Highlights:

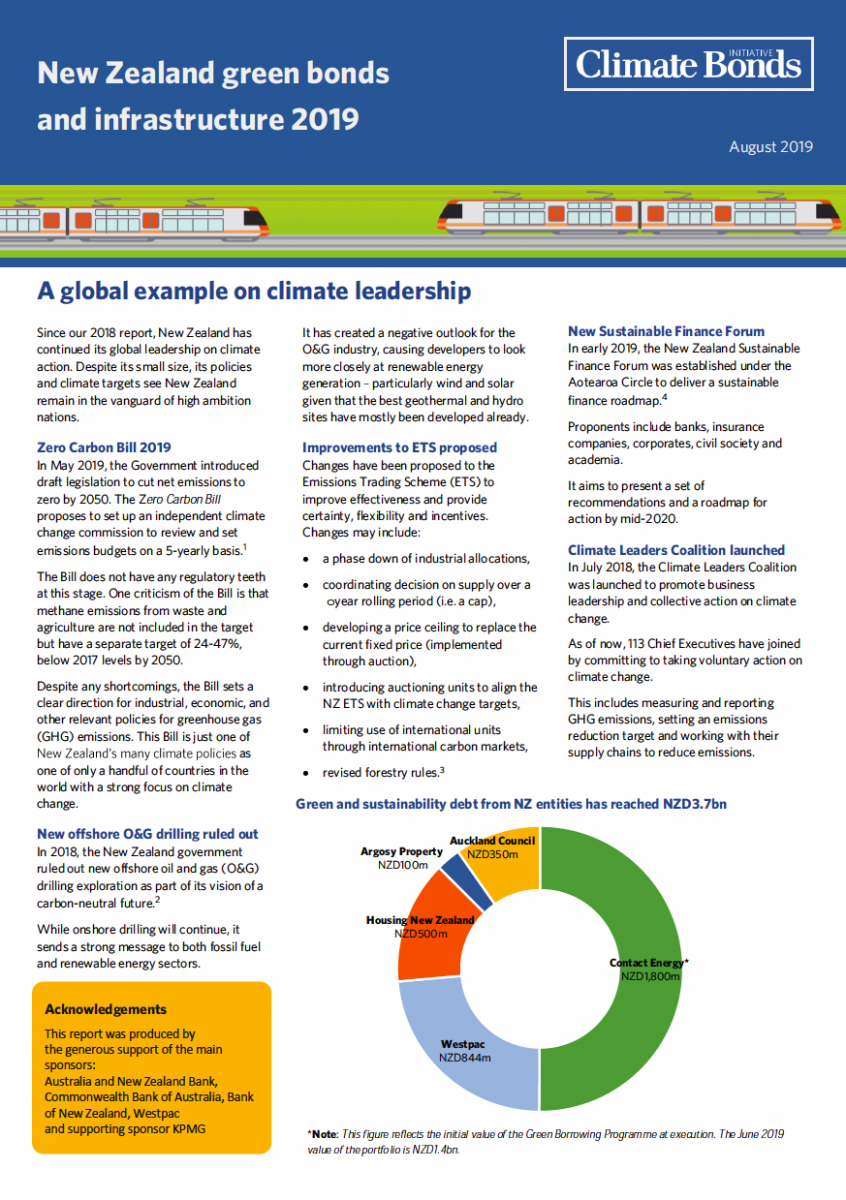

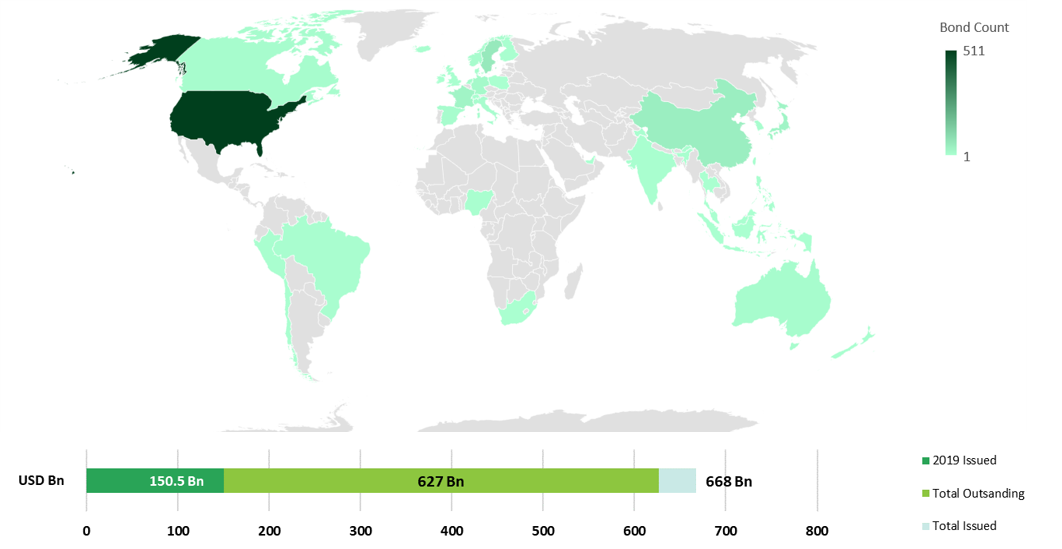

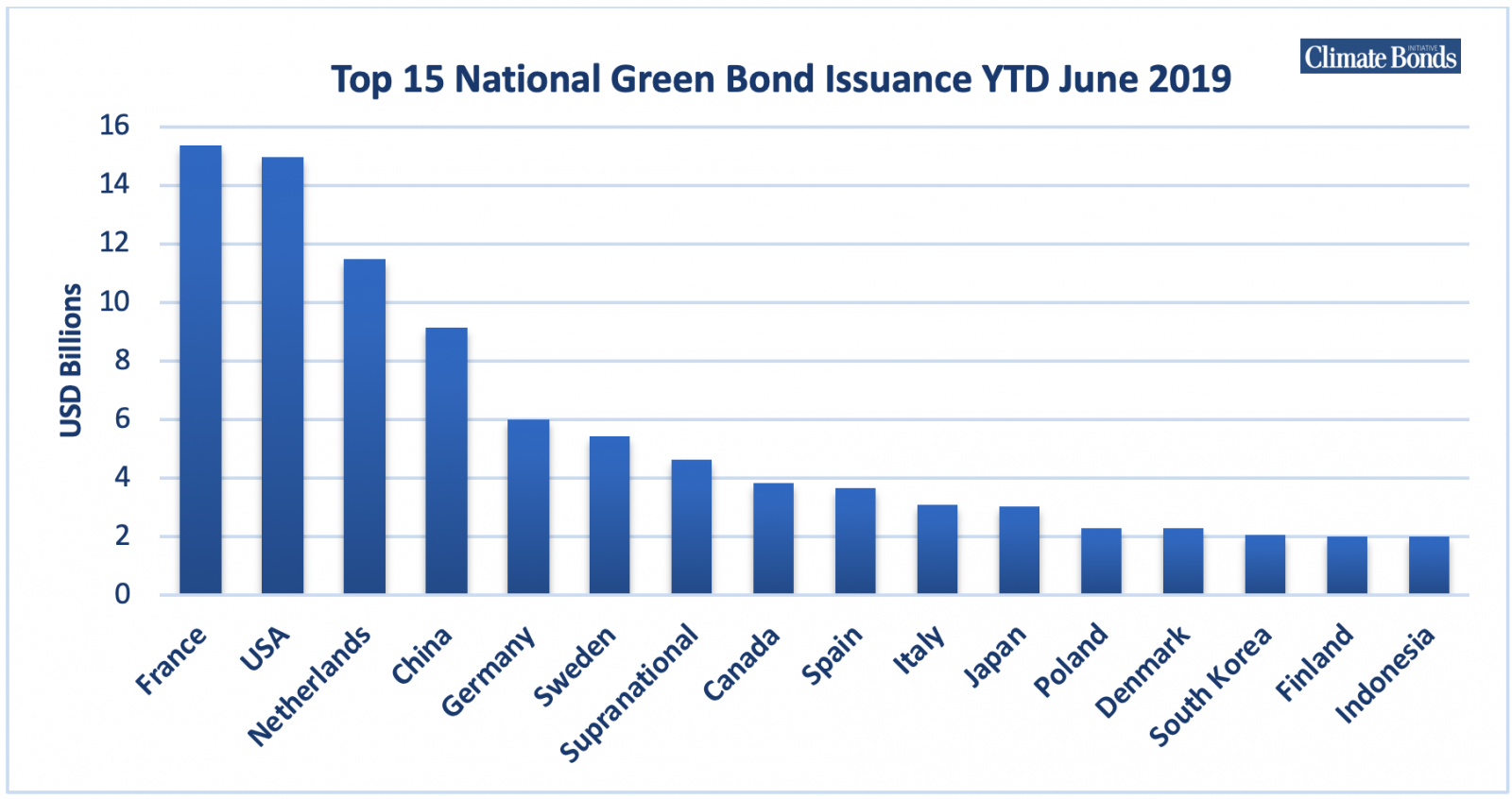

2019 issuance has surpassed USD150bn with August volume of USD7.7bn (+9.8% vs August 2018) China: Jiangxi Province of China issued the country’s first municipal GB (CNY300m/USD42m) in June 2019

Australia: QIC raises AUD300m (USD202m) in first Certified Climate Bond for shopping centre assets

USA: Strong Muni issuance with 10 deals and USD450m debut from industrial company Owens Corning

Don’t miss!

In New York for Climate Week? Moody’s Climate Week Briefing, in partnership with Climate Bonds. Register here.

![]()

![]() Climate Bonds has launched a revamped Certified Bonds Database, which allows screening Certified Climate Bonds by sector, country, issuer and/or verifier.

Climate Bonds has launched a revamped Certified Bonds Database, which allows screening Certified Climate Bonds by sector, country, issuer and/or verifier.

Climate Bond’s new Approved Verifiers Directory facilitates searching by region, verifier name and sector criteria.

![]()

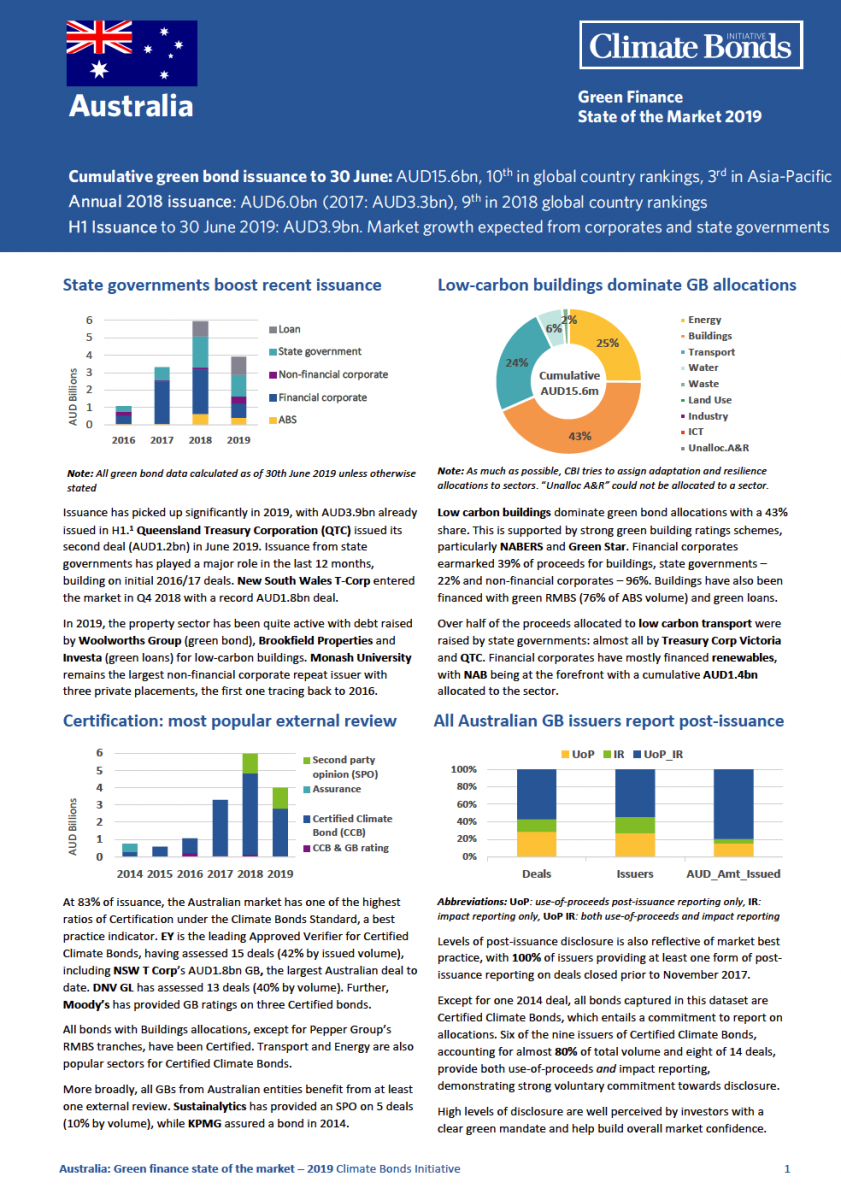

![]() Climate Bonds has launched GIIO Australia 2019 and Australia green finance state of the market – 2019. The GIIO report comments on green infrastructure investment state of play and opportunities in energy, transport, water and waste management. The state of the market report provides an overview of the GB market, identifies issuance trends and explores the potential for future growth.

Climate Bonds has launched GIIO Australia 2019 and Australia green finance state of the market – 2019. The GIIO report comments on green infrastructure investment state of play and opportunities in energy, transport, water and waste management. The state of the market report provides an overview of the GB market, identifies issuance trends and explores the potential for future growth.

![]() Climate Bonds also launched New Zealand green finance and green infrastructure 2019, a summary report that looks into the evolution of the green and sustainable bond markets to date and provides an overview of green infrastructure investment opportunities.

Climate Bonds also launched New Zealand green finance and green infrastructure 2019, a summary report that looks into the evolution of the green and sustainable bond markets to date and provides an overview of green infrastructure investment opportunities.

Green bond deals across the globe – 2019

![]()

August at a glance

Green bond issuance for August reached USD7.7bn, translating into approximately 9.8% growth year-on-year. This takes the 2019 total to date above USD150bn, just USD20bn short of 2018 annual volume.

![]()

August is usually a slow month for issuance. Over USD12bn of labelled green bonds were issued during the month, but only 63% of that volume met the requirements of the CBI green bond database methodology, the lowest monthly ratio so far this year. Of the USD7.7bn qualifying bonds, USD2.7bn were Certified Climate Bonds. 12 deals totalling USD3.8bn have been excluded mainly due to high working capital allocations and non-alignment with the Climate Bonds Taxonomy.

![]()

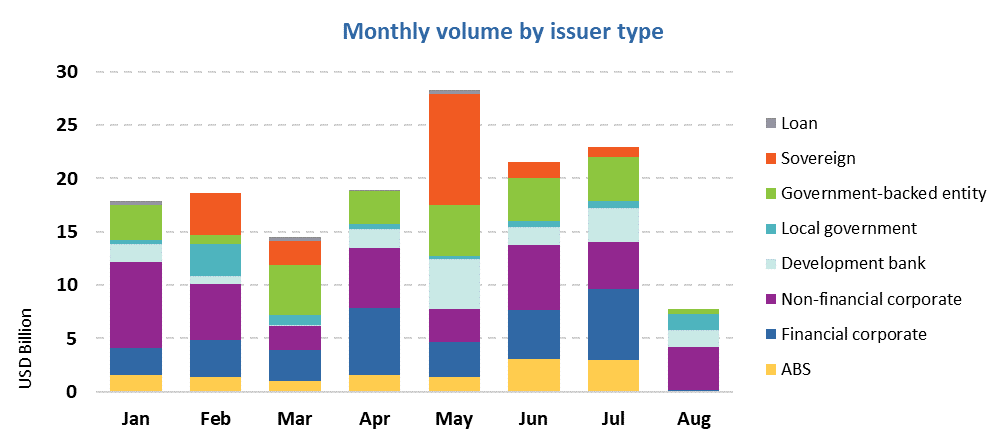

The highest volume of green bond deals came from non-financial corporates: USD4bn, or approximately 52% of monthly issuance. Compared to August 2018, when this issuer type represented 17%, the figure has almost tripled. The largest deal of the month came from debut issuer E.ON (Germany), which entered the market with a EUR1.5bn (USD1.7bn) bond for energy and infrastructure projects.

Development banks were the second largest contributors at 21% of August issuance, with EIB raising funds for renewable energy and low-carbon building projects in the third largest deal of the month (GBP800/USD972m). Local government issuance picked up from USD1bn in August 2018 to USD1.5bn last month, and this contributed to 19% of August volume.

Issuance from financial corporates significantly decreased, accounting for 1.9% of August volume compared to 33.9% in August 2018 with only three deals, one each from E Sun Commercial Bank (Taiwan), Hangzhou United Rural Commercial Bank (China) and Deutsche Hypo (Germany).

Developed markets accounted for 80.7% of total issuance volume. Germany dominated in August with more than 42.3%, followed by the US (28.8%) and France (3.6%). China led the way in the EM markets with USD217m of a total volume of USD520m, which compares to much stronger issuance from China in August 2018: USD2.4bn.

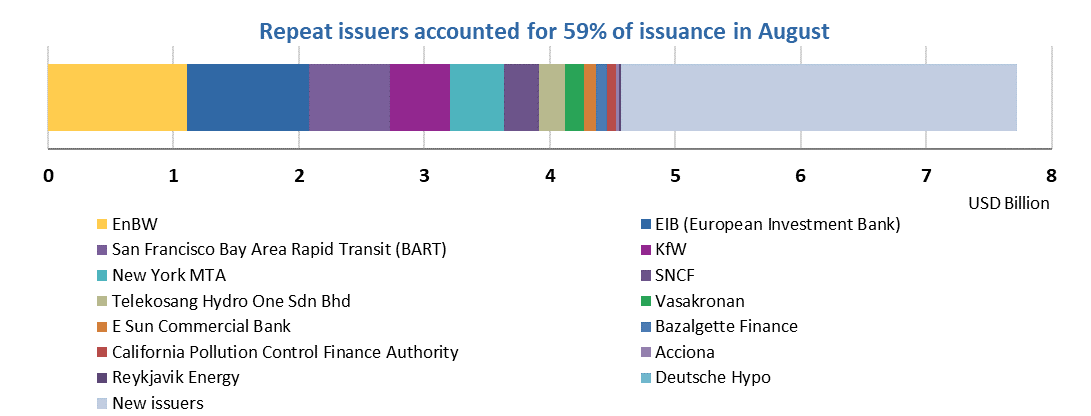

Repeat issuers accounted for 59% of issuance in August. We saw 11 debut issuers.

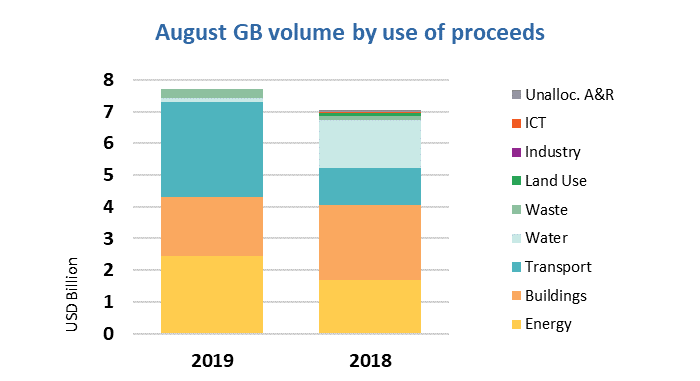

Funding for transport and energy dominated issuance, with transport totalling USD3bn (39%) compared to USD1.2bn (17%) in August 2018. Water projects showed a sharp dip compared to last year from USD1.5bn to USD100m in 2019.

![]()

Note: In August, we included Fannie Mae Green MBS issuance of USD2.3bn in July figures.

> The full list of new and repeat issuershere.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

QIC Shopping Centre Fund (AUD300m/USD202m), Australia, issued a 6-year bond Certified against the Low Carbon Buildings Criteria of the Climate Bonds Standard, making it the first Certification for shopping centres. The proceeds will refinance the redevelopment of three shopping centres in Queensland and Victoria. Upon completion in 2020, the expected CO2 emissions reductions will exceed 34%, which is the threshold requirement for a 10-year bond.

Annual reports will be made available on the QIC website. They will be reviewed by Sustainalytics or another external reviewer. The reports will have information on the allocation of proceeds, as well as descriptions and qualitative impact indicators about the shopping centres.

Williams Caribbean Capital (BBD3m/USD2m), Barbados, issued a 4-year bond in June 2019. It is Certified against the Solar Criteria of the Climate Bonds Standard: the first Certification awarded in the Caribbean region. Proceeds are intended to be used to finance the development of new solar PV installations on commercial rooftops and open land.

Throughout the term of the bond, quarterly reports will be provided to bondholders. This includes information on the allocation of proceeds, amount of installed solar PV capacity that has been funded as well as amount of electricity that has been generated by these solar PV installations.

New issuers

E.ON SE (EUR1.5bn/USD1.7bn), Germany, entered the green bond market with a senior unsecured 10.5-year bond, which benefits from a second party opinion (SPO) by Sustainalytics. The proceeds are intended to fund renewable energy, energy efficiency and clean transportation projects.

E.ON will provide annual information on allocations such as amounts allocated in each category, year of investment and the financing / refinancing split, as well as the balance of unallocated proceeds. If feasible, an impact report will be provided as well containing quantitative indicators such as capacity of renewable energy connected, CO2 emissions avoided, number of smart grid components installed, and number of electric vehicle charging stations.

Climate Bonds view: It is encouraging to see another energy giant joining the green bond market, as it signals the crucial need for continued and increasing investments in low-carbon energy infrastructure.

Hangzhou United Rural Commercial Bank (CNY300m/USD43m), China, entered the market with a 3-year bond, for which CCX provided an SPO. The deal will provide funds for the construction of an efficient irrigation system in Aksu City in western China, a vehicle recycling centre with an annual capacity of dismantling 5,000 cars and remanufacturing 350,000 tons of steel, a river dredging project and a solar farm with a total capacity of 13.8MW.

The use of proceeds and progress of the projects in the previous year will be disclosed before April 30th of each year.

Climate Bonds view: The issuer has provided a clear green bond framework and detailed project information for this deal, demonstrating best practice.

New Jersey Resources (USD4m), USA, debuted with a 10-year bond and has become the first New Jersey corporate to enter the green bond market. The proceeds will support the company’s clean energy investments in the fiscal year 2019, including six commercial solar installations with a total capacity of 50MW.

Climate Bonds view: We are pleased to see more corporates – especially medium-sized companies – leveraging the latent potential of the US green bond market. We would encourage New Jersey Resources to provide post-issuance reporting. Commissioning an external review for their bond would also be consistent with market best practice.

Owens Corning (USD450m), USA, entered the green bond market with a 10-year issue to fund investments in solar and wind power generation facilities, projects to increase energy efficiency and investments in eco-efficient programs, such as increasing the level of recycled material in their products. No reporting commitment was stated.

Climate Bonds view: Owens Corning is the first US industrial company to enter the green bond market, which is in itself commendable. The aspirations of greater energy efficiency and increased use of recycled material are likewise a positive. However, improved transparency and disclosure – such as a clear commitment to post-issuance reporting on achieved improvements – would benefit the market and issuer credibility, especially in the case of new sectors and issuers that fund projects and programs focused on improvements.

Two new US Municipal issuers obtained a ‘BAM GreenStar Bond’ assessment from Build America Mutual (BAM):

Climate Bonds view: BAM assessments are aligned with ICMA’s green bond principles (GBP). We would encourage issuers that obtain BAM GreenStar Bond assessments to make the formal assurance statement from BAM public, e.g. by including it in pre-issuance documentation. We also encourage more extensive disclosure on proposed and actual proceeds allocated as well as information on the development of the projects.

Pennsylvania Economic Development Financing Authority (USD50m), USA, entered the market with a 20-year green muni issue. The proceeds will be used for pollution prevention and control, which includes mainly projects that focus on the improvement of non-ferrous metals’ recycling and the beneficial re-use of ash. The remaining funds will go towards machinery and equipment used for solid waste handling and processing supporting energy-from-waste infrastructure and other sustainable waste management solutions.

Climate Bonds view: It is great to see another US agency issuing debt for waste management projects. This bond brings total issuance for waste management projects from US Munis to USD1.1bn.

Portland Water District (USD7m), USA, came out with a 20-year municipal bond that is intended to fund cleaning, relining, repair and replacement of water mains, service lines, valves and related appurtenances. Expenditure of the use of proceeds will be reported in the annual report until all the proceeds of the bond have been fully allocated.

Climate Bonds view: This issuance is the second from Portland, bringing the cumulative issuance to USD21m.

San Diego Association of Governments (USD335m), USA, entered the green bond market to fund the existing ‘San Diego Trolley Blue Line’ light rail system, which will extend over 10.92 miles across the County of San Diego. It aims to enhance the connections between academic institutions, medical centres and research hubs, and link lower income communities to health care, employment and activity centres in the University City Community.

SANDAG commits on reporting on the use of proceeds annually, until full allocation. Information on design and operational characteristic of the project, which are in line with the overarching objective of improving mobility and supporting sustainability in the area, might be disclosed as well.

Climate Bonds view: Investments towards urban transit are essential to achieve decarbonisation of the transport sector. This is particularly important in the US where the transportation system is heavily reliant on personal vehicles. The project is also helpful as it facilitates mobility in the region.

University of Vermont and State Agricultural College (USD38m), USA, issued a 30-year municipal bond which will fund the construction of a new event centre, renovating the hockey arena and converting the existing gymnasium to a recreational facility. The new centre construction, comprising of 96% of total proceeds, will be constructed to LEED Silver specifications.

Climate Bonds view: Post-issuance disclosure on the progress of projects funded with this bond is encouraged to conform to best practice. LEED Silver is a respectable certification level, but we hope to see rising ambitions among issuers to achieve higher certification levels and better energy performance.

Visit our Bond Library for more details on all August deals.

Bonds issued before August 2019

Jiangxi Province of China (CNY300m/USD42m), China, has issued a 30-year municipal bond that benefits from an SPO by Lianhe Equator. This deal from June 2019 marks the first municipal green bond from China. The proceeds will be fully allocated to two utility tunnel projects.

Climate Bonds view: Together with Xinjiang, Guangdong, Guiyang and Zhejiang, Jiangxi province is a green finance pilot zone in China. We look forward to more issuance from the Chinese public sector, particularly from these pilot zones.

Utility tunnels – a.k.a. common service tunnels, utilidors or underground pipeline corridors – are underground passages built to house utility connections such as electricity, water supply and sewer pipes, as well as telecommunications lines (fibre optics, TV and phone cables). Instead of installing pipelines and cables individually, a tunnel that carries multiple facilities could enable easier subsequent repair and renewal with limited need for surface excavation. Therefore, it is considered as an eligible urban infrastructure by both China’s local green bond catalogue and Climate Bonds Initiative. Accommodating gas pipeline in the tunnel – as is the case here – is not ideal, but we included this bond nonetheless, considering the overarching benefits of having the tunnel infrastructure itself, which can avoid negative impacts on air quality, vegetation, landscape, and soil use in the life cycle of the pipelines. Furthermore, we considered the fact that gas pipelines can also potentially be used for biofuels and hydrogen in the future.

Athon Energia S.A. (BRL40m/USD11m), Brazil, brought to the market a 10-year private placement in July 2019 that benefits from an SPO by Sitawi. The proceeds will finance six solar PV projects in five Brazilian states, all falling under distributed energy generation (i.e. above 75kW and under 5MW) and with commercial contracts in place. One is already operational, while the other five are expected to be completed by April 2020.

The issuer has stated it will provide regular reports on its website. These will include the allocation of proceeds until full allocation and the environmental impacts, namely renewable energy generation in GWh and GHG emissions avoided in tCO2e, until bond maturity.

Climate Bonds view: The focus on distributed generation of solar energy is important as it can increase network resilience and add independence for end users – we hope more green bonds will support this expansion, possibly even from energy companies that traditionally operate via more centralised generation structures.

Anshun Automobile Transport Company (CNY130m/USD19m), China, debuted with a 6-year green ABS in July 2019. The 7-tranche deal is backed by ticket receivables from bus and coach services in Anshun city, Guizhou province. Due to the karst topography in that area, high speed passenger rail has less cover in the region whereas coaches are more popular for intercity travel.

Climate Bonds view: This is the second green ABS deal backed by cash flows from public transport in Guizhou province, after Guiyang Public Transport’s debut issuance in March 2017 (see August 2017 Market Blog).

Similar to other ABS deals from China, the detailed information on the underlying asset pool and planned use of proceeds is not available at issuance. We will keep tracking the updated details in the near future and the annual post issuance report next year.

Ergon Perú (USD222m), Peru, debuted in July 2019 with a 15-year green bond private placement, which was rated E1/81 by S&P. The proceeds will fund several small-scale PV systems in off-grid rural areas in the north-central and southern regions of Peru. A report containing environmental key performance indicators will be published on a quarterly basis. This entails indicators such as tons of carbon dioxide and greenhouse gas emissions avoided.

Climate Bonds view: We welcome Peru’s fifth green bond issuer to the market debuting with the second largest bond so far. Ergon Peru follows the trend of previous issuers and will finance energy projects with the proceeds. We look forward to more sector diversification in the future as the Peruvian green bond market grows.

Japan Prime Realty Investment Corporation (JPY5bn/USD46m), Japan, entered the green bond market in July 2019 with a senior-unsecured bond rated Green1 by JCRA. The company will invest the proceeds in properties that have been awarded 3 stars or more under the DBJ Green Building certification scheme or a B+ rating or higher under the CASBEE-Building system.

The issuer has committed to reporting on the status of proceeds allocation, number of eligible assets, third-party certification level obtained by each eligible asset as well as total floor area of the asset pool. In addition to that, impact indicators will be disclosed including energy consumption, CO2 emissions, and water consumption.

Climate Bonds view: As we forecasted in our Japan Green Finance State of the Market report published in February 2019, the Japanese REIT sector has become more active with 9 bonds issued year-to-date to a total of USD407m equivalent. This illustrates the potential of leveraging green finance in the real estate sector.

Tongling Construction Investment Holding Co.,Ltd. (CNY600m/USD87m), China, issued a 3-year bond in July 2019, for which Zhongcai Green Financing provided a second party opinion. According to the limited disclosure from a news release, all proceeds of this bond will be used to refinance for the project “Xihu District Water Ecological System Improvement Project”.

Climate Bonds view: Although a specific description of the use of proceeds is not available yet, water ecological systems management and improvement qualifies as eligible adaptation measures. Further analysis will be carried out once more information is available. Tongling Development Investment Group is the local government financing vehicle (LGFV) of the Tongling city government. We hope to see more LGFVs using green bonds to refinance low-carbon infrastructure.

Millicom (SEK2bn/USD210m), Sweden, issued a 5-year senior unsecured green bond in May 2019. The deal benefits from an SPO by Sustainalytics. The proceeds will go towards energy efficiency improvements to data centres, its network and measures related to building design and upgrades, network solutions, and enhanced monitoring. The acquisition of spectrum and the renewal of existing spectrum licenses to expand and maintain high-quality coverage to unconnected communities and underserved communities, as well as targeted investments in social programmes are also included.

Climate Bonds view: A lot of Swedish issuance has come from public sector entities and the property sector, so it is good to see further diversification. ICT in particular has the potential to improve operational efficiency in public service delivery and business, reduce the need for travel (and related emissions) and power the implementation of systematic energy performance monitoring.

The bond was previously in pending, while we assessed allocations to social programmes, but it is now our understanding that these are expected to be relatively small and will be delivered in tandem with energy efficiency improvements and network roll out. We would encourage issuers to specifically link related climate and social outcomes from projects.

Nagoya Railroad (JPY1bn/USD9.1m), Japan, took out a 4-year term loan in March 2019 to finance the construction of office buildings, which aim to achieve CASBEE Rank A and Building Energy Management System (BEMS) certifications. In addition to sound insulation and absorption, the building will use high-efficiency equipment. The issuer will report on the status of CASBEE and BELS certifications and will provide information on the introduction of energy-saving equipment.

Climate Bonds view: We are pleased to see issuance to fund energy-efficient buildings from the transport sector and would welcome more deals from public and private sector issuers upgrading their building stock to reduce their carbon footprint.

Repeat issuers – August

- Acciona: EUR17m/USD19m

- Bazalgette Finance: GBP75m/USD91.1m

- California Pollution Control Finance Authority: USD73.7m

- Deutsche Hypo: EUR5m/USD5.6m

- E Sun Commercial Bank: TWD3bn/USD95.4m

- EIB (European Investment Bank): GBP800m/USD972.3m

- EnBW: EUR1bn/USD1.1bn - Certified Climate Bond

- KfW: HKD 300m/USD38.3m

- KfW: NOK 4bn/USD443.8m

- New York MTA: USD428.6m

- Reykjavik Energy: ISK2bn/USD16m

- SNCF: EUR100m/USD112m - Certified Climate Bond

- SNCF: EUR100m/USD111.9m - Certified Climate Bond

- SNCF: EUR50m/USD56m - Certified Climate Bond

- San Francisco Bay Area Rapid Transit (BART): USD643.5m

- Telekosang Hydro One Sdn Bhd: MYR590m/USD208.1m

- Vasakronan: SEK1.2bn/USD123.7m

- Vasakronan: SEK200m/USD20.5

![]()

Repeat issuers before August

- City of Ottawa: CAD200m/USD152.2 - July 2019

- Deutsche Hypo: EUR5m/USD5.6m - July 2019

- Export Development Canada: CAD500m/USD379.7m - July 2019

- Fannie Mae: USD2.38bn - July 2019

- JRTT: JPY55.3bn/USD497.7m – Certified Climate Bond - March 2019

- Korea Development Bank: EUR500m/USD566.1m - July 2019

- LBBW Landesbank Baden-Wuerttemberg: EUR500m/USD556.2m - July 2019

- Mitsubishi UFG: EUR500m/USD561.9m - July 2019

- Sichuan Railway Investment Group Co.,Ltd(SRIG): CNY1.8bn/USD262m - July 2019

- Vasakronan: USD75m - July 2019

- Vasakronan: EUR10m/USD11.2m - June 2019

- Vasakronan: AUD30m/USD20.9m - June 2019

- Vasakronan: NOK100m/USD11.4m - May 2019

- Vasakronan: SEK200m/USD21.6m - April 2019

- Vasakronan: JPY10bn/USD90.4m - March 2019

- World Bank (IBRD): CAD1.5bn/USD1.14bn - July 2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

Issuer Name | Amount issued | Issue date | Reason for exclusion/ pending |

|---|

Shandong Iron and Steel Company Ltd | CNY1.5bn/USD209m | 15/08/2019 | Excluded (Working capital) |

Huaneng Tiancheng Financial Leasing Co.,Ltd. | CNY500m/USD70.9m | 09/08/2019 | Excluded (Working capital) |

Hebei Iron & Steel Group Co.,Ltd. | CNY1.58bn/USD224.1m | 09/08/2019 | Excluded (Working capital) |

Battery park city authority | USD89.7m | 06/08/2019 | Excluded (Not aligned) |

Suzhou Wuzhong Too Too Development Co.,Ltd | CNY570m/USD81.3m | 06/08/2019 | Excluded (Working capital) |

Nanchuan District of Chongqing City Construction Investment Co.,Ltd. | CNY1.08bn/USD154m | 06/08/2019 | Excluded (Working capital) |

Harris County Municipal Utility District | USD11.7m | 01/08/2019 | Excluded (Not aligned) |

Ping An International Financial Leasing Co.,Ltd. | CNY800m/USD116.2m | 29/07/2019 | Excluded (Working capital) |

Yancheng South District Development and Construction Investment Co.,Ltd. | CNY1bn/USD145.3m | 26/06/2019 | Excluded (Working capital) |

Indiana Finance Authority | USD185m | 10/04/2019 | Excluded (Not aligned) |

Mexico City Airport | USD3bn | 20/09/2017 | Excluded (Not aligned) |

Mexico City Airport | USD1bn | 20/09/2017 | Excluded (Not aligned) |

Mexico City Airport | USD1bn | 29/09/2016 | Excluded (Not aligned) |

Mexico City Airport | USD1bn | 29/09/2016 | Excluded (Not aligned) |

The Confederated Tribes of the Warn Springs Reservation of Oregon | USD20.4m | 29/08/2019 | Pending (Waiting for more information) |

California Community Housing Agency | USD110.8m | 28/08/2019 | Pending (Waiting for more information) |

Williston State College | USD7m | 22/08/2019 | Pending (Waiting for more information) |

San Lorenzo Valley Water District Revenue Certificates of Participation | USD13.7m | 14/08/2019 | Pending (Waiting for more information) |

Public Service Colorado | USD550m | 13/08/2019 | Pending (Waiting for more information) |

Sun Life Insurance | CAD750m/USD566.8m | 13/08/2019 | Pending (Waiting for more information) |

Porsche | EUR1bn/USD1.12bn | 12/08/2019 | Pending (Waiting for more information) |

China Merchants Bank Co., Ltd. | CNY970m/USD144.6m | 06/03/2019 | Pending (Waiting for more information) |

Huzhou Zhili urban construction investment and operation group Co.,Ltd | CNY700m/USD101.5m | 02/08/2019 | Pending (Waiting for more information) |

Zhejiang Rongsheng Environmental Protection Paper Joint Stock Co., Ltd. | CNY330m/USD48m | 23/07/2019 | Pending (Waiting for more information) |

Linghua Group Limited Company | CNY100m/USD14.6m | 12/07/2019 | Pending (Waiting for more information) |

Hunan Provincial Expressway Group Co.,Ltd | CNY652.1bn/USD305.6m | 11/07/2019 | Pending (Waiting for more information) |

Jiaxing Xiuhu Development Investment Co.,Ltd | CNY1bn/USD145.2m | 10/07/2019 | Pending (Waiting for more information) |

China Three Gorges Corporation | CNY3.5bn/USD509.2m | 05/07/2019 | Pending (Waiting for more information) |

Marfrig (USD500m), Brazil, issued a 10-year “sustainable transition bond” in July 2019 under a bond framework. The project seeks to contribute to the preservation of biodiversity, the avoidance of land deforestation, the protection of indigenous rights and the avoidance of the use of forced labour within the supply chain.

Vigeo Eiris provided an SPO which notes “Vigeo Eiris values Marfrig’s commitment toward the Protection of the Amazon Biome as well as Marfrig Club initiatives, which are a good first step towards addressing the main environmental and social issues in its value chain. However, in the absence of mandatory on-site audits throughout its supply chain, Vigeo Eiris has a moderate assurance on the ability of Marfrig to effectively manage and mitigate the environmental and social risks associated to the Eligible Project.”

Climate Bonds view: This bond is excluded from the CBI green bond database.

Marfrig is Brazil’s second largest food processor and second largest beef producer globally. Beef production is a complex topic. In terms of mitigation, the main issues with cattle raising in Brazil are related to productivity (output produced per unit of land), which impacts grazing land requirements and can lead to deforestation. A key concern with cattle is high methane emissions (methane is a potent greenhouse gas).

Over the last decade, it has been common practice for most of the Brazilian beef industry to monitor direct cattle suppliers regarding any increase in deforestation within these suppliers’ properties, and suspending purchases where reduction of forest coverage has been identified. However, this has not been the case yet for indirect suppliers (mainly calf growers), which proves to be more challenging to control and is the gap that Marfrig aims to address with its bond. While there has been significant progress in increasing productivity over the years, and these practices present an important step for the sector, the industry is still faced with challenges regarding traceability of livestock, degraded pastures and deforestation along the supply chain.

We do not consider the bond “green” as it does not address climate change mitigation beyond avoiding illegal deforestation from cattle suppliers, in addition to the challenges of ensuring traceability and deforestation. How the cattle, manure and land are being managed on an ongoing basis to reduce and minimise emissions should be considered, including the expansion of degraded pastures. The bigger question of whether livestock management can be seen as green due to its high relative emissions for livestock, compared to other food substitutes, is noted as an ongoing discussion.

This offering attracted considerable media and stakeholder attention around its labelling and objectives, reflecting in part the widening international focus on sustainable agricultural practices, livestock and climate change. It is a brave and encouraging step that Marfrig has taken in opening the debate on livestock management and natural resource impact in supply chains. We look forward to seeing how other potential issuers in the beef industry may learn from the Mafrig issuance and aim to raise the bar on emissions reductions.

Green bonds in the market

Investing News

Moscow Exchange has announced the opening of a Sustainable Development Sector following their roadmap for the formation of a green finance market in Russia. The division in green bonds, social bonds and national projects will be aligned with either ICMA’s Green and Social Bond Principles or the Climate Bonds Initiative’s taxonomy or are aligned with one of the goals of the national projects.

The Swedish pension fund AP3 has announced that it plans to double its investments in sustainability and green bonds by 2025, also targeting to lower their carbon footprint by 50% by 2025.

Commonwealth Bank of Australia restricts fossil fuel lending and commits to exit thermal coal in their Environmental and Social Framework. The bank will no longer lend capital for such projects beyond 2030.

Green Bond Gossip

Kenya is looking to issue its first green bond through the Acorn Project. It plans to raise KES5bn (USD48m) to finance sustainable and climate-resilient student accommodation. Bond sales will be restricted to sophisticated investors.

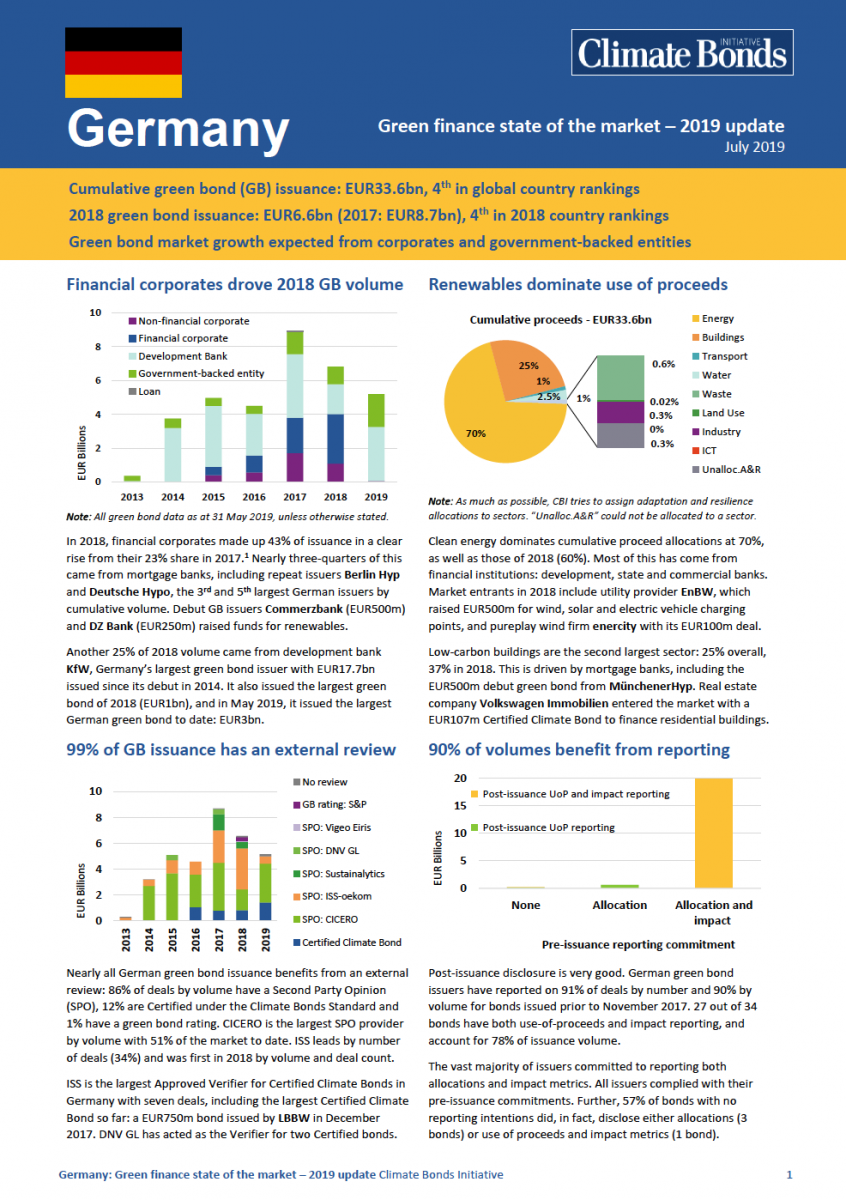

Germanyintends to issue a climate bond with a guaranteed return of 2% a year and a maturity date in 2030. The deal will be done through state bank KfW, Germany’s largest green bond issuer with over USD22bn issued to date.

Infrastructure bank CIFI is planning to issue a bond that will refinance a previously issued green bond and finance renewable energy and water treatment projects in Panama.

Phone carriers Orange SA and BT Group Plc both plan to issue bonds that fund environmentally friendly projects. The funds will serve to replace copper wires or build 5G networks that enables cities, factories and homes to be more efficient.

The Conservation Fundannounced its first green bond issuance together with Sustainable Conservation raising between USD100m to USD150m. Proceeds from the offering will be used primarily to increase the scale of its Working Forest Fund® conservation initiative, dedicated to mitigating climate change, strengthening rural economies and protecting natural ecosystems by the permanent conservation of at-risk forest landscapes.

Readings & Reports

Bretton Woods Project published a report on the role of multilateral development banks (MDBs) in sustainable finance. It addresses the issue that not all planned infrastructure projects are climate resilient and aligned with the low- or zero-carbon targets. It advocates for a unanimous definition of ‘sustainable infrastructure’ by MDBs as well as mainstreaming this in their infrastructure lending approach.

The IPCC provides an update on the current knowledge on Climate Change and Land in their newly released Special Report. It focusses on greenhouse gas fluxes in land-based ecosystems, land use and sustainable land management linked to climate change adaptation and mitigation, desertification, land degradation and food security.

Cristina Banahan from ISS Corporate Solutions advocates for a Green Standards Committee and calls for more regulation. This would facilitate a clear definition of what is considered a green bond. In addition to that such a committee represents a body that can require better disclosure and oversight and make sure there are no conflict of interests between second party opinion provider and issuers, which are purchasing ratings.

McKinsey & Company published a report on a study, which found that investors are not able to process sustainability reports readily in order to make informed investment decisions because there is a multitude of different standards. McKinsey suggests reducing the number of standards which would be beneficial for both investor and issuers. The report also discusses a number of measures to made sustainability reporting more meaningful for all stakeholder groups.

Paris Agreement Capital Transition Assessment has launched their 2°C Scenario Analysis tool which is supported by the UN Principles for Responsible Investment. It allows users to integrate climate objectives and long-term climate-related risks into portfolio management. This includes a stress-testing module and methodology documentation.

The World Resources Institutecritically looks at the agenda of 181 CEOs of the largest US companies who have recently released their new Statement on the Purpose of a Corporation. The commentary calls for more action with set sustainability targets.

'Till next time,

Climate Bonds

Peer Stein, Global Head of Climate Finance, Financial Institutions Group, IFC:

Peer Stein, Global Head of Climate Finance, Financial Institutions Group, IFC: Sean Kidney, CEO, Climate Bonds Initiative:

Sean Kidney, CEO, Climate Bonds Initiative:

Frits Vervoort CFO, Vesteda:

Frits Vervoort CFO, Vesteda:  Manuel Adamini, Head of Investor Engagement, Climate Bonds:

Manuel Adamini, Head of Investor Engagement, Climate Bonds:

The diversity of these new entrants into the green bond market is an encouraging sign.

The diversity of these new entrants into the green bond market is an encouraging sign.

“PKO Bank Hipoteczny is the largest issuer of mortgage covered bonds in Poland and the obvious leader on the market. All of this encourages us to introduce innovative financial products and set new standards on the Polish market.”

“PKO Bank Hipoteczny is the largest issuer of mortgage covered bonds in Poland and the obvious leader on the market. All of this encourages us to introduce innovative financial products and set new standards on the Polish market.”

“This is the first time this key milestone has been reached in the first half the year.”

“This is the first time this key milestone has been reached in the first half the year.”

“We congratulate Chile on its sovereign issuance. It’s a huge step in the development of green finance in Latin America and a benchmark for the region. It is also an example of national leadership towards fulfilling the Paris Agreement."

“We congratulate Chile on its sovereign issuance. It’s a huge step in the development of green finance in Latin America and a benchmark for the region. It is also an example of national leadership towards fulfilling the Paris Agreement."

Mr. Akio Inoue*, Executive Officer of Accounting & Financial Group of Meidensha:

Mr. Akio Inoue*, Executive Officer of Accounting & Financial Group of Meidensha: Sean Kidney, CEO Climate Bonds Initiative:

Sean Kidney, CEO Climate Bonds Initiative: