Webinar Invitation: Green Infrastructure Investment Opportunities Indonesia report. 08:00 BST 20 June.

If you’re a DCM & Emerging Market Analyst, Infrastructure and Infrastructure Debt Specialist, ESG and Sustainable Portfolio Manager, Direct Investment or Project Finance specialist this is for you. Details here.

Highlights:

Global firsts: forest green covered bond (Sweden) and shipping GB (Japan)

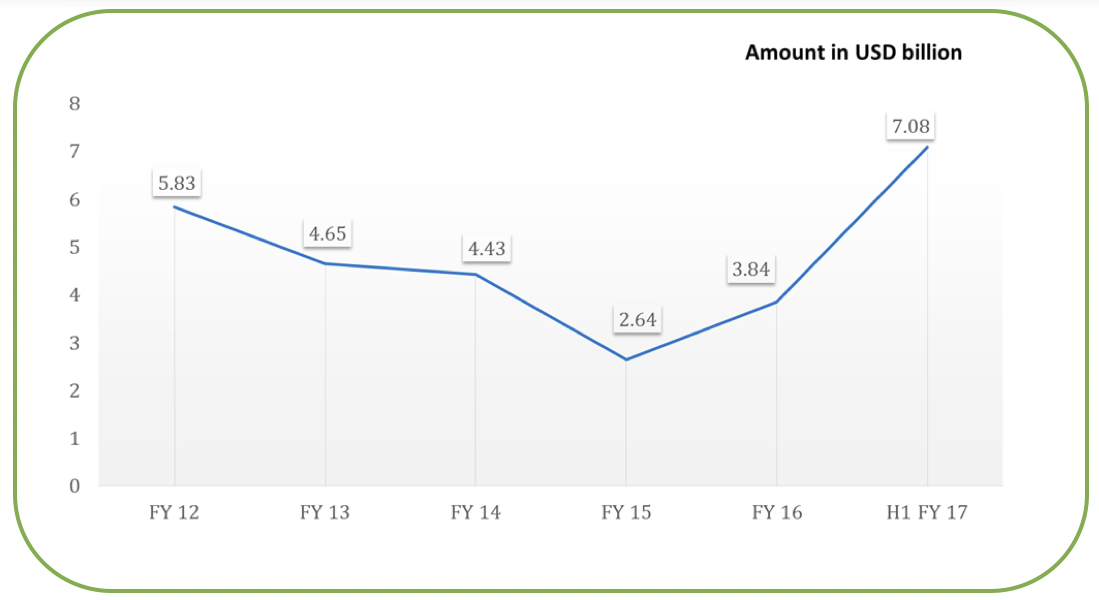

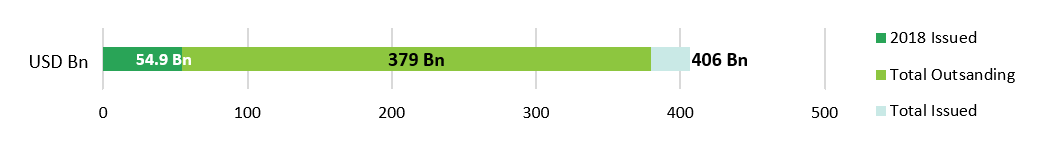

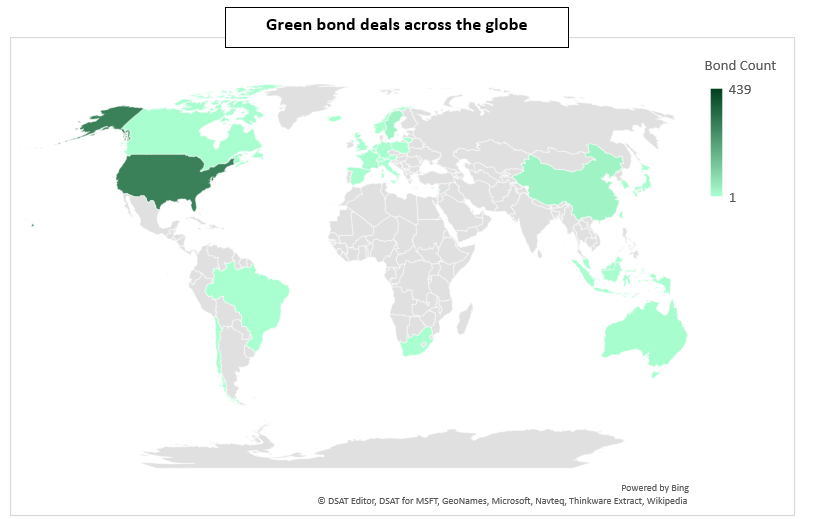

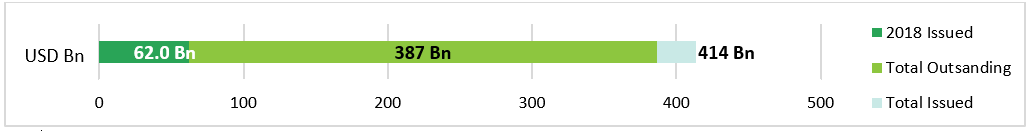

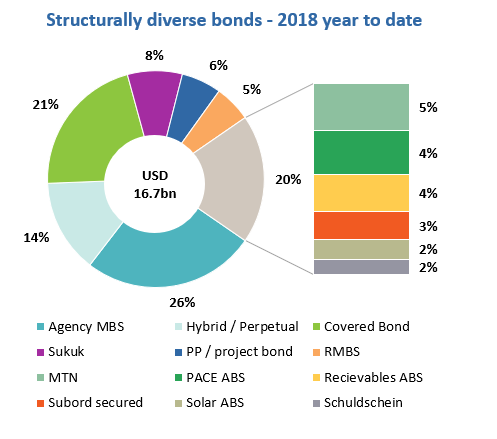

USD55bn issuance in 2018 to date. Cumulative global GB issuance reached USD406bn, with USD379bn outstanding

12 debut issuers from 9 countries in May and over half of monthly issuance contributed by financial institutions, excluding development banks

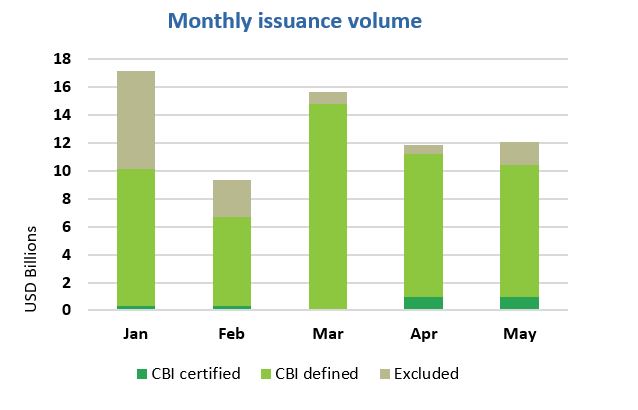

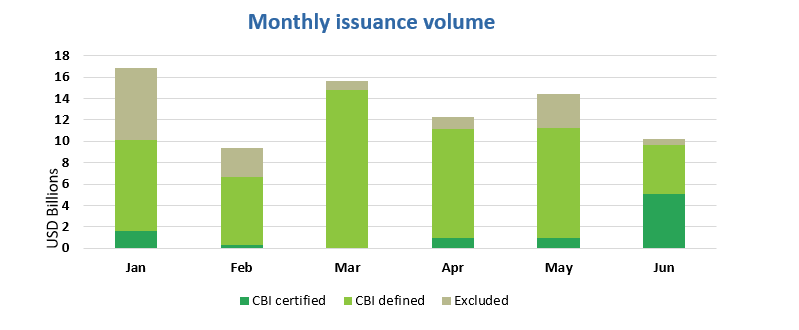

January-May issuance up on 2017, if the increasing number of sustainability and social bonds are included (still pending inclusion of Fannie Mae green MBS issuance for April and May)

![]()

![]()

Go here to see the full list of new and repeat issuers in May and early June.

May at a glance

The first green covered bond secured on FSC-certified forest assets emerged from Sweden. The first shipping green bond was issued by NYK.

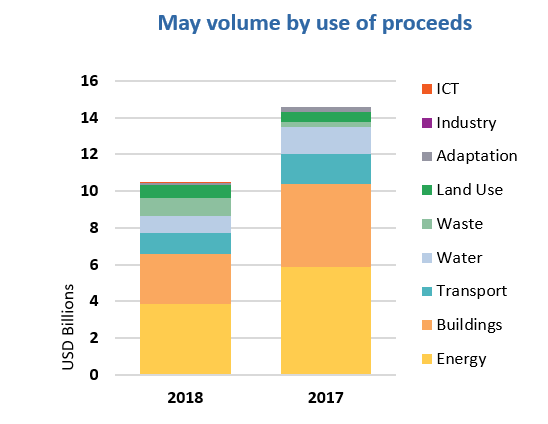

Green bond issuance in May totalled USD10.5bn, 28% lower year-on-year for the month. However, issuance from Fannie Mae – which accounted for 16% of last year’s figure – is not included yet. Country and bond type diversity continues increasing with two global firsts in the last two weeks.

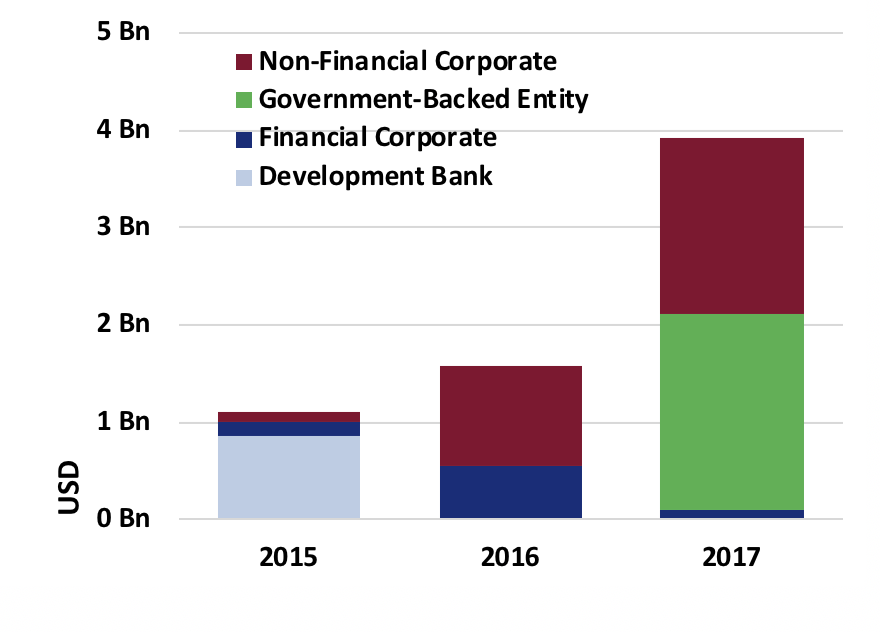

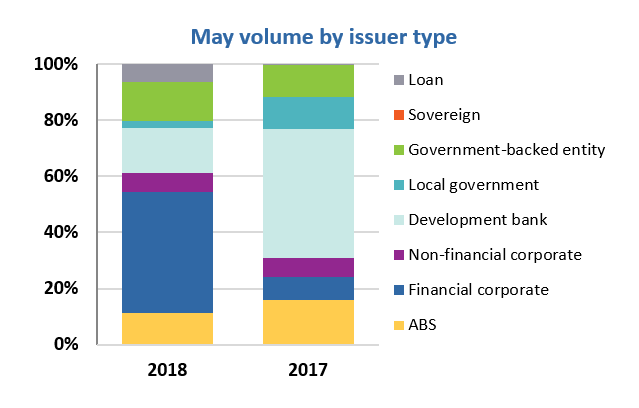

USD4.5bn of issuance came from financial corporates, with Manulife contributing CAD600m to volume and the rest coming from Bank of America, which was the month’s largest issuer with its USD2.25bn deal, and debut issuers BBVA and Landshypotek Bank. Overall, financial institutions, including government-backed banks and non-bank lenders but excluding development banks, accounted for 55% of volume, up from 28% in May 2017 (which includes Fannie Mae issuance). Banks, in particular, seem to be taking a more active role in the market.

Development banks, on the other hand, contributed 16% to May issuance in 2018, down from 46% in 2017. As noted in our 2017 Highlights, development banks have an increasing role in supporting the market via risk bridging and initial investment.

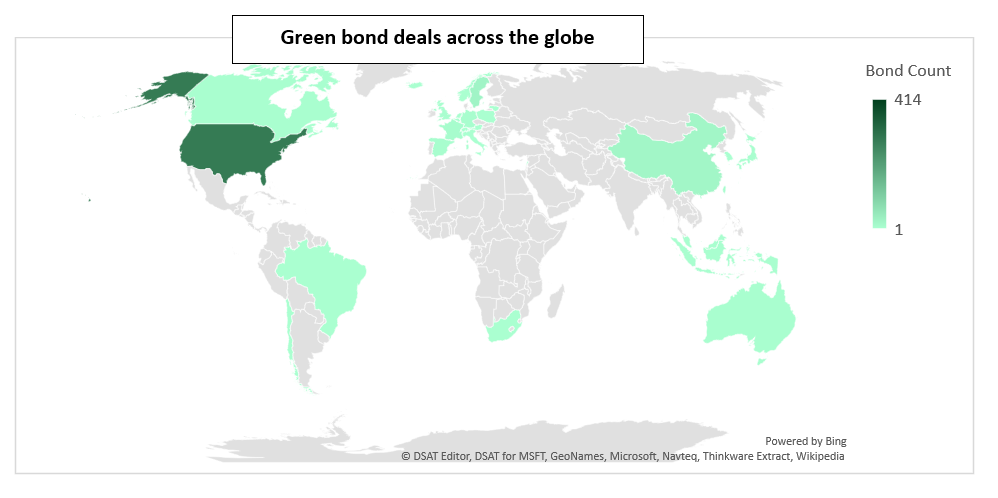

Developed markets accounted for 78% of May 2018 issuance volume, with the US, Spain and Sweden topping country ranks. Emerging markets issuance was limited (9%), with China accounting for 3% of the total compared to 19% in 2017. In general, issuance from China has been subdued this year, but issuance from other Asian markets is increasing and diversifying, particularly from Indonesia, Japan and South Korea.

![]()

For the year to date, green bonds included in the CBI database are 9% down on 2017, pending the inclusion of April and May issuance from Fannie Mae. However, total issuance – including excluded bonds – is up 5%. Sustainability bonds of USD4.8bn represent almost 40% of excluded bonds. Social bonds – CBI tracks USD6.5bn from Jan-May 2018, up 5-fold on Jan-May 2017 – are not included in these figures. Adding them in, would bring the total’s growth rate to 13% up on 2017.

We expect to see growing use of sustainability bonds: issuance for the first 5 months is up 73% year on year. The climate change mitigation and resilience allocations from sustainability proceeds can be significant. To better track that, we would prefer to see sustainability deals split into green and social tranches.

>The full list of new and repeat issuers here.

>Click on the issuer name to access the new issuer deal sheet in the online bond library.

Certified Climate Bonds

There were no new issuers in the Certified Climate Bonds space between 21 May and 5 June.

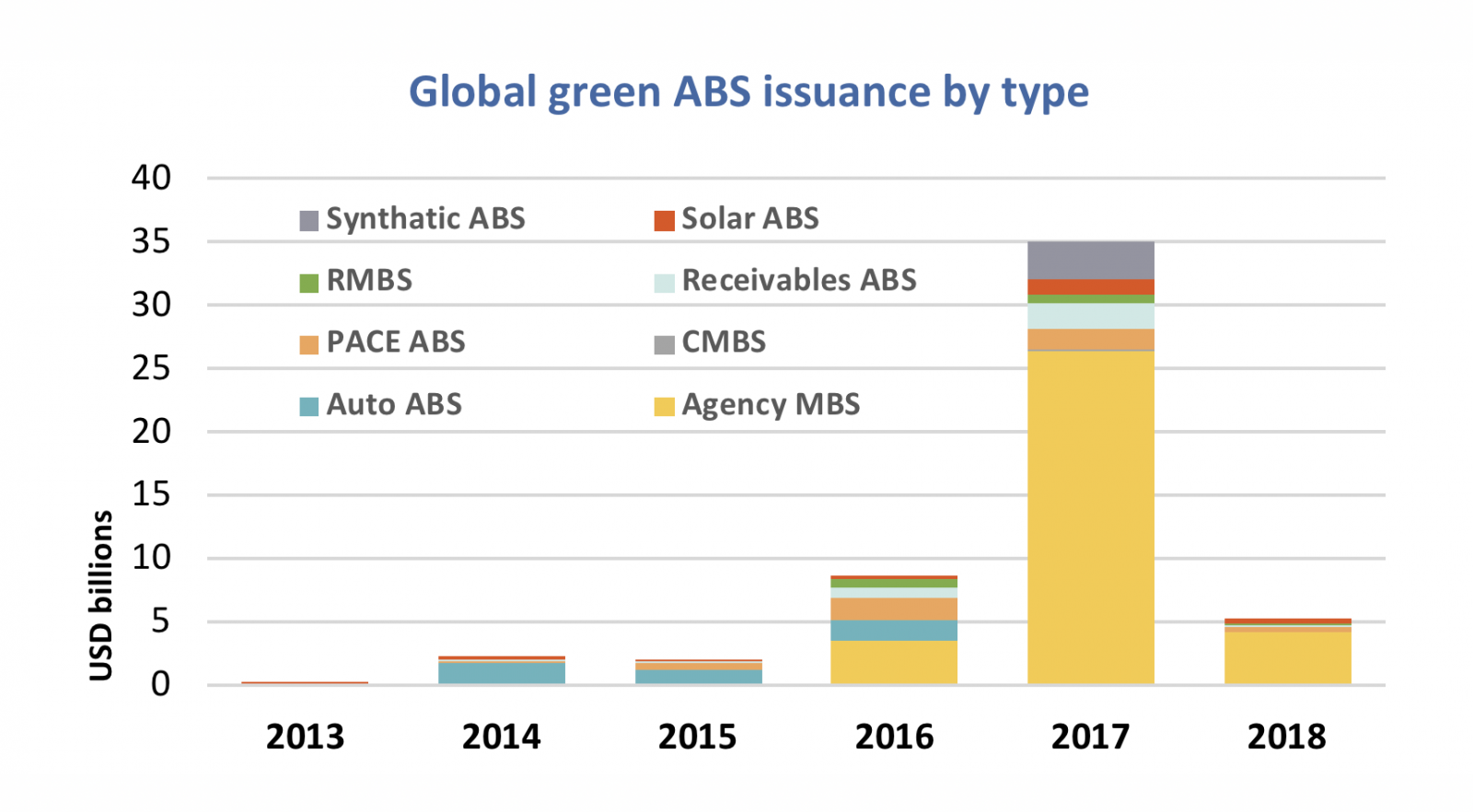

On the ABS front, both Obvion and FlexiGroup issued their third Certified Climate Bonds ABS deals during May.

Obvion’s Green Storm 2018-GRN is a EUR588m (USD685m), 5-tranche green RMBS with a call date in May 2023 and legal final maturity in 2065. The AAA-rated Class A is EUR550m.

FlexiGroup issued a AAA-rated Class A2-G green tranche of AUD66m (USD49m), secured on rooftop solar loans, as part of FLEXI 2018-1, following the well-established formula from its first two deals. But, for the first time, it also offered a AA-rated Class B-G of AUD15.3m (USD11m), a subordinated green tranche, to investors, which suggests investor appetite for higher-yielding bonds and increased comfort with a somewhat higher risk level.

New issuers

California Statewide Communities Development Authority (USD91.1m) issued a 16-tranche green US Muni deal (longest dated bond: 27-year term). As stated in the prospectus, proceeds will finance construction, renovation and improvement projects at the Marin General Hospital in Greenbrae. The issuer is committed to obtaining a LEED Silver certification level.

Climate Bonds view: This is the fourth California US Muni deal this year, for a total of USD636m, and brings the state’s cumulative issuance to USD6.9bn since the first California US Muni transaction in October 2014.

China Resource Leasing (CNY1.3bn/USD213m), China, issued a 4-tranche green ABS with a 9.5-year term. The deal is backed by receivables from 76 leasing agreements in five major industries, including solar, hospitals, built environment and ships. The proceeds will be fully allocated to 27 solar farms and an onshore wind farm in China.

Climate Bonds view: Although the collateral is not necessarily green, the funds raised will be fully applied to finance green assets. Coupled with the disclosure of expected environmental and climate impact, we support this green solar and wind ABS.

Far Eastern New Century Corporation (TWD3bn/USD101m), Taiwan, issued a 5-year green bond in January 2018 and DNV GL provided an assurance report. Proceeds will be allocated to four projects:

1) waste polyester recycling facilities, which aims to reduce the use of PCR (polymerase chain reaction) products;

2) polymer batching facilities that could improve energy efficiency and reduce industrial solid waste;

3) anhydrous dying facilities that could save water use and reduce waste water discharge; and,

4) a green building project, which has been certified against Taiwan’s Construction and Planning Agency Green Building Standard, Gold.

The issuer has disclosed very detailed information on the expected positive environmental and climate impact. For example, it is estimated that introducing anhydrous dying facilities alone will save 31K tons water per year and avoid 33.8K tons of waste water discharge per year.

Climate Bonds view: We support green bonds financing for industrial efficiency improvement, waste management and pollution control, especially when the expected impact is clear.

Helios (USD255m), a subsidiary of US solar service provider Sunnova Energy, issued a 3-tranche, 32-year Solar ABS in 2017. The securitisation is backed by a pool of 13,838 leases, power purchase agreements (PPA), EZ Pay PPAs, and 20 hedged solar renewable energy certificate contracts related to residential PV installations in 14 US states, Puerto Rico and Guam, with California, New Jersey and Puerto Rico accounting for two-thirds of the assets. In October 2017, Hurricane Maria damaged a significant percentage of assets located in Puerto Rico, but Sunnova expects to recover repair expenses through its insurance policy.

Sunrun (USD111m), USA, issued a 2-tranche Solar ABS with a 30-year tenor in 2015. The issuer’s inaugural deal is backed by a pool of leases and power purchase agreement contracts related to residential solar PV systems.

Climate Bonds view: The deals were previously treated as unlabelled, but we have now decided to include all solar ABS, where the collateral is solar assets, in our database. Solar ABS underpins the adoption of residential rooftop solar in the USA and its territories. We would hope to see more solar ABS in other markets as well.

Huadian Fuxin Energy Corporation (CNY840m/USD131m), China, issued a 12-tranche green ABS in March 2018 and Zhongcai Green Financing provided a second party opinion. The subordinated tranche has a 12-year tenor, while the senior 11 tranches have an initial term of three years and will be redeemed and refinanced every three years on adjusted terms in accordance with an expected rate of return mechanism. ABS summary features are available here.

The deal is secured on the feed-in tariff receivables from solar and wind power projects of seven subsidiaries of Huadian Fuxin Energy Corporation Limited. The underlying assets comprise benchmark price, as well as partially and purely subsidized electricity revenue rights. The proceeds will be used for the development and operation of green industry projects.

Climate Bonds view: This is one of the more complicated funding structures we have seen for solar and wind assets and has been designed to match the cash flows of the seven subsidiaries, providing an example of how corporates can aggregate smaller funding requirements and combine different types of revenue streams across their group. While we are comfortable with the underlying assets’ green credentials, we would hope to see more documents being made publicly available by the issuer.

JRTT – Japan Railway Construction, Transport and Technology Agency(JPY24.5bn/USD228m) issued a 20-year green bond in February 2018. The deal will finance the development of the Eastern Kangawa Lines “Enhancement of Convenience of Urban Railways” project. The lines will link the western part of Yokohama City and the central part of the Kangawa Prefecture with the Tokyo metropolitan area. The project is expected to reduce around 1800 tons of CO2 per year and 18 tons of NOx per year.

Climate Bonds view: This is JRTT’s second green bond following their debut JPY20bn (USD176m) issuance in November 2017. The deal was previously placed as pending due to lack of clarity on proceed allocations. Thanks to the provision of additional documentation by the lead underwriter, Mizuho, we were able to confirm the bond’s compliance with the Climate Bonds Taxonomy and include it in our database.

Japan Retail Fund Investment Corp (JPY8bn/USD73m) issued a 5-year green bond. This is the first Japanese REIT to tap the green bond market and it focuses on retail assets. Proceeds will be used to acquire buildings, which have achieved 3, 4 or 5 stars under the DBJ Green Building Certification Programme or B+, A or S rank under the CASBEE Certification Rank. The deal benefits from a Sustainalytics second party opinion.

Climate Bonds view: Introducing energy efficiency measures in buildings is paramount to reduce CO2 emissions. Eligibility thresholds for both DBJ Green Building Certification Programme and the CASBEE Certification Rank are on the middle-to-upper end of the scheme levels. We strongly encourage issuers to aim for high-end certification levels to maximise the environmental impact of energy efficiency related investments.

Kungsleden (SEK2.5bn/USD304m), Sweden, issued a 2-tranche green bond with a 4-year tenor. The property manager’s deal benefits from a CICERO second party opinion. Proceeds will be allocated to green buildings, solar, wind and geothermal energy and electric vehicle infrastructure. Building eligibility criteria require a minimum green certification of LEED Gold, BREEAM Very Good, Miljöbyggnad Silver or EU GreenBuilding. Additionally, for LEED and BREEAM, at least 70% of the points in the energy category have to be achieved. Energy efficiency projects and renovations of commercial properties must lead to at least a 25% energy use reduction.

Climate Bonds view: This deal was previously pending inclusion in our database due to lack of information. Once the second party opinion was made publicly available we were able to confirm that the proceeds of the bond are in compliance with the Climate Bonds Taxonomy.

Landshypotek Bank (SEK5.2bn/USD605m), Sweden, issued a 5-year green covered bond – the first green covered bond and largest green bond from a Swedish issuer. The cover pool comprises mortgages on FSC and/or PEFC certified forestry assets, however the green bond framework also includes wind and solar assets, buildings with an EPC rating class of A or B – which translates to at least 25% less total energy use per heated square meter than required by the Swedish National Building code – and building retrofits, which aim to achieve at least 30% improvement in energy use. In its second party opinion, CICERO awarded the framework a Dark Green shading.

Climate Bonds view: Forests are valuable assets to maintain biodiversity and to absorb sizable amount of carbon dioxide emissions. It is very gratifying to see that forests represent the cover pool of the first green covered bond issued in Sweden, and we hope to see more issuers following suit.

> Climate Bonds has opened a public consultation on our new Forestry and Land Conservation/Restoration Criteria. Register for the 18 June webinars here.

NYK – Nippon Yusen Kaisha (JPY10bn/USD91.5m), Japan, issued a 5-year green bond, a first for the shipping sector. Proceeds will finance and refinance LNG-fuelled ships, LNG-bunkering ships, ballast water management systems and SOx scrubber systems. Vigeo Eiris provided the second party opinion and stated “LNG is the best available option for full scale application to reduce emissions in the global shipping industry, especially for long-distance navigation purposes”.

Climate Bonds view: The decision to include the bond in our green bond database hinges on GHG emission reductions and NYK's adoption of fuel efficiency optimisation alongside the switch to LNG, measures to keep methane leakage to an absolute minimum and a commitment to provide impact reporting using operational data. On its own, the switch to LNG does not provide sufficient emission cuts. Renewable fuels are not yet a commercially viable option for long-haul shipping, so best practice would be to incorporate flexibility at the design stage to easily retrofit the vessels to run on renewable fuel in the future, i.e. to avoid lock-in of fossil fuel technology. The decision to include this bond was not a simple one – our special briefing provides details.

> Climate Bonds is currently establishing a Technical Working Group (TWG) and an Industry Working Group (IWG) to develop specific eligibility Criteria for Certification of shipping-related green bonds under the Climate Bonds Standard. If you would like to join the TWG or IWG please contact Katie House, Senior Research Analyst (katie@climatebonds.net).

Stena Metall Finans (SEK800m/USD91m) issued a 5-year green bond, becoming the first Swedish issuer from the waste management sector. The deal will finance waste recycling projects and assets related to the Sterna Nordic Recycling Centre located in Halmstad, Sweden. CICERO provided the second party opinion.

Climate Bonds view: Recycling is key to sustainable resource management. This month has also seen repeat issuance from waste management company Renewi (formerly Shanks Group) and we would hope to see more deals from the sector.

> Climate Bonds criteria for recycling and waste management are under development.

Taipei Fubon Commercial Bank Co (TWD1bn/USD190m), Taiwan, issued a 2-year green bond in March 2018 to finance the development of renewable energy and energy technology, including the construction of solar and wind power stations and the procurement of corresponding equipment. The renewable energy plants can generate around 14GWh – 22GWh per year. Deloitte provided an assurance report, confirming compliance with ICMA GBP, and the deal complies with the green bond requirements set by the Taiwanese government.

Climate Bonds view: The expected outcome is to initiate growth in clean technology development, diversify energy production sources and improve environmental quality in the region. Going forward we would hope to see longer dated paper which can provide security of financing for renewable energy and other green projects.

Taiwan Business Bank (TWD1bn/USD190m), Taiwan, issued a 3-year green bond in January 2018. Proceeds will be allocated to three major areas: 1) renewable energy and technology development; 2) energy efficiency and savings using energy storage equipment, energy monitoring devices, peak demand shift devices and energy efficiency equipment; and, 3) waste control and management, comprising waste and wastewater treatment, pollution control, resource recycling and noise control. KPMG provided an assurance report. The deal complies with the green bond requirements set by the Taiwanese government.

Climate Bonds view: The wide range of projects and ambitious allocation programme leads us to believe that this is the start of an initiative to create momentum in clean energy transition by improving of energy efficiency and pollution control in industry and other business sectors. We would hope to see more and longer-dated bonds raised to finance such projects.

Vastra Gotalandsregionen (SEK1bn/USD113m), Sweden, issued a 10-year green bond and obtained a second party opinion from CICERO. Proceeds from the region’s debut green bond will be allocated to buildings that have obtained a Miljöbyggnad Silver certificate or above. Eligible projects also include buildings with at least 25% lower energy input per square meter per year than required by applicable regulations or major renovations, which aim to achieve at least a 30% reduction in energy usage.

Climate Bonds view: Setting high green building certification levels and a minimum energy performance improvement of 25% or above are aligned with best practice. Achieving Miljöbyggnad Gold would demonstrate an even greater commitment.

Repeat issuers – 21 May to 5 June

Credit Agricole CIB: USD25m (previously pending)

EBRD: SEK1bn/USD114m

EIB: EUR500m/USD577m

Export-Import Bank of Korea: USD400m

Harvest Capital: CNY1bn/USD157m

Humlegarden Fastigheter AB: SEK400m/USD45m

Korea Development Bank: KRW300bn/USD0.3m

New Jersey Infrastructure Bank (formerly New Jersey Environmental Infrastructure Trust): USD36m

Obvion (Certified Climate Bond): EUR588m/USD685m

Renewi (formerly Shanks Group): EUR550m/USD648m

Renovate America/Hero Funding: USD206m

Skanska: SEK1bn/USD114m

TenneT Holdings: EUR1.25bn/USD1.5bn

May trends

![]()

![]()

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

Issuer Name | Amount issued | Issue date | Reason for exclusion/ pending |

Hera SpA | EUR200m (USD236m) | 17/05/2018 | Pending – sustainable revolving credit line |

Bank of Hebei | CNY2.5bn (USD393m) | 22/05/2018 | Not aligned |

ADB | HKD200m (USD25m) | 25/05/2018 | Pending |

Corporacion Andina de Fomento (CAF) | COP150bn (USD53m) | 25/05/2018 | Pending |

Bank of Kunlun | CNY400m (USD63m) | 28/05/2018 | Not aligned |

Huishang Bank | CNY4bn (USD623m) | 29/05/2018 | Pending |

Jinping Xinyuan Hydropower | CNY400m (USD63) | 05/04/2018 | Pending – first hydro ABS |

IBRD | AUD3m (USD2m) | 04/06/2018 | Pending |

Credit Agricole | USD10m | 09/05/2018 | Insufficient information |

AfDB | EUR1.25bn (USD1.5bn) | 24/05/2018 | Sustainability bond |

City of Palo Alto | USD9m | 05/06/2018 | Not aligned |

DTE Electric | USD525m | 07/05/2018 | Pending |

MTR | HKD413m(USD53m) | 02/05/2018 | Unlabelled |

Green bonds in the market

Investing News

The People’s Bank of China (PBOC) – China’s central bank – plans to expand the guarantee scope of its medium-term lending facility to include green bonds as an eligible collateral.

The EU is set to announce legislative proposals on sustainability taxonomy.

Robeco & RobecoSAM join forces to introduce new SDG bond fund.

Luxembourg signs deal to provide EUR1m to IFC’s green cornerstone bond fund programme.

Nasdaq Helsinki launches Sustainable Bond Market and MuniFin becomes the first green bond issuer to be listed on the segment.

Green Bond Gossip

Kenya is planning to issue a sovereign green bond.

Norwegian bank DNB has published a green covered bond framework.

City Bank, Bangladesh: private placement with IFC

According to an S&P Global article in its Leveraged Commentary & Data, the first green CLO is on its way.

Wunder Capital looking at Commercial & Industry solar ABS launch in 2019.

Ambitious plans for offshore wind developments in Taiwan are expected to bring at least NTD400bn (USD13.35bn) in lending opportunities.

Reading and Reports

The Intergovernmental Panel on Climate Change (IPCC) has invited governments to comment on the Final Draft of the Special Report on Global Warming of 1.5oC (SR15) ahead of the approval plenary in early October.

The Portfolio Carbon Initiative – a collaboration between World Resources Institute (WRI), UNEP Finance Initiative and 2 Degrees Investing Initiative – have published Exploring Metrics to Measure the Climate Progress of Banks.

The UK’s House of Commons Environmental Audit Committee recommends that the Government should make it mandatory for large companies and asset owners—such as pension funds—to report their exposure to climate change risks and opportunities by 2022.

17 organisations promote regenerative agriculture.

Global electric vehicle production is set to quadruple by 2020, to 4.5 million units, according to McKinsey.

Climate Bonds Reports

“Green Bond Pricing in the Primary Market: October – December 2017” report

“Securitisation as an enabler of green asset finance in India” briefing paper

“NYK issues first green bond from the shipping sector – green enough for now but not for long” special briefing

Moving Pictures

Flashback to Climate Bond March Conference. Six minutes with Mr. Bola Onadele. Koko, Managing Director/CEO, FMDQ OTC Securities Exchange talking green finance in Nigeria and West Africa. (6:05mins)

The future of food and water – selections from LinkedIn

Watch how this desert farm is harvesting food using just solar power and seawater.

This invention can turn seawater into drinking water and could provide a cheap alternative to energy intensive desalinisation.

Cochin International Airport in Kerala, India, is the world’s first airport fully powered by solar and uses the land between panels to grow vegetables.

‘Till next time,

Climate Bonds

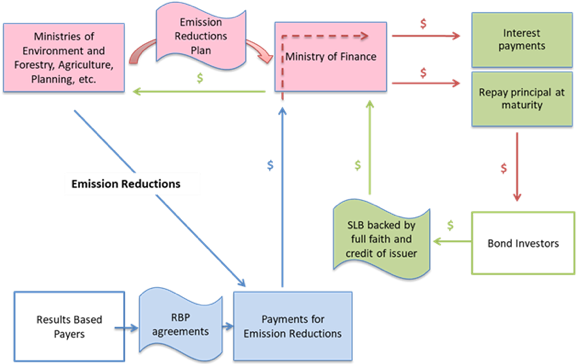

At a global level, forests mitigate climate change through carbon sequestration and contribute to climate resilience, balancing oxygen, carbon dioxide and humidity in the air and protecting biodiversity. Forests also have a significant role in reducing the risk of natural disasters, including floods, droughts, landslides and other extreme events.

At a global level, forests mitigate climate change through carbon sequestration and contribute to climate resilience, balancing oxygen, carbon dioxide and humidity in the air and protecting biodiversity. Forests also have a significant role in reducing the risk of natural disasters, including floods, droughts, landslides and other extreme events.

Financial Times,

Financial Times,

UNITED KINGDOM

UNITED KINGDOM BANK OF AMERICA

BANK OF AMERICA

What’s it all about?

What’s it all about?