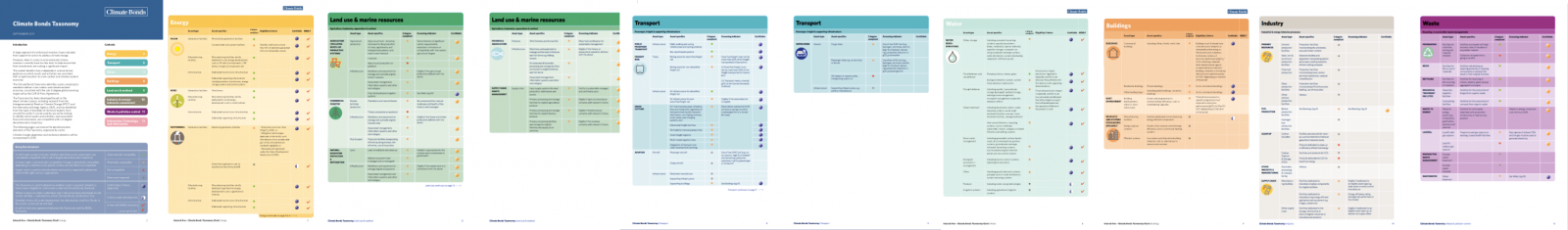

The topic is critical for any understanding of the new field of green finance, which has exploded over recent years. Around $155bn of green bonds were issued last year, almost double the total in the previous year. Banks have established their own green funding rules and frameworks, alongside those established by NGOs. They have also issued green bonds of their own, which implies calibrating certain assets as green, causing green-ness to ripple through the financial system.

Forbes, Eco-Civilization: Will China Become The World's Climate Savior?, Jake Hayman

Article looks at the Chinese paradox – country that’s world’s biggest emitter is, at the same time, planet’s biggest hope when it comes to reduction of emissions.

In this context the ‘green’ sector in China has boomed: green nergy, green loans, green mortgages, green supply chains, green bonds, emissions trading schemes – the list of policy initiatives, subsidies and incentives is endless. It is expected that China will be ahead of most of the world on phasing out production of petrol cars and it is already leading the way on solar energy and clean technology.

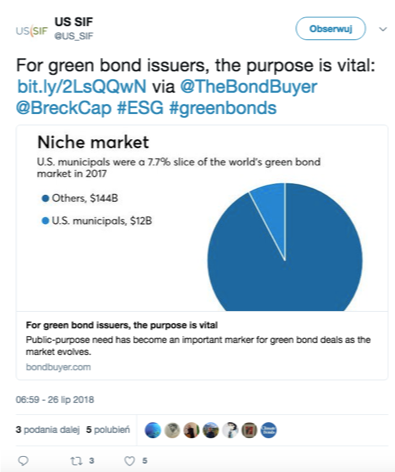

Markets Media, Institutional Investors Look To Green Bonds, Shanny Basar

![]() A upbeat story of operating world’s largest green bond fund.

A upbeat story of operating world’s largest green bond fund.

Bram Bos, lead portfolio manager green bonds at NN Investment Partners, said there is “overwhelming” demand for green bonds and there are the first signs of institutional investors in the market.

The Edge Markets, Bonds: Growing need for retail green bonds, Khairani Afifi Noordin

Article cites chief representative for Asia-Pacific at ICMA who stressed a need of increasing availability of green products to retail investors.

There are currently a few mutual funds and exchange-traded funds (ETFs) with exposure to green bonds that are available to retail investors. They include Mirova Global Green Bond fund, Calvert Green Bond fund and VanEck Vectors Green Bond ETF, which tracks the S&P Green Bond Select Index.

Business World, Moody’s expects sovereign green bond issuance to accelerate, Cathy Rose A. Garcia

![]() 7 countries have already issued sovereign green bond and Moody’s, in a recent report, predicted that the pace of governmental issuance will be on the rise over coming years.

7 countries have already issued sovereign green bond and Moody’s, in a recent report, predicted that the pace of governmental issuance will be on the rise over coming years.

Moody’s also said the deployment of sovereign green bond proceeds to a diverse array of projects will support investor demand. This is in contrast to the broader green bond market, where funds are mostly used for energy-related projects.

Governing, Green Bonds Are in High Demand, But Are They a Better Deal?, Liz Farmer

Author of the article questions the price benefit that some municipal bonds issuers to date obtained when labeling their bond as green.

Another factor driving better rates for some green bonds is the reputation and transparency of the government issuer.

Les Echos, Vers un boom des green bonds, Pierre Rondeau

![]()

Les Echos on the success story of French sovereign green bond.

L’État français a emboîté le pas de son voisin polonais dès janvier 2017 avec une levée initiale de 7 milliards d’euros sur 22 ans, suivie des Fidji, du Nigéria, de la Belgique, de la Lituanie et plus récemment de l’Indonésie.

elEconomista, Las empresas españolas apuestan por la financiación sostenible

Además, los bonos verdes y los bonos sostenibles emitidos por empresas y administraciones públicas se han empezado a hacer hueco en los mercados financieros, al igual que los créditos sostenibles. En 2017, Climate Bonds Initiative (CBI), cifró en 155.000 millones de dólares las emisiones internacionales en bonos verdes y prevé que en 2018 alcance entre los 250.000 a 300.000 millones de dólares

COUNTRY NEWS

IRELAND

Irish Times, Ireland tipped to jump on ‘green bonds’ bandwagon, Joe Brennan

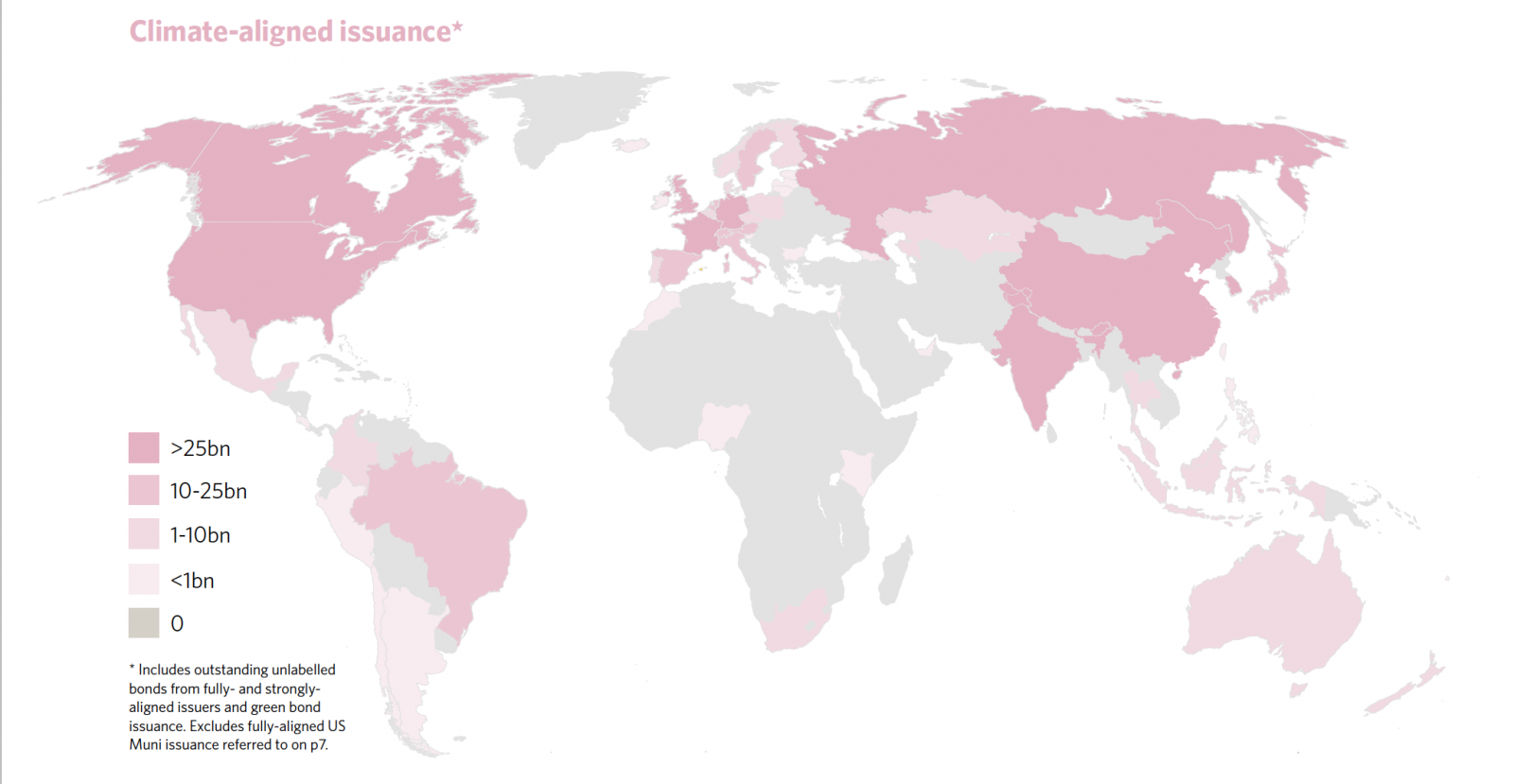

Irish Times reports on the head of Ireland’s debt agency announcing plans for a sovereign green bond issuance.

Ireland has been tipped to join a growing number of sovereigns raising finance from the sale of “green bonds”, which may command lower interest rates than mainstream debt at a time when the European Central Bank (ECB) is winding down its €2.5 trillion stimulus programme.

The Times, Investor seeks €7.5m for renewable energy, Michael Cogley

In July, also BVP, Ireland’s leading green investment firm, announced details of a planned €7.5m green bond issuance.

BVP, a leading green investment firm, is aiming to raise €7.5 million which it will use to invest in a number of renewable energy projects and companies across Ireland.

INDIA

Fortune India, Green bonds: The $2 trillion opportunity, Ashish Gupta, Prerna Lidhoo

A long piece outlining how green bonds fit into India’s enormous infrastructure needs and climate goals.

Yet, as Bank of America country head and president Kaku Nakhate points out, local markets have still not understood the concept of green bonds as the West has. Thus, India has raised only $6.15 billion from 16 issuances.

Bloomberg, SBI's Bond Plan Eyed by India Firms Mulling Offshore Return, Anurag Joshi

![]()

State Bank of India started a roadshow for a dollar-denominated green bond in a time of uncertainty for Indian offshore bond market.

No Indian company sold offshore notes last quarter, the first time that happened since 2009, as a selloff in emerging-market assets following rate increases from the U.S. Federal Reserve damped investor appetite.

Business Standard, More than $6 bn green bond issues still stuck due to rising interest rates, Anup Roy

Author claims that since debt issuance in India stalled, there are several green bond issuances on hold and awaiting lower interest rates.

Green bonds of huge amounts from India are stuck because of rising interest rates and global uncertainties, even as the country’s largest lender, SBI, is in the process of going through its maiden issue of green bonds of at least $500 million

AUSTRALIA

Australian Financial Review, Australian social impact investment market hits $6 billion, Alice Uribe

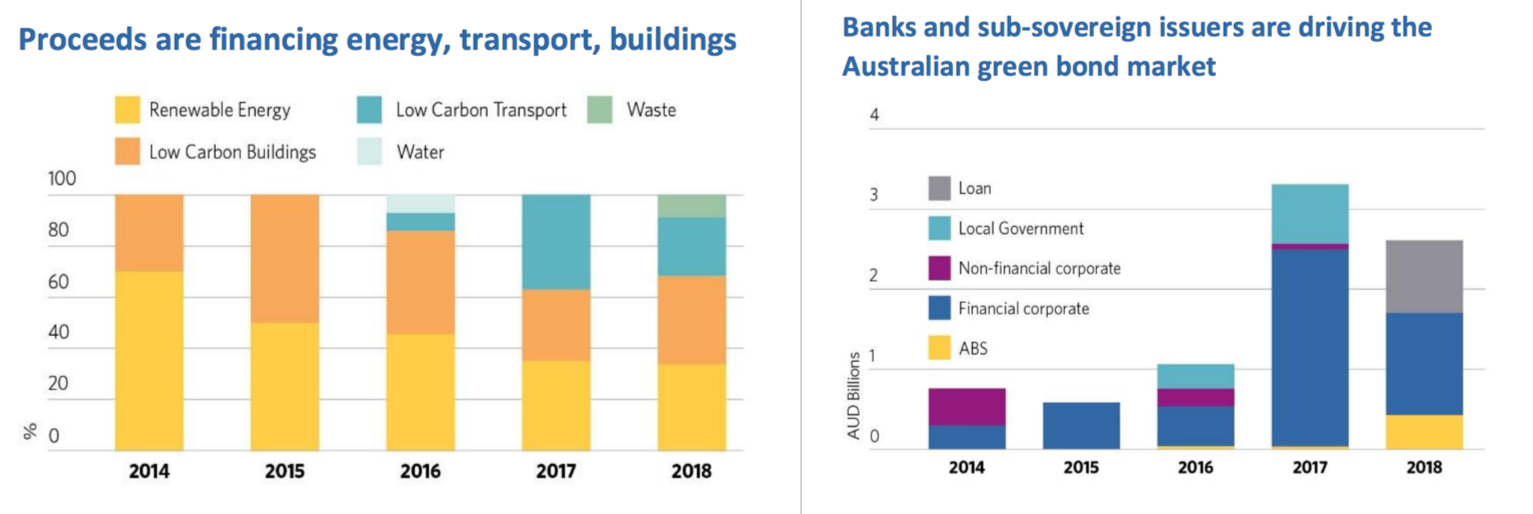

Australian ESG market experienced a four-fold increase in less than three years with rapidly growing green bonds accounting for 85% of the $6 billion figure.

Since 2015, Australian public and private institutions have issued over $4 billion in green bonds, with most coming in 2017, compared to the global market with over $US120 billion of certified green bonds issued in 2017, according to the Climate Bonds Initiative (CBI).

Financial Standard, Impact investing reports sharp growth, Harrison Worley

Another Australian publication covers findings of the Responsible Investment Association Australasia (RIAA) research.

According to the report, property and infrastructure investments are the biggest type of investments after green bonds, which RIAA said was responsible for avoiding or abating more than 2.1 million tons of carbon dioxide equivalent.

MOROCOO

Devdiscourse, IFC and Morocco join forces to promote Green, Social and Sustainability Bonds

Guidelines for Morocco’s green bonds market have been released by the country’s capital markets authority.

The new guidelines have been developed by AMMC with advisory support from IFC, and comprise updated guidelines for Morocco’s green bonds market, as well as a new framework for the social and sustainability bonds market, combined into a single reference document.

La Nouvelle Tribune, Un nouveau pas en avant pour la finance durable au Maroc, Selim Benabdelkhalek

L’AMMC (Autorité Marocaine du Marché des Capitaux), avait publié un guide sur les Green bonds, dans la foulée de l’engagement du secteur financier marocain, pris lors de la COP 22, d’encourager le développement du marché des instruments financiers durables.

EGIPT

Al-Monitor, Egypt approves green bonds to boost eco-friendly projects, Menna A. Farouk

In July, Egypt approved a legal framework to issue green bonds to support the financing of renewable energy and clean transportation projects.

“We will unveil regulations and measures necessary for the issuance of green bonds in accordance with the best international applications, as part of a partnership with the International Financial Corporation [IFC] (…)” said Mohammed Omran, head of the Egyptian Financial Supervisory Authority (…)

UK

Business Green, City Minister: 'Green finance has yet to reach its full potential', James Murray

An important speech from the Economic Secretary to the Treasury, in which he expressed an ambition for “green finance” to become simply – “finance”.

Glen, who also serves as City Minister, said the green finance sector was making encouraging progress, citing this week's launch of the largest green bond listing on the London Stock Exchange in the form of a $1.58bn offer from the Industrial and Commercial Bank of China.

COVERAGE OF CHOSEN JULY’S GREEN BOND ISSUANCES

EMPRESA DE ENERGÍA DEL PACÍFICO (EPSA)– Colombia’s first Climate Bond Standard certified green bond.

Latin Finance, FDN, IFC back Epsa green bonds, Mick Bowen

Colombian power unit obtains $146m in local currency, becomes first non-FI to print sustainable securities in the country.

Devdiscourse, IFC and FDN help Epsa raise funding for climate change projects in Colombia

The bond have also been certified with the Climate Bonds Standard & Certification Scheme, which ensures that the projects where the resources will be allocated contribute to the reduction of carbon emissions and the mitigation of climate change.

Renewables Now, Colombia's Epsa to issue green bonds for 185 MW of solar power

The IFC pointed out that Epsa would be the first company in the real sector in Colombia to use this fixed-income financial instrument exclusively for environmental projects or projects related to climate change.

FARO ENERGY – first Climate Bonds Standard certified green bond for solar energy in Brazil.

PV Tech, Faro Energy issues Brazil’s first certified green bond for solar, Tom Kenning

The bond has been verified by Bureau Veritas, an international verification agency, and Certified according to the Climate Bond Standard & Certification Scheme

Energy Live News, First certified solar bond lands in Brazil, Jonny Bairstow

The bond will be used to finance distributed solar power projects across the country – the company says Brazil’s solar market is growing rapidly and green financing solutions are “critical” to enable the market to continue to scale.

![]() NIGERIA SOVEREIGN GREEN BOND – first African nation and fourth country in the world to issue a sovereign GB.

NIGERIA SOVEREIGN GREEN BOND – first African nation and fourth country in the world to issue a sovereign GB.

Business Day, DMO to List N10.69bn FGN Sovereign Green Bond on NSE, Cynthia Ikwuetoghu & Jonathan Aderoju

Debt Management Office (DMO) will list N10.69billion, five-year tenor, Federal Government Sovereign Green Bond at coupon rate of 13.48% on the Daily Official List of the NSE on Friday, July 20, 2018.

CNBC Africa, Nigeria should expect more green bonds – Minister

Nigeria’s Minister of State for Environment Ibrahim Usman Jibril says the listing of the 10.69 billion naira, 5-year Sovereign green bond is the first of many to come, as the ministry aims to return to the market before the end of the year.

CNBC Africa, DMO celebrates green bond listing on NSE

An interview with Patience Oniha, Director General of Nigerian DMO.

CITY OF TORONTO

![]() Financial Post, Toronto goes green, raises $300 million and saves on interest by doing so, Barry Critchley

Financial Post, Toronto goes green, raises $300 million and saves on interest by doing so, Barry Critchley

And for the citizens of the country’s largest metropolis, the 30-year, $300-million transaction brings a financial benefit: the yield (3.213 per cent based on a 3.20 per cent coupon) required to clear the market was a tad lower than what a traditional debenture would have cost.

Smart Cities Dive, Toronto issues first green bond, joins food waste initiative, Jason Plautz

Toronto follows Ottawa as the second Canadian city to engage in green financing.

NATIONAL WILDLIFE FEDERATION

Bloomberg, National Wildlife Federation Goes to the Green-Bond Market, Amanda Albright

The National Wildlife Federation is selling about $11 million of bonds Wednesday to refinance a loan that was used to build its headquarters in the Washington, D.C. (…)The foundation’s headquarters, which opened in 2001, is designed to reduce energy usage, bond offering documents say, and uses solar panels to heat its water.

ASIAN DEVELOPMENT BANK’S first euro-denominated green bond

Global Capital, Green currency debuts for supra pair, Craig McGlashan, Lewis McLellan

Asian Development Bank piced up €600 and was able to tighten pricing as it sold a green bond in euros for the first time.

The Asset, ADB prices first euro-denominated green bond, Chito Santiago

The seven-year bond was priced at 99.924% with a coupon of 0.35% per annum payable annually to offer a yield of 43bp.

Modern Diplomacy, ADB Sells €600 Million 7-Year Green Bond to Spur Climate Financing

Proceeds of the green bond will support low-carbon and climate resilient projects funded through ADB’s ordinary capital resources and used in its non-concessional operations.

SARANA MULTI INFRASTRUKTUR (SMI)– Indonesia

Reuters, Indonesia's SMI raises 1.5 trln rupiah in bonds to fund green projects

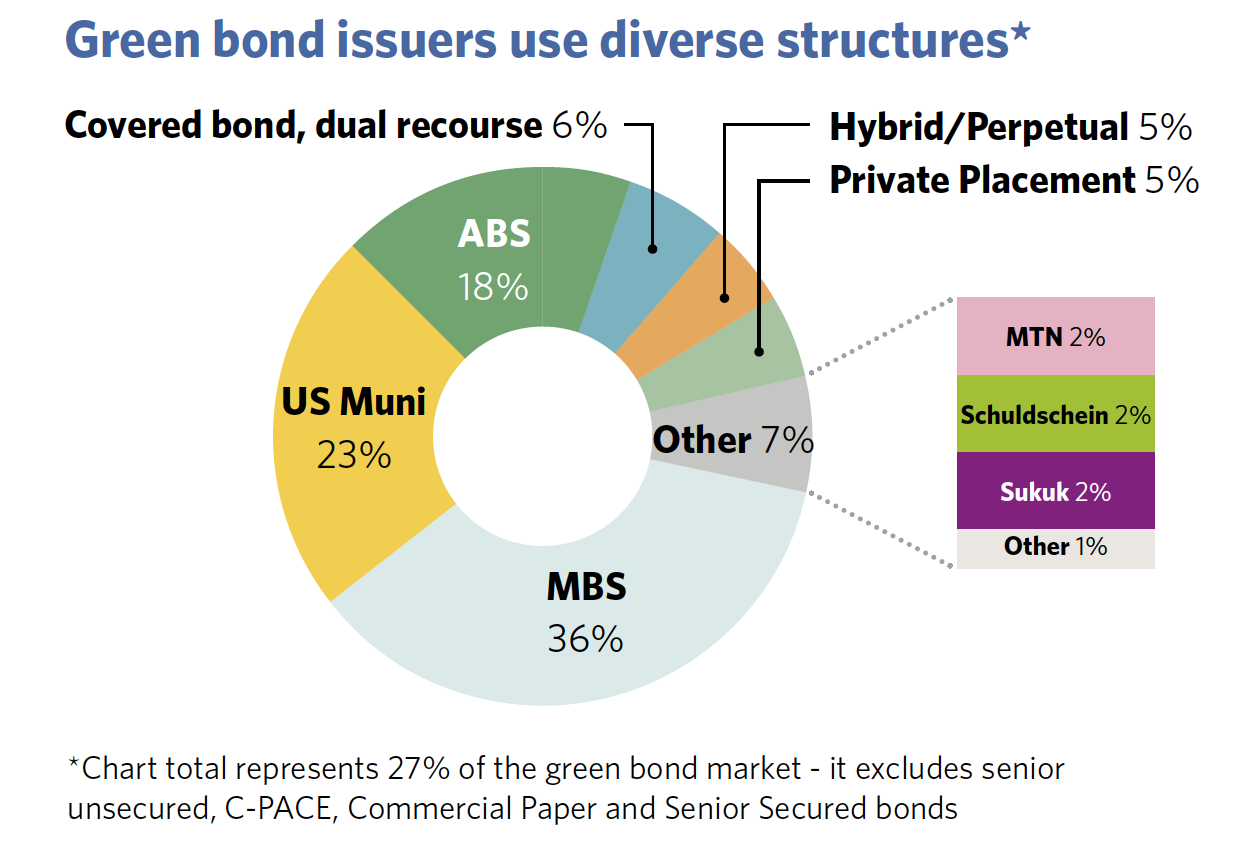

Indonesia’s Sarana Multi Infrastruktur (SMI), a state-owned infrastructure financing firm, said on Tuesday it had issued a combined 1.5 trillion rupiah ($104.6 million) via green bonds and sukuk, tapping into environmentally-minded investors.

The Jakarta Post, Sarana Multi Infrastruktur issues green bonds and sukuk, Riza Roidila Mufti

SMI president director Emma Sri Martini said the funds obtained from the debt paper issuance would be used to finance various sustainable development goals (SDGs) and sharia-based infrastructure projects in the country.

Indonesia Investments, Sarana Multi Infrastruktur First Indonesian Company to Sell Green Bonds

The green bonds are part of the Indonesian government's efforts to turn the Sustainable Development Goals (SDGs), which came into effect in January 2016, into a success.

Author dives into US municipal green bonds market after speaking with experts from the investor side as well as academia.

Author dives into US municipal green bonds market after speaking with experts from the investor side as well as academia. A upbeat story of operating world’s largest green bond fund.

A upbeat story of operating world’s largest green bond fund. 7 countries have already issued sovereign green bond and Moody’s, in a recent report, predicted that the pace of governmental issuance will be on the rise over coming years.

7 countries have already issued sovereign green bond and Moody’s, in a recent report, predicted that the pace of governmental issuance will be on the rise over coming years.

NIGERIA SOVEREIGN GREEN BOND – first African nation and fourth country in the world to issue a sovereign GB.

NIGERIA SOVEREIGN GREEN BOND – first African nation and fourth country in the world to issue a sovereign GB. Financial Post,

Financial Post,

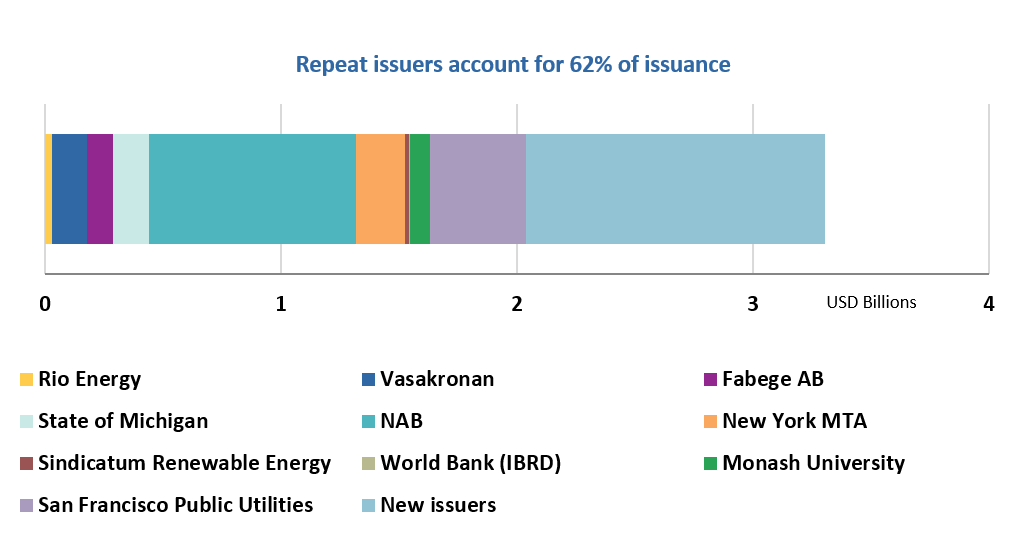

Climate Bonds' two newest reports have just been launched in Sydney today.

Climate Bonds' two newest reports have just been launched in Sydney today.

The infrastructure investment opportunities explored were based on four sectors. The Climate Bonds

The infrastructure investment opportunities explored were based on four sectors. The Climate Bonds