As promised, here is Part 2 of our Jumbo Market Blog with many of the issuances that have been coming thick and fast in the last month!

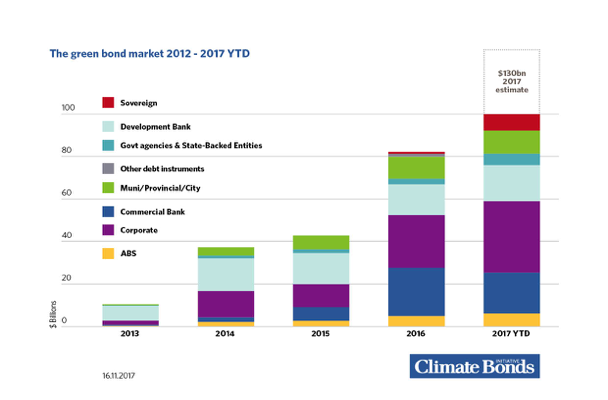

We passed the big $100bn GB milestone on final days of COP23. Will the year end close to our $130bn 2017 forecast?

If this pace keeps up in the last weeks of December....

New issuers

Certified Climate Bonds

Contact Energy - NZD75.5m (USD51.75m)

Now here’s something new – New Zealand power utility, Contact Energy, has just launched a Green Borrowing Programme to support its past and future renewable energy generation initiatives. Its framework has been Certified by Climate Bonds and the Programme is a first of its kind in New Zealand and the world.

As of 31st July 2017 - when the Framework was put in place - the eligible debt under the Programme totalled NZD1.8bn. This includes bonds issued from 2013 onwards – USD340m in multiple US private placements, a NZD50m wholesale bond and three retail bonds totalling NZD472m – as well as NZD525m from bank facilities and NZD250m in commercial paper. The company plans to refinance maturing debt and raise new debt under the framework. The first new transaction under the programme is a NZD75.5m (USD51.75m) bank facility.

But what actually is a ‘Green Borrowing Programme?’ you may ask. Well, Contact is certifying all the finance it is raising or intends to raise in the future for its renewable energy programme – this finance could be raised through the direct issuance of green bonds or through other types of debt instruments. Although also future debts instruments fall under the certified programme, use of proceeds will still have to comply to the Sector Criteria of the Climate Bonds Taxonomy.

Examples of debt instruments that may be issued under the programme are:

Committed bank facilities, including specialised funding such as its export credit agency facility (“NEXI facility”)

Commercial paper issued under its domestic Commercial Paper Programme Wholesale bonds

Listed retail bonds

US Private Placement Notes

Bonds issued in other offshore jurisdictions

Through the Green Borrowing Programme, the company will support existing and future renewable energy generation assets that meet the Climate Bonds Standard V2.1, as set out in the Green Borrowing Programme Framework. Specifically, eligible assets are hydro power projects and geothermal assets.

Hydro assets? Yes, regular readers may recall that there are unresolved issues with hydro projects and, as of yet, hydro projects cannot be Certified under the Climate Bonds Standard. So, Contact Energy have done two things to ensure their alignment with the standard:

The first green bond to actually be issued (remember, the full borrowing programme is not all being used yet) is just for geothermal assets;

The Framework states that future assets must meet Climate Bonds Criteria or future criteria when they are included. This means no hydro assets are included just yet but may become eligible when the criteria are ready (if, of course, they meet the criteria requirements).

For geothermal projects, eligible projects must have an emission intensity lower than 100gCO2e/kWh to be in line with Climate Bonds Geothermal Criteria. This means that, for example, the Ohaaki geothermal plant was excluded from the asset pool as it does not meet this threshold.

The independent assurance report was provided by EY.

Underwriters: ANZ

Barclays - EUR500m (USD580m)

We’ve already reported on this deal, but here is some colour about the deal process…

Books opened with initial price talk of MS+65bps area. After 3 hours, books were above EUR1.8bn, and price guidance was at that time revised to MS+55bps area. The deal was launched with over EUR2.25bn in the order book.

Geography of investors: Germany / Austria / Switzerland (27%), France (22%), UK / Ireland (19%), Southern Europe (15%), the Nordic countries (7%), Benelux (7%) and Others (3%).

Investor types: asset managers (56%), insurance / pension funds (22%), central banks / official institutions (12%), banks / private banks (8%) and hedge funds (2%).

Manulife Financial - SGD500m (USD368.8m)

Manulife’s USD368.8m Certified Climate Bond is the first green issuance from a life insurer corporation. Perhaps it’s paving the way for a flood of insurers to come to the market?

The green bond framework contains a variety of eligible assets (see below) but the nominated Projects to be financed by this inaugural bond are exclusively made up of wind and solar projects or of infrastructure wholly dedicated to these assets and Certified against our Wind and Solar Criteria:

83% projects located in Canada and 17% in the US.

The full Manulife Green Bond Framework has a detailed list of potentially eligible project groups which broadly fit into the following categories:

Renewable energy and related transmission infrastructure

New or existing residential and commercial green buildings

Purchase and operation of sustainably-managed forests holdings with certifications

Energy efficiency equipment, projects and modelling systems

Clean transportation including rail, electric vehicles and mass public transport infrastructure

Sustainable water management including treatment, re-use, flood defence and distribution

Pollution prevention and control including treatment, recycling, diversion and emissions reduction

Well done Manulife!

Sustainalytics provided the verification.

Underwriters: DBS, HSBC, Standard Chartered.

Corporate

Innogy - EUR850m (USD998m)

Innogy, Germany’s largest energy group, recently issued their debut green bond which was several times oversubscribed!

Proceeds will be used to refinance four offshore and one onshore wind projects in the UK, Germany and the Netherlands. Wind is easy – it’s an essential part of the infrastructure needed to transition to a low carbon economy and therefore in line with a 2-degree world. Annual expected electricity production of all wind farms is about 3 TWh, which is sufficient to power approximately 830,000 households.

This is the largest German corporate green bond to date, which is a great step for the German market. For those of you who read our 2017 German Green Bond Market Update (Auf Deutsch), you may remember that despite there being the potential for a huge green bond market in Germany (active bond market, big pipeline of assets, large issuer and investor base etc.), the vast majority of issuance had been from the development bank KfW rather than from the corporate market – perhaps this bond is a sign of change in the wind?

Sustainalytics provided the second opinion.

Underwriters: ABN AMRO, Société Générale, DZ Bank, HSBC, LBBW and MUFG.

Iren - EUR500m (USD587m)

Iren issued their maiden green bond, which attracted significant demand and received subscriptions for approximately EUR2.2bn, making it more than 4x oversubscribed! The company is one of the major Italian electricity and gas distributors.

IREN will use the proceeds of the bond to refinance the following projects and assets:

Renewable energy (31.55%): mini hydro, solar PV, energy network development

Energy efficiency (45.57%): energy distribution and management, cogeneration facilities

Waste management efficiency and recycling (7.88%): waste collection and sorting upgrades

Waste water treatment (15%): wastewater treatment plant upgrades

A detailed description of the project specifics is available here.

Mini hydro projects are under 5MW of size.

DNV GL provided the second opinion.

Underwriters: Banca IMI, Goldman Sachs, Mediobanca, SocGen CIB and Unicredit.

OBOS Forretningsbygg - NOK430m (USD52.632m)

OBOS is the largest Nordic cooperative building association and a major player in driving buildings development in Oslo. It has just issued its first green bond for NOK430m.

Eligible projects:

Green buildings: with a minimum of BREEAM-NOR “Very good” or Energy Class B

Renewable energy: solar, geothermal, local energy solutions (excluding fossil fuels), wind

Transport: electrical bike pools, electrical car pools, bike sharing systems/bicycle pools, mass transportation (e.g. local public transportation buses, trams, trains etc.)

Waste management and recycling: Underground waste transportation systems, local mass waste collection

Renewable energy and transport are all pretty easy.

For green buildings, we note that BREEAM-NOR “very good” is a high certification level within this scheme. Targeting a BREEAM-NOR level of excellent or above would show an even clearer commitment, which is why the green buildings category was awarded a “medium green” by CICERO.

Under waste, we’re not entirely sure what underground waste transportation means, but we note that it apparently reduces the impact of waste collection - which CICERO has classified as ‘dark green’.

CICERO provided the second opinion.

Underwriters: DNB, Nordea.

Gas Natural Fenosa - EUR800m (USD928.56m)

Gas Natural Fenosa closed its first green bond totalling EUR800m. The bond was nearly 2x oversubscribed and orders were placed from 130 institutional investors coming from 19 countries.

Yes, it has ‘gas’ in the title of the company (eek!) – that’s because its main business is in gas and electricity - it is the largest natural gas distributor in Latin America!

But proceeds will finance or refinance wind and solar renewable energy generation projects:

Renewable energy is pretty straight forward, and both eligible projects and environmental benefits are clearly set out. The company has committed to becoming carbon neutral by 2050 by increasing renewable energy generation – with a target of GW2.5 renewable power by 2020 - so this is a step in that direction.

Vigeo Eiris provided the second opinion.

Underwriters: Banco Bilbao Vizcaya, Banco Sabadell, Santander, Caixa Bank, Commerzbank, Crèdit Agricole CIB, HSBC, Royal Bank of Canada, Goldman Sachs, Unicredit.

Avangrid - USD600m

Avangrid issued its inaugural green bond this November. The issuer is a US diversified energy utility company operating in 27 states.

Proceeds will finance:

Renewable energy projects from wind and solar energy

Transmission and distribution network projects connecting renewable energy or reducing emissions through installation of transmission infrastructure to connect renewable energy generation resources and equipment to improve system efficiency

Two specific projects that will be financed by the proceeds are the construction of the 208MW Amazon Wind Farm North Carolina – Desert Wind farm in (you guessed it) North Carolina, which started operating in early 2017, and the purchase of the 56MW Gala Solar Plant in Oregon, which reached commercial operation in October 2017.

You can find Vigeo Eiris’ second opinion here.

Underwriters: BBVA Securities, BNP Paribas, Citigroup, Deutsche Bank, Drexel Hamilton, Wells Fargo.

Ørsted - EUR1.25bn (USD1.49bn)

Ørsted closed its first green bond totalling EUR1.25bn. Investor demand was high and the bond was sold only 10 hours after the launch.

Eligible projects according to Ørsted’s Green Bond Framework are:

Offshore wind farms and other renewable energy generation

Bioenergy

Energy storage, smart grid and other energy solutions

The company notes that biomass projects are important in enabling the full divestment from fossil fuel energy generation – they aim to generate no electricity from coal by 2023 (great news!).

But, burning biomass isn’t all that sustainable unless it is truly carbon neutral. Indeed, as we already pointed out for other bonds, projects involving biomass can be contentious as it can lead to rapid deforestation, destruction of forest ecosystems and resiliency to climate change by impacting water resources, land use and biodiversity. According to our the Taxonomy, bioenergy projects are defined as “green” bioenergy sources do not deplete existing terrestrial carbon pools.

For this bond, Ørsted aims to finance only sustainable biomass. At a company level, it aims to source 61% of certified biomass by 2016 and 100% by 2020. Farewell to coal by 2023 – now that’s pretty exciting!

CICERO provided the second opinion.

Underwriters: BNP Paribas, Rabobank, Deutsche Bank, Skandinaviska Enskilda Banken, Barclays, Nordea.

Tideway/Bazalgette Finance - GBP250m (USD333.17m) and GBP200m (USD266.45m)

Bazalgette Finance plc, also known as Tideway, has issued its GBP250m (USD333.17m) and GBP200m (USD266.45m) inaugural green bonds - part of a multicurrency bond programme with a total portfolio of GBP10bn, established in June 2017. In November 2017, S&P awarded the programme an E1 rating - the highest Green Evaluation Score on the scale.

The bond will finance the construction of the Thames Tideway Tunnel, a 25km sewer tunnel that will help protect the River Thames from sewage pollution, as laid out in Tideway’s Green Bond Framework. The project aims to manage the amount of sewage discharged into the Thames and the growth in water and sewage demand determined by projected increases in London’s population, and making the infrastructure climate change resilient.

Wastewater management, pollution control and climate adaptation infrastructure are all broadly positive environmental categories. It’s hard to separate really high-impact wastewater projects from others at the moment as there are few metrics or definitions that do this – hopefully this will change in the not too distant future.

External review: S&P.

Underwriters: Credit Agricole, Lloyds, MUFG Securities, Royal Bank of Canada, Santander, SMBC Nikko Securities.

ABS

Dividend Finance - USD129m

American Dividend Finance recently closed its first green securitisation totalling USD129m. The issuer is a provider of residential solar loans and administrator of PACE financing.

To be eligible for the allocation of the green proceeds, the solar loans can fund either solar panel modules, inverters or services relating to installation.

Great to see another issuer growing the ABS space!

Sustainalytics provided the second opinion.

Underwriter: Credit Suisse.

Financial Corporates

Swedbank - EUR500m (USD579m)

Swedbank, a Climate Bonds Partner, recently closed their debut green bond and, apparently, their ambition is “to be an annual issuer in the green market”! The deal was nearly 3x oversubscribed!. Initial price talks at MS+15bps tightened to final terms at MS+7bps.

This first bond will finance renewable energy and energy efficiency projects. The green bond framework lists the following eligible categories:

Renewable energy: wind, solar, small scale hydro (hydropower plant of maximum 10 megawatts) or investments in existing larger hydro power plants for refurbishments without increasing the size of its reservoir

Energy efficiency: low carbon buildings with minimum LEED “Gold”, minimum BREEAM “Very Good” and upgrades reducing energy losses to at least 25% below the national average

Land use:

Sustainable forestry defined as forestry certified by the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC)

Sustainable agriculture defined as certified organic farming in compliance with national and EU-legislation

Pollution prevention and control: waste management including recycling and WTE (biogas, non-recyclable municipal waste or forest biomass meeting FSC requirements)

Transport:

- Public passenger transport such as electric rail, metros, trams and electric or hybrid buses

- Low carbon vehicles - electric, fuel cell and hybrid vehicles that complies with Euro 5 and Euro 6 emission standards and does not emit more than 50 gCO2/km.

Wow, it’s quite a lot to consider!

Small hydro under 10MW is generally considered to be fine. Investing in large hydro facilities is covered by our Taxonomy only if they increase efficiency and energy yield of the power plant – this seems to be the case here as the upgrades are all to existing plants without increasing reservoir capacity.

For land use, sustainable forestry projects with international certifications are easily defined as green. Organic farming is a bit trickier and is currently pending from our Taxonomy as there is ongoing research aimed at defining lifecycle GHG emissions and potential standards setting adequate benchmarks.

For low-carbon vehicles, a threshold of 50gCO2/km meets the Low Carbon Transport Criteria’s passenger per km benchmark for hybrid vehicles up to 2030, which is set at 56gCO2/km (the Criteria thresholds decrease over time). This is pretty ambitious - keep it up Swedbank!

DNV GL provided the eligibility assessment.

Underwriters: ABN Amro, HSBC, Swedbank.

Mizuho Financial Group – EUR500m (USD589m)

Mizuho Financial Group, one of the largest financial institutions in the world, issued their inaugural green bond in October.

The eligible categories under their green bond framework are:

Renewable energy: renewable energy such as wind, solar, solar thermal, biomass (excluding sustainable feedstock and viable forest based biomass), geothermal energy, and small hydro (25MW or less).

Clean transport: public transportation facilities including expansion and improvements to rail transport, non-motorised transport (such as bicycles), manufacturing of electric vehicles, and multi-modal transport.

Pollution prevention and control: such as waste recycling and WTE power plants.

Overall, the bond looks pretty green, but it is worth taking a closer look at biomass projects included in the renewable energy category. Excluding sustainable feedstock may seem counterintuitive, but what they mean is that Mizuho has committed to exclude biomass projects that use feedstock intended for food production or viable forest. This is in line with market norms. They haven’t stated what they will include, but once those are excluded other options are mostly waste sources or non-food feedstocks which are generally considered to sustainable feedstocks.

Viable forest are not eligible feedstocks under the Climate Bonds Taxonomy as they classify as ‘carbon pool’ i.e. it has the capacity to store carbon. Safeguarding viable forests is essential to both maintain carbon storage and prevent the release of emissions caused by deforestation.

The second opinion was provided by Sustainalytics.

Underwriters: BAML, Barclays, BNP Paribas, Mizuho, Natixis.

Deutsche Hypo - EUR500m (USD589.3m)

As we announced in an earlier blog while the issuance was still in the pipeline, Deutsche Hypo recently closed its first green pfandbrief (or covered bond).

Proceeds will be used to finance construction, acquisition or renovation of energy efficient buildings. The minimum Green Building certification requirements for an asset to classify as a Green Building are as follows:

The full list of minimum requirements is here.

Setting minimum standards for Green Building certification is good practice. However, leading issuers in this space have set minimum standards as LEED Gold, BREEAM Very Good or equivalent – making these thresholds below market best practice. They are also lower than those defined in the Climate Bonds Low Carbon Buildings Criteria. Come on Deutsche Hypo – let’s push best practice!

The book build took only one hour, tightening to mid-swaps minus 14bp, which is in line with what a vanilla Pfandbrief could have achieved. The bond managed to attract new investors with dedicated green portfolios.

Oekom provided the second opinion.

Underwriters: ABN AMRO, Crèdit Agricole, DZ Bank, NordLB, Unicredit.

Other Debt Instruments

Green Sukuk - Quantum Solar Park – MYR1bn (USD236m)

Malaysian Quantum Solar Park issued their maiden green Sukuk in October, raising MYR1bn.

Proceeds will be utilised to construct three 50MW solar PV power plants in three different Malaysian districts.

Wow, another green Sukuk in just a few months (first was Tadau Energy)! The Malaysian Securities Commission has put in place some pretty enticing incentives to stimulate the market – it looks like it’s working!

(For those of you who can’t remember what exactly a Sukuk is… it’s an Islamic Financial instrument - explained in a bit more detail in the blog about Tadau Energy).

CICERO provided the second opinion.

Underwriters: CIMB Investment Bank, Maybank.

Green Schuldschein - MANN+HUMMEL - EUR400m (USD470m)

MANN+HUMMEL, Germany-based global leader in filter solutions for vehicles and industrial applications, issued a EUR400m green Schuldschein last month, after raising their target from an initial EUR250m due to oversubscription.

Proceeds will be used to refinance:

Water filtration solutions for wastewater treatment (membranes and systems for a wide variety of applications such as ultrafiltration, bio-membrane reactors, and reverse osmosis)

Compression filters and solutions

Electrified propulsion solutions: high-voltage battery and fuel cell solutions. These are used in hybrid, plug-in hybrid, and battery electric vehicles. Fuel cell filters have applications in energy-efficient combined heat and power installations and fuel cell-powered forklift trucks

Air filtration solutions

Many of the technologies listed here are quite technical, and, without in depth knowledge of them, are a bit difficult to analyse – but here are some thoughts based on initial research:

Water filtration for wastewater treatment is regarded as environmentally beneficial because it reduces pollution of natural water bodies (where wastewater would flow directly into) and offers a water source for commercial and industrial uses preventing the depletion of other natural water sources.

Compression filters and solutions are used to remove air contaminants after an air compression process has taken place. We don’t see this type of product often, however Sustainalytics states in the second opinion that these projects produce indirect environmental benefits by making compression products more energy efficient.

Electrified propulsion solutions also have an indirect environmental benefit, because they promote the expansion of the hybrid and electric vehicles market. This type of project is included in the Taxonomy in the transport category as part of the manufacturing of low carbon and electric vehicles, and is identifiable as green.

For air filtration solutions, M+H products received an A+ rating from Eurovent on the energy efficiency air filtration products and heating ventilation and air conditioning (HVAC) products.

Sustainalytics provided the second opinion on the framework.

Underwriters: BNP Paribas, ING and LBBW.

Pending Inclusion

Fingrid - EUR100m (USD117.51m)

Fingrid, Finland’s electricity transmission operator, issued a USD117.51m green bond in November, after having published its Green Bond Framework.

The proceeds from the 10-year bond will be allocated to energy efficiency projects:

For transmission infrastructure, the Climate Bonds Taxonomy defines eligible transmission projects as those directly connecting low carbon energy generation to the grid.

This bond includes connection of renewables but will also finance general transmission infrastructure upgrades. This is a difficult area – transmission infrastructure upgrades can lead to large energy efficiency improvements but is this type of investment really moving the needle? Our friend Bill McKibben recently said in an article for Rolling Stone magazine regarding climate change that “Winning slowly is the same a losing” – these investments are positive but are they an example of winning slowly?

CICERO awarded the “development of transmission networks to decrease network losses” project type a light to medium green. We would say its on the light side. More specific project disclosed at a later date may enable its inclusion.

CICERO provided the second opinion.

Underwriters: SEB, ING.

Wider thematic bonds

HSBC issues its first SDG bond – see more details here.

Hemso Sustainability bond – see more details here.

Gossip

Le fonds CM-CIC Green Bonds is awarded the (French) TEEC label.

AlphaFixe launches first Green Bond Fund managed in Canada! AlphaGreen is a global green bond fund with a Canadian bond market risk profile and was launched on the 21st of November. AlphaGreen has already committed over CAD100m to invest in labelled green bonds and climate-aligned bonds.

HSBC pledges $100 billion of finance by 2025 to combat climate change.

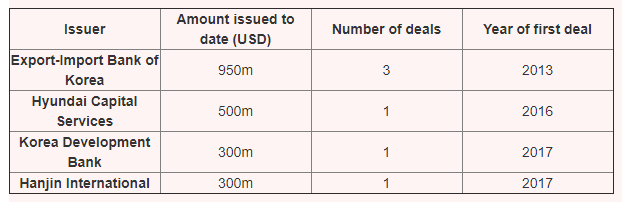

KEPCO seeks to issue $500m Green Bond– is this part of a trend in Korea?

Fondaction porte à 67 millions de dollars son portefeuille en obligations vertes.

Canadian Solar issues JPY7.4bn green bond for solar park in Japan.

Sumitomo Mitsui Financial Group is the first Japanese issuer of a green bond in compliance with the Ministry of Environment’s guidelines.

Reports

S&P Global Ratings study available here considers how nearly 300 green bonds issued between 2012 and 2017 which met the Climate Bond Initiative eligibility criteria would score under our recently launched Green Evaluation service. The full report titled "How Do Labeled Green Bonds Measure Up?," is available on RatingsDirect and also soon on the Green Evaluations dedicated webpage and the Green Evaluation section of the Infrastructure Hub.

Repeat issuers

There's more to come in 2017, keep an eye out for our post coming in the last week of December,

'Till next time,

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.

.png)

.png)

.png)

.png)

.png)

.jpg)

.jpg)

_small.jpg)

.png)

.png)

.png)

.JPG)

.png)