Green bonds issuance hitting the record $100 mark, certified green bonds from Barclays, Bank of China, ICBC and China Development Bank... Yes, November was a month full of big news for the green bonds market! Here is the selection of media coverage for a busy November.

Magic $100 billion mark

As we reported in November, green bonds issuance hit $100 billion mark during COP23! See what media are saying.

Reuters, Green bond deals hit record $100 billion in year to date: data, Nina Chestney

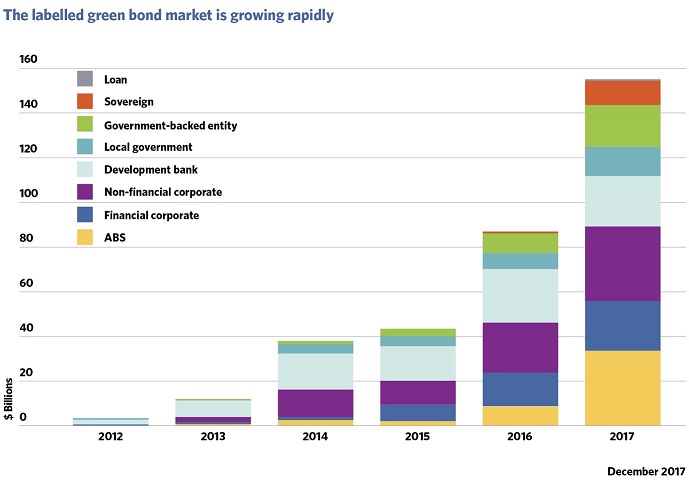

Global green bond deals will top the $100 billion mark on Thursday and hit a new record, putting them on track to reach $130 billion by the end of the year, data from the Climate Bonds Initiative (CBI) showed.

Business Green, Green bonds clear $100bn mark for the first time

Climate Bonds Initiative confirms 2017 will be the first year when over $100bn of green bonds have been issued.

PV Tech, Green Bond issuance surpasses US$100 billion in 2017, Tom Kenning

Last year saw a previous record of US$81.6 billion issuances, but CBI forecasts an estimated US$130 billion to be reached by the end of this year.

Energy Live News, Global green finance reaches record $100bn

China leads the issuance, followed by France, the US, Germany, Netherlands, Sweden, Mexico, Spain, India and Canada.

Climate Action Programme, Green bonds reach $100 billion milestone

According to Climate Bonds Initiative, the top countries for 2017 are China, with more than $16 billion green bonds issued, France with $15 billion, and the US with approximately $14 billion in green bonds.

SolarQuarter, Green bonds reach $100 billion milestone

As the organization [CBI] states, the milestone was reached due to several global banks creating a momentum for green bonds.

More Market News

Financial Times, Green bond issuers are poised to charge a premium, Kate Allen

Pricing advantage emerging for green bonds?

As volumes of environmentally friendly and socially responsible finance-raising grow rapidly, the increasing depth of the market could result in the emergence of a premium in prices and lower yields for such paper.

Financial Times,Green bond issues hit record high on ‘sustained global momentum’, Kate Allen

Record green bonds issuance as reported by Moody’s picked up by Financial Times.

According to new figures from credit-rating agency Moody’s, nearly $95bn of green bonds were issued globally in the first three-quarters of this year — up 49 per cent year on year — with full-year volumes set to top $120bn for the first time.

Financial Times, Green bond issuance booms, set to top $120bn this year

Another FT article stressing the $120bn figure that Moody’s expect the green bonds market to reach by year-end.

Matthew Kuchtyak, a Moody’s analyst, said there was “sustained global momentum” in the green bond market, with an increasing volume of transactions coming from emerging markets.

Reuters, HSBC pledges $100 billion of finance by 2025 to combat climate change, Nina Chestney

That declaration attracted a lot of media attention in November.

HSBC said it will facilitate financial flows to help boost support for clean energy and lower carbon technologies.

Business Green, HSBC pledges to deliver $100bn of green finance through to 2025, James Murray

HSBC has become the latest banking giant to unveil sweeping new green investment plans, confirming today that it intends to deliver $100bn of low carbon and sustainable finance through to 2025.

South China Morning Post, Why some Chinese green bonds are ‘not so green’ in the eyes of international investors, Georgina Lee

Difference between green bond standards set by the PBOC and Climate Bonds Standard explained.

A main difference lies in the use of proceeds. The NDRC regulation allows issuers to use up to 50 per cent of the funds to repay bank loans, or invest in general working capital; whereas for institutional investors outside China, they accept only issuers that use 95 per cent of the proceeds for green assets or projects, according to the CBI.

Investments & Pensions Europe, China, EIB collaboration seeks 'common language' for green finance, Susanna Rust

A step towards harmonizing green finance standards between China and EU

The European Investment Bank (EIB) and the China Green Finance Committee (CGFC) have presented the initial conclusions of a project that ultimately seeks to facilitate the establishment of a common language in green finance, or “a standard-neutral taxonomy for the environmental use of proceeds”.

FTSE Global Markets, SK Securities/Climate Bonds promote green economy in South Korea

FTSE reporting on the Memorandum of Understanding (MoU) signed between SK Securities and the Climate Bonds Initiative with the aim of advancing green economic development and expanding South Korea’s green bond market.

Sean Kidney, CEO Climate Bonds Initiative adds, “There are enormous low carbon investment opportunities for South Korea. Implementation of climate plans, sustainable development and green infrastructure domestically and across Asia provides many directions to develop green finance.”

Private Wealth, Green Bonds: 5 Things To Know About A Growing Investment Opportunity

Facts you shouldn’t miss when making a green bond investment decision.

Green bonds (…) saw about $81 billion in corporate, municipal and sovereign issuances last year, according to the Climate Bonds Initiative (CBI), and are estimated to be $130 billion in 2017.

AltEnergyStocks, Second Largest Quarter For Green Bonds Ever

AltEnergyStocks publishes our blog post covering green bonds market developments in Q3.

The green bond market has kept its strong pace in Quarter 3 2017, reaching a total of USD27.7bn from July to September.

Wealth Professional, Green bond issuances reach new heights, Gerv Tacadena

Wealth Professional presents findings of the Bonds and Climate Change: Canada Report.

According to the 2017 Bonds and Climate Change: State of the Market Canada report by the Smart Prosperity Institute and the Climate Bonds Initiative, Canada's green bond issuance this year exceeded that of the recent years combined.

Financial Post, The case for a Canadian sovereign green bond, Barry Critchley

Ottawa should issue a sovereign bond that would provide “the scale and liquidity” the nascent green bond market needs, according to the State of the Market report.

Climate Bonds Standard certified bonds this month

BARCLAYS

On the first day of COP23, Barclays issued a EUR500m green bond certified under the Low Carbon Buildings Criteria of the Climate Bonds Standard. Read more here.

Financial Times, Banks help to bring climate change for green bonds, Thomas Hale

Last week, Barclays sold the first green bond from a UK financial institution linked to assets within the country. The €500m deal, which attracted almost €2bn of orders, followed other inaugural deals for banks in the burgeoning market for green financing.

Financial Times, Barclays launches first UK bank green bond to fund British assets, Thomas Hale

The Barclays deal paves the way for financial institutions — which are major sellers of bonds across Europe — to expand their issuance in the market.

CityAM, HSBC and Barclays throw weight behind green finance projects, Jasper Jolly

According to the Climate Bonds Initiative, a charity which promotes green bonds, $94bn (£72bn) has been raised so far over the course of 2017. Some 40 green bonds are listed on the London Stock Exchange.

The Financial, UK first as Barclays issues €500m Green Bond

Sean Kidney, Founder and CEO of Climate Bonds Initiative, said: “Barclays has taken a lead among UK banks and FTSE 100 companies with this innovative certified green bond, that is an example of international best practice standards. (…)”

Climate Action Programme, Barclays issues €500 million bond for “green mortgages”

Sean Kidney (…) commented: "The UK green bond market has been slow to develop, lagging many G20 and EU nations. This new Barclays green bond should trigger more global banks and Financial Times Stock Exchange 100 Index (FTSE) companies to act and initiate their own green bond programs into 2018”.

Business Green, 'UK first': Barclays issues €500m Green Bond, James Murray

Banking giant says first green bond issued by a UK bank using UK assets attracted final order book of €1.85bn.

Capital, Barclays sees strong demand for green bond, James Hester

Barclays began issuing green bonds today as it seeks to become a leader in the niche, climate-friendly segment.

BANK OF CHINA

The third green bond issued by the Bank of China is Climate Bonds certified! Read more here.

Reuters, Bank of China issues green bond in Paris - Xinhua

One of China’s biggest banks, state-owned Bank of China, has issued a green bond denominated in the Chinese yuan currency in Paris, the first of its kind in France.

Financial Times, Bank of China Paris branch sells triple-currency ‘climate bond’, Gabriel Wildau

The deal is certified by the Climate Bond Initiative, a London-based advocacy group that sets standards for green finance.

Xinhua.net, Spotlight: China's green bond market goes to internationalization: expert

"The three large Chinese banks -- Bank of China (BOC), Industrial and Commercial Bank of China (ICBC) and China Development Bank (CDB) -- all have issued climate bonds, certified green bonds and it is a sign of the internationalization of China's bond market," Kidney told Xinhua.

Leaders League, Bank of China Paris Issues $1.5bn Equivalent Third Offshore Green Bonds, Jeanne Yizhen Yin

On the occasion of 2nd anniversary of COP21 and Paris Accord, Bank of China Paris Branch has priced its third offshore Green Bonds. The move, which took place on November 15th, is certificated by the Climate Bonds Initiative (CBI) (…).

Business Standard, China's green bond market goes to internationalization: Expert

"There has been very strong demand from offshore investors for quality green bonds, and the demands for this Bank of China green bonds from international investors reflects that there is an appetite there for certified, quality green issuance out of China," said Kidney.

ICBC

ICBC issued its inaugural green bond also certified under the Climate Bonds Standard at the end of October. More here.

Delano, Chinese bank floats green bonds on lux bourse, Aaron Grunwald

Finance and government officials are ringing the ceremonial bell at the Luxembourg Stock Exchange on 30 October to mark the successful listing by ICBC of the world’s first climate bonds that are part of the “Belt and Road Initiative”.

Bourse Luxembourg, ICBC lists its inaugural “Belt and Road” climate bond in Luxembourg

The Climate Bond Initiative has certified the bonds as climate bonds. They are now listed on LuxSE’s Euro MTF market and displayed on the Luxembourg Green Exchange (LGX).

CHINA DEVELOPMENT BANK

And the third green bond from China this month is certified under the Climate Bonds Standard!

Nikkei Asian Review, China Development Bank Prices 5-Year $500 Million Green Bond, Amy Lam

Policy lender China Development Bank has set the coupon for its $500 million five-year Green Bond issue at 2.75%, according to a termsheet for the offer. (…) The bonds obtained the Climate Bonds Initiative Certification on Nov. 6.

Institutional Asset Manager, China Development Bank issues green bond on CEINEX market place in Frankfurt

The CDB green bond is in line with the Green Bond Principle (2017) by the International Capital Markets Association (ICMA) and has obtained the Climate Bonds Initiative Certification by the independent Climate Bonds Initiative (CBI).

INDIAN POWER FINANCE CORPORATION

An inaugural green bond from 4th largest railway network in the world also certified! Read more.

LiveMint, Power Finance lists green bond on London Stock Exchange, Aditi Khanna

India’s Power Finance Corp.’s (PFC) has listed its first international bond in almost two decades on the London Stock Exchange to finance renewable energy projects in the UK. The 10-year dated green bond raised $400 million.

The Economic Times, Power Finance Corp lists green bond on London Stock Exchange

The latest Climate Bonds Initiative certified bond is the seventh green bond listed on London Stock Exchange in November 2017, and the fifth green bond by an Indian issuer in London.

Climate Change News, India raises $400m green bond to fund renewables drive, Megan Darby

The projects will be independently verified and certified by the Climate Bonds Initiative (CBI), to ensure they are sustainable, according to the framework document.

The Tribune India, India’s Power Finance Corp lists green bond on London Stock Exchange

“PFC is unlocking and promoting green finance across India, enabling the country to achieve its ambitious climate change targets set out under the COP21 agreement,” said Nikhil Rathi, CEO of London Stock Exchange Plc.

India Today, Indias Power Finance Corp lists green bond on London Stock

"The funds raised will help promote renewable energy projects across the country and aid in achieving the government’s target of 175GW of installed renewable energy capacity by 2022," said PFC chairman Rajeev Sharma.

The Hindu Business Line, PFC lists green bond on London Stock Exchange

According to LSE, green bonds in London had raised over $3.2 billion in November 2017 alone. There are 59 green bonds listed in London that have raised over $19.5 billion in aggregate terms across seven currencies.

MANULIFE

Certified green bond from a Singaporean life insurer.

Advisor.ca, Manulife becomes first life insurer to offer green bond

Manulife Financial Corporation has issued Climate Bonds in Singapore certified by the Climate Bonds Initiative, an investor-focused not-for-profit organization that promotes large-scale investment in the low-carbon economy.

Finews Asia, Manulife Goes Green in Singapore

Manulife Financial said it placed SG$500 million worth of «green bonds,» its first issuance of an instrument meant to raise capital for projects with environmental benefits.

The Business Times, Manulife prices first green bond; S$500m of 12-year notes offer 3% coupon, Rachel Mui

Manulife said that the bonds are the first green bond of benchmark size issued by a life insurance company.

The Straits Times, Manulife prices its first green bond

Manulife's first green bond is only the second Singdollar green bond and the third by Singapore corporates to hit the market.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.

.gif)

.gif)

.gif)

.png)

.jpg)

.png)

.png) Tobias Lindbergh, Head of Sustainable Finance, Handelsbanken

Tobias Lindbergh, Head of Sustainable Finance, Handelsbanken Elisabet Jamal Bergström, Head of Sustainability, Handelsbanken

Elisabet Jamal Bergström, Head of Sustainability, Handelsbanken.png) Sean Kidney, CEO, Climate Bonds Initiative

Sean Kidney, CEO, Climate Bonds Initiative.jpg)

.jpg)

.jpg)

ALZBETA KLEIN

ALZBETA KLEIN

RATHIN ROY

RATHIN ROY CHRISSA PAGITSAS

CHRISSA PAGITSAS ULRICH BOGNER

ULRICH BOGNER

.png)

.png)

.PNG)

.png)

.png)

.png)

.png)

.png)

.JPG)