Headline story

The Green Bond Pledge is now live, launched at our Annual Conference by climate chief Christiana Figueres. Signatories are being sought from Cities, municipal authorities and corporates. $1trillion in green bonds by 2020 is the goal.

Other highlights:

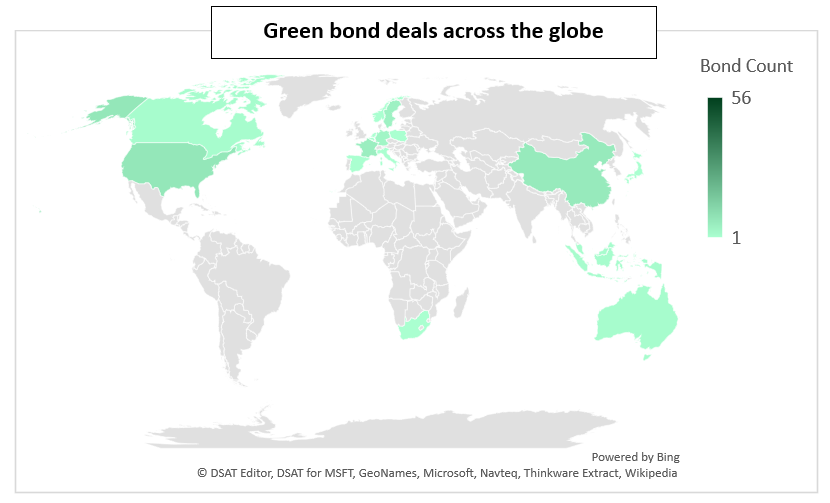

- Chinese entrants dominate March list by number.

- Landsvirkjun kick starts Iceland’s green bond market.

- Growthpoint Properties is the first corporate green bond listed on the JSE. Prologis becomes the first green bond issuer from the logistics sector worldwide.

- US muni issuance grows with New York State Energy Research and Development Authority’s Certified Climate Bond and San Rafael Joint Powers Financing Authority’s green bond.

- More on Certified Climate Bonds from Westpac and Ivanhoé Cambridge & Natixis Assurances.

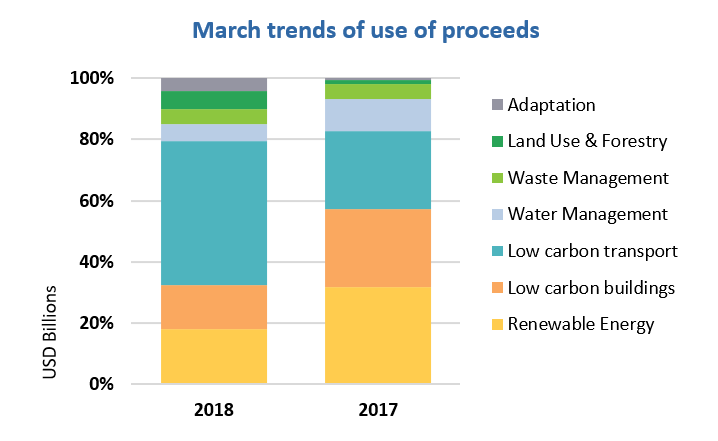

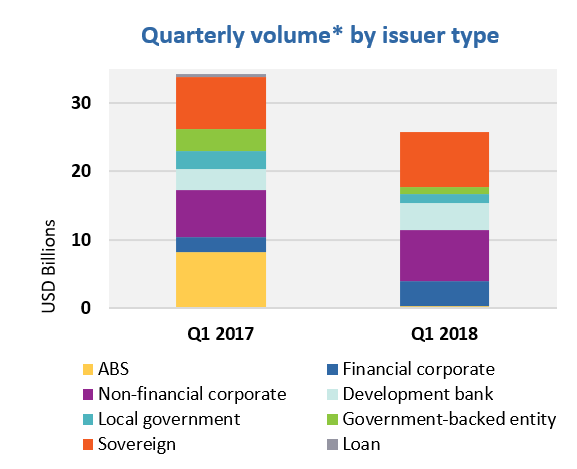

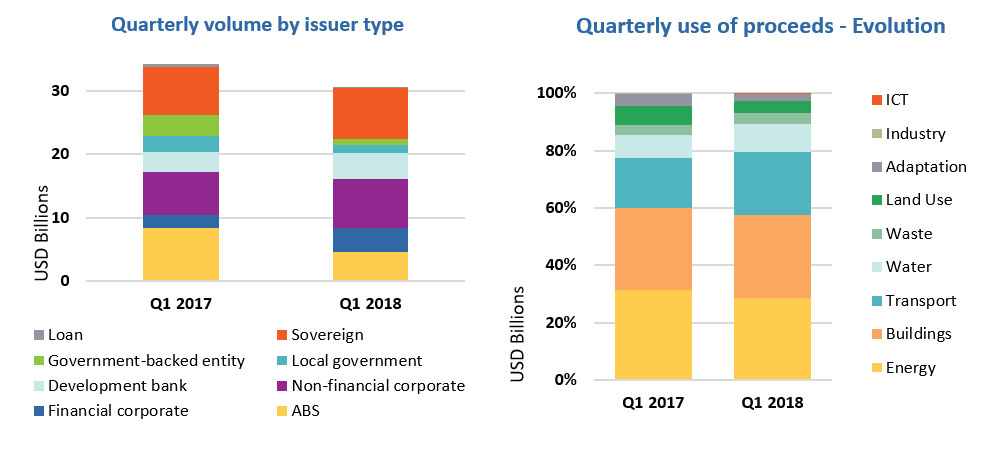

- March trends: Low Carbon Transport takes the lead in proceeds allocation, followed by Renewable Energy. Sovereigns keep driving issuance among issuer types.

Click here to see the full list of new and repeat issuers in March

At a glance

Among the debut deals is the first green bond from an Icelandic issuer and the first from a logistics company. But it is the Kingdom of Belgium and the Republic of Indonesia green sovereigns – analysed in our previous market blog– that top the rankings as the largest bonds accounting for an astounding 56% of March issuance to date.

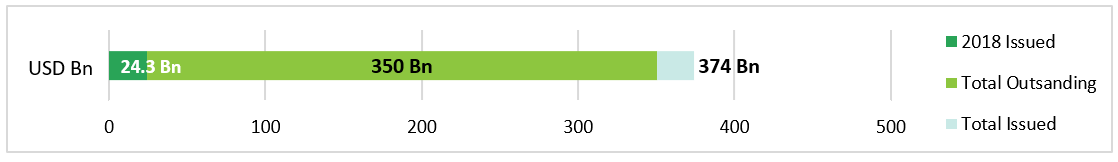

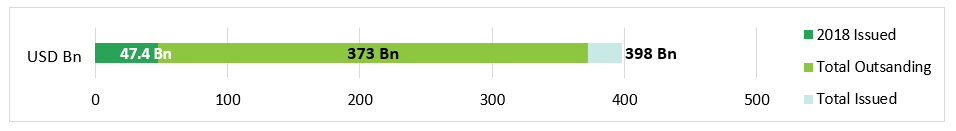

As of 28th March, the month has also seen the highest green issuance so far this year, totalling USD12.1bn – more than doubling February volume (including Swedbank’s green bond deal which has priced and is closing on the 29th). The twelve new issuers account for 72% of volumes so far, a reversal on February which saw very high volumes contributed by repeat issuers.

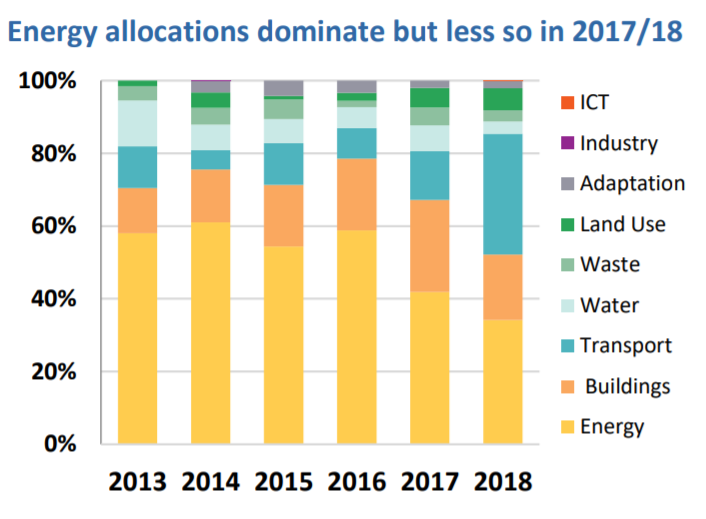

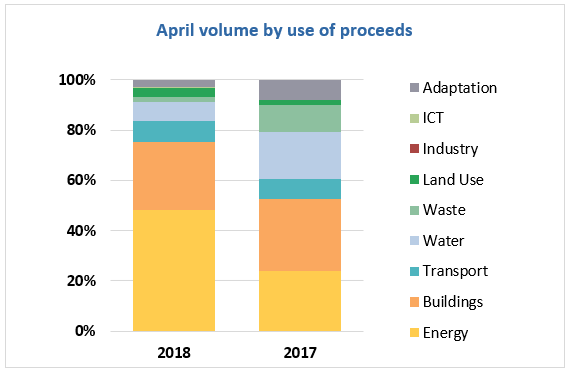

Use of proceeds became more diversified compared to previous months, with Belgium’s Green OLO boosting allocations to Low Carbon Transport to 50% and the remaining half spread across all other sectors.

>See the full list of new and repeat issuers here.

Certified Climate Bonds

New York State Energy Research and Development Authority (USD18.5m) issued a 16-year US Muni green bond. This is the first US green bond being certified under the renewable energy sector criteria of the Climate Bonds Standard and the third sub-sovereign/agency certified issuer in the State of New York after New York State Housing Financing Agency and the NY MTA.

Proceeds will be allocated to loans for residential solar PV for eligible applicants to the NYSERDA’s Green Jobs – Green New York program for one-to-four family residential structures. First Environment provided the Independent Verification Statement.

Ivanhoé Cambridge and Natixis Assurances(EUR480m/USD558m) put in place a senior secured loan in November 2017 and certified it in February 2018 under the Climate Bonds Standard for Low Carbon Buildings (Commercial), making it the first European green loan to be certified under the commercial buildings criteria. Oekom provided the Post-issuance Verification Report.

In another first, the Canadian real estate investor and French insurer will apply the loan’s proceeds towards the construction of the DUO towers in Paris, rather than refinance an existing property. The project comprises two towers with office space, shops, hotel and restaurants. The buildings will be built to comply with the Effinergie+ label and to obtain a HQE Exceptional and LEED Platinum certifications.

Westpac Banking Corporation (AUD117.3m/USD91m) has continued the Australian market’s best practice model of certification issuing a 5-year Certified Climate Bond in a private placement. Westpac issued its first Certified Climate Bond in 2016 and is eligible for Programmatic Certification under the Climate Bonds Standard. Eligible assets identified under the bank’s green bond framework cover Low Carbon Transport, Low Carbon Buildings, Solar and Wind Sector Criteria. Proceeds will be allocated to renewable energy projects, low carbon commercial property and rail transport.

EY provided past Post-Issuance Verification Reports. The one-year post-issuance report is currently due.

New issuers

Beijing Capital Group (USD603m), issued a green bond in two tranches of USD500m (3-year tenor) and CNY630m (2-year). This is the first offshore green bond issued by a Chinese corporate that is denominated in two currencies. Proceeds will finance water & waste management, air pollution control, low carbon transport, sustainable agriculture and green buildings with minimum certification thresholds of LEED Gold, Silver BREAAM Plus, China Green Building Standard and other equivalent labels. Sustainalytics provided a Second Party Opinion.

Climate Bonds view: For sustainable agriculture, Sustainalytics notes that the framework does not explicitly exclude genetically modified (GM) crop seeds from their definition of sustainable farming methods and prompts the issuer to ensure that proceeds don’t finance this type of projects. We include this bond to our database for now as GM is not automatically excluded from either international green bond definitions or China’s domestic guidelines. According to PBoC’s green bond endorsed projects catalogue, GM projects are permissible as long as they are in compliance with the Safety Management Regulation of Agricultural Genetically Modified Organisms (GMOs).

Growthpoint Properties (ZAR1.1bn/USD93m), South Africa’s largest real estate investment trust (REIT), issued a three-tranche green bond deal with a 10-year term. Growthpoint Properties is the first South African corporate to issue a green bond on the Johannesburg Stock Exchange. The REIT will mainly finance office buildings within its THRIVE Platinum Portfolio, which includes Growthpoint’s highest rated assets, but retail and industrial buildings that meet the eligibility criteria may also be financed. Proceeds will be allocated only to properties which have obtained at least a Four-Star Green Star SA rating on a scale from one to six. The deal benefits from a KPMG assurance report.

Climate Bonds view: It’s encouraging to see to see South Africa’s pool of green bond issuers expanding with new issuer types coming to market and we hope to see more of the country’s corporates following suit. We also note that in our 3rd Annual Green Bond Pioneer Awards last week the JSE was recognised for introducing a green bond list and listing guidelines in 2017. Well done!

We haven’t analysed the Green Star SA rating tool before, so let’s take a closer look. The rating system covers several categories that evaluate the environmental performance of a commercial property, including energy, emissions, materials and land use. Each category is assigned a percentage score and category weighting factors are then applied to calculate the final rating. The six levels of the scale also indicate the weighted score range and a recognition parameter of the rating level achieved (acknowledgement, best practice, South African Excellence, World leadership). We note that a Four-Star Green Star SA level stands on the middle to upper range of the rating system, which is good. What would be even better is seeing issuers achieving commercial property certifications on the highest end of the scale.

Huarong Xiangjiang Bank (CNY2.5bn/USD396m), China, issued a 3-year bond, its debut green bond, on China’s interbank bond market. The green bond framework states proceeds will be allocated to clean energy, energy saving, pollution prevention and adaptation, and all the categories are eligible under PBoC’s green bond project catalogue. The issuer has disclosed examples of projects to be financed by this bond, including dredging to maintain the holding capacity of a reservoir and construction of sewage treatment infrastructure. EY provided a Second Party Opinion for the deal.

Climate Bonds view: We strongly support clarity on the use of proceeds for each bond issued – particularly in the case of banks and local governments, who may have wide-ranging green bond frameworks. Ideally, transparency around funded projects should be a feature of both issuance disclosure and post-issuance reporting.

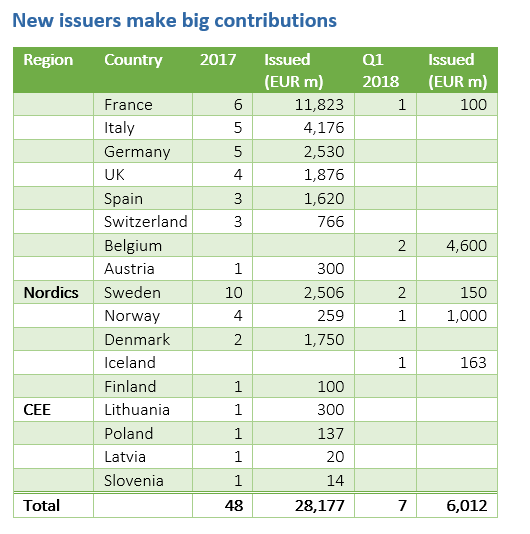

Landsvirkjun (USD200m), the National Power Company of Iceland, became the first Icelandic green bond issuer with its 10-year, four-tranche private placement green bond deal. The proceeds will fund the development of the 900MW Theistareykir geothermal station and the 100MW expansion of the Burfell hydropower plant.

More broadly, the green bond framework lists geothermal, hydropower and wind as eligible assets. Geothermal energy projects must comply with a direct emissions upper limit of 100g CO2/kWh. Hydropower projects must have a capacity of up to 100MW and annual emissions of less than 4g CO2/kWh to be eligible. The deal benefits from a Sustainalytics Second Party Opinion.

Climate Bonds view: We identified Landsvirkjun as a candidate for green bond issuance in our Nordic and Baltic Public Sector Green Bonds report earlier this year and are very pleased to see it come to market. Both geothermal and hydro eligibility criteria reflect best practice in the market, setting a high benchmark for future issuers.

Prologis European Logistics Fund (EUR300m/USD369m), the European fund manager of US-based warehouse REIT Prologis, issued a 10-year green bond. It is the first logistics investor to enter the green bond market. Funds will be allocated to green buildings, solar panels and wind related assets. The eligibility criteria require properties to have obtained LEED, DNGB, BREEAM, HQE or CASBEE building certification, with the thresholds set from the middle to the high end of the scale. In its Second Party Opinion, Sustainalytics notes that imposing certification criteria for large and potentially energy intensive properties will have a positive environmental impact.

Climate Bonds view: Promoting high energy performance in large logistics units is important for achieving lower property emissions overall. We agree with Sustainalytics that setting certification requirements in the framework is aligned with good practice, but we hope to see certification thresholds tightened further in the future.

San Rafael Joint Powers Financing Authority (USD45.5m), California, closes a 16-year green US muni bond on March 28th. Proceeds will be allocated to a new public safety centre and two new fire stations. All three buildings have received a LEED Gold certification. The prospectus lists building elements that will be present within each project, including recycled content of building material and solar power to reduce electrical grid demand.

Climate Bonds view: This is the third California US muni which has come to market this year so far. The preliminary prospectus offers a good level of disclosure on the proceed allocation and a LEED Gold certification is on the highest end of the scale. Although the issuer did not seek for an external review, we see an increasing trend in US Muni green bonds benefiting from Second Party Opinions.

Shanghai Lingang Economic Development Group (CNY1bn/USD160m), China, issued a two-tranche green bond. Proceeds will be used for the construction of three office buildings at Shanghai Lingang industrial park, and all three are designed to achieve China Green Building Evaluation 2-Star Label. The expected environmental and climate impact of the bond includes: avoidance of 2305t of standard coal equivalent per year, water savings of 2378m3 per year, and use of 425k tons of recycled materials. CCXI provided an external review.

Climate Bonds view: The China Green Building Evaluation standard rates buildings against a range of criteria in six categories: land savings and outdoor environment, energy savings, water savings, materials savings, indoor environmental quality, and operations and management. The standard is administered by the Ministry of Housing and Urban-Rural Development and is considered as one of the most widely used green building rating systems in China. We consider the intended use of proceeds on green buildings is aligned with our definition.

Suntien Green Energy (CNY590m/USD93m), China, is engaged in planning, development and operation of wind farms as well as the sale of electricity. Proceeds from its green bond will finance or refinance 15 wind farms in China. In the bond prospectus, the issuer disclosed the expected climate impact of two eligible wind farms. For example, a wind farm in Hebei province has a total installed capacity of 200MW and will deliver positive impact by avoiding 180k tons of standard coal equivalent, 1010k tons of CO2 and 42t of SO2. EY provided an external review.

Climate Bonds view: We consider this bond a good example of the level of disclosure we prefer. Not only is the intended use of proceeds fully aligned with the 2oC target for global warming, but the issuer provided very detailed disclosure on the name and location of eligible projects as well as expected impact.

Tianjin Rail Transit (EUR400m/USD496m), China, issued a 4-year green bond. Proceeds will be allocated to renewable energy, low carbon transport, energy efficiency and pollution prevention. Eligible projects falling under Transport include the construction and maintenance of rail tracks, upgrade of electric line network, upgrade of signalling system to improve capacity and reliability, as well as towards adopting technologies to increase air circulation and air filtration, set up noise barriers, and improve efficiency of rail turnouts. Sustainalytics provided a Second Party Opinion.

Climate Bonds view: This is the first green bond issuance from Tianjin Rail with all eligible projects related to the construction or efficiency improvement of rail infrastructure. Although noise barriers may not have significant positive climate impact, we included this bond to our database considering it’s an essential part of the urban rail system and its role in mitigating noise pollution.

Vellinge municipality (SEK200m/USD24m), Sweden, issued a 5-year green bond. Proceeds can fund a range of eligible categories including sustainable bioenergy, waste management, low carbon transport infrastructure and property, according to its green bond framework. To be eligible, buildings must use at least 25% less energy per m2 Atemp/year than the construction requirements of the National Board of Housing, Building and Planning (Boverket), a minimum certification of Silver Miljöbyggnad or a Green Building certificate from the Swedish Green Building Council. In its Second Party Opinion, CICERO noted that the building criteria are below best practice.

Climate Bonds view: The Vellinge Municipality is one of 13 Swedish local governments which was identified in our Nordic and Baltic Public Sector Green Bonds report as potential green bond issuers. We agree with CICERO that the building eligibility criteria could be more stringent but hope to see proceeds allocated to green buildings exceeding the minimum levels when the municipality starts reporting on use of proceeds.

>See the full list of new and repeat issuers here.

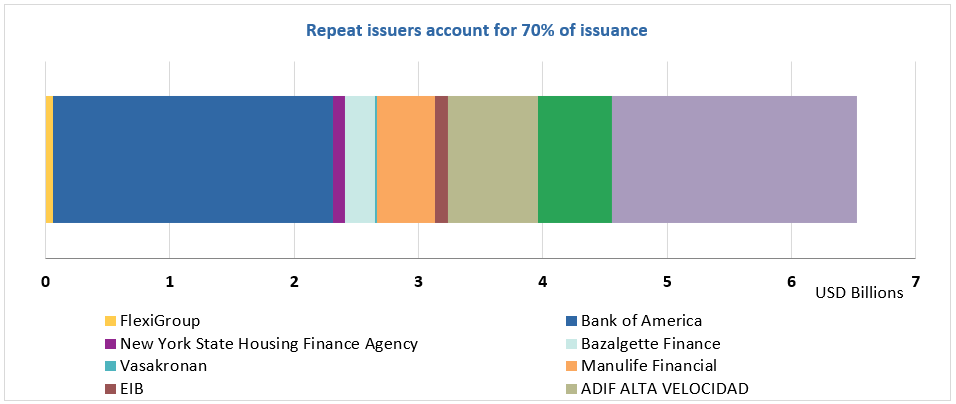

Repeat issuers

- Arise: SEK650/USD79m

- California Infrastructure and Economic Development Bank (Ibank): USD449m

- EIB: AUD200m/USD157m (tap), EUR250m/USD307m (tap)

- Iberdrola: EUR700m/USD859m

- Modern Land: USD350m

- Province of Quebec: CAD500m/USD394m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds taxonomy in our green bond database. Though we support the Sustainable Development Goals overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

- Kungsleden AB (SEK2bn/USD244m)– Pending: we are waiting for additional information on proceed allocation to be made available by the issuer.

- Land NRW (EUR1.8bn/USD1.9bn)– Excluded: sustainability bond with 82% of proceeds to be allocated to sustainable development projects, including education and healthcare. Only 18% of proceeds are to be allocated to projects aligned with the Climate Bonds Taxonomy.

- Cassa Depositi e Prestiti (EUR500m/USD614m)– Excluded: social bond issued in November 2017. Proceeds to be allocated to SMEs to support Italian employment, economic growth in areas affected by natural disasters, and economically underperforming regions.

- African Development Bank (EUR500m/USD614m)– Excluded: social bond issued in November 2017 to finance a wide range of projects, including education, health and financial inclusion.

- Bayerische Landesbodenkreditanstalt (EUR500m/USD614m)– Excluded: social bond issued in November 2017 as part of BayernLabo’s Social Bond Programme. Proceeds will refinance loan programmes for low-interest loans for private housing and modernisation of rental housing, as well as the company’s municipal subsidy loan programme.

- Danone (EUR300m/USD370m) - Excluded: social bond with proceeds allocated to projects within five eligible categories: research & innovation of advanced medical nutrition, social inclusiveness, responsible farming and agriculture, entrepreneurship financing and quality healthcare and parental control.

Trends of the month

Green bonds in the market

- Credit Suisse: USD500m – roadshow started 12th March

- Swedbank: EUR700m – priced, closes 29th March

Investing News

On 16th March Amundi and IFC successfully launched the Amundi Planet Emerging Green One, the world’s largest green bond fund focused on emerging markets. The fund closed at USD1.4bn, attracting a wide range of investors including pension funds, insurance companied, asset managers and development banks. The goal, however, is to reach USD2bn over the fund’s lifetime to support climate-aligned investments and stimulate green finance development in emerging markets. The fund will also provide technical assistance programme to promote best-practice standards in EM’s green bond markets.

BMO Global Asset Management has launched a responsible Euro corporate bond fund, following increasing demand for ESG-focused funds.

UK-based Gore Street Energy Storage Fund aims to raise £100m from its initial public offering on the London Stock Exchange.

President Macron said France would extend an extra EUR700m (USD861m) through loans and donations by 2022 for solar projects in emerging economies.

The UK Government joined forces with the Lima Stock Exchange and contributed£22,900 towards the development and publication of a Guide to Green Bonds in Peru, which presents the basic principles that must be met in order to issue green bonds to finance projects for the mitigation and adaptation to climate change.

The China-UK Green Finance Taskforce has included the development of an international ABS market based on Chinese green loans as one of the four priorities.

Lots of Green Gossip

Auckland Council, New Zealand, plans to issue NZD green bonds later this year to fund infrastructure projects.

Swedish real estate company Jernhusen has released its green bond framework in preparation for its first green bond issue and has obtained a Second Party Opinion from Sustainalytics.

Californian company Climatic Energy is planning to use credit enhanced green bonds to retrofit commercial buildings.

The first publicly placed Commercial Property Assessed Clean Energy (C-PACE) ABS is expected to come to market in May, according to Environmental Finance. The first C-PACE ABS was issued by Greenworks (USA) in September 2017, but was privately placed, unlabelled and not rated.

Massachusetts Governor Charlie Baker submitted a USD1.4bn bond bill, with USD300m that will be directed to climate mitigation and adaptation projects.

Belarus’ Deputy Economy Minister Dmitry Matusevich stated the country’s interest in introducing green financial instruments that support the development of its green economy.

Reading and Reports

The UK Green Finance Task Force Report is hot off the press!

The Loan Market Association launched the Green Loan Principles (GLP) on 21 March. They reflect the Green Bond Principles (2017) and provide a high-level framework for the green loan market. In the future, we hope to see a stronger push towards disclosure of external reviews, harmonisation of reporting standards and convergence of green project/asset documentation.

S&P reports on green bond issuance from top 200 banks.

The Transition Pathway Initiative published a study assessing how the business strategies of oil and gas companies align with the Paris Agreement’s emission reduction targets.

Climate Bonds Reports:

“Korea State of the Market Overview and Opportunities”, launched at our conference, explores Korea’s green bond market and prospects for development.

“Sovereign Green Bonds Briefing”, launched on Monday, focuses on sovereigns, and their key role in growing local markets and meeting national climate targets.

Moving Pictures

Renewable Energy World has a delightful 1:07min clip explaining the Green Bond Pledge and associated 2020 target. Don’t miss it.

‘Till next time,

Climate Bonds