Since our last Market Blog, we have seen 19 issuers, including a new green RMBS from one of our green bond pioneers Berlin Hyp, first time issuance from Italy’s Intesa Sanpaolo and Norway’s Nordea Bank has taken the plunge into green waters.

Now this is good, but let’s look at some big thinking…

$1 Trillion in Green Bonds by 2020?

Writing in Nature Magazine, a group of global climate leaders including Christiana Figueres have identified six urgent climate action Milestones for 2020.

Among the actions is a call for the green bond markets to be scaled up by a factor of 10, and Milestone No 6 sets the objective of $1 trillion by 2020.

It’s no blue sky 2040 or 2050 target. It’s a right here, right now goal for the end of the decade.

Three and half years and four global COP Conferences away.

The onus is now on policy makers and global finance.

We think its achievable. What do you think? Read the full story here.

New issuers

Repeat issuers

Certified Bonds

China Three Gorges Corporation - EUR650m (USD726m) and CNY2bn (USD294.8m)

China Three Gorges Corporation (CTG) has just issued two green bonds – for onshore and offshore wind projects.

- Offshore wind CNY2bn issued on China interbank market:

All proceeds will go to two offshore wind farms in China with 300MW installed capacity each China Bond Rating provides a second opinion.

Underwriter: Agricultural Bank of China, CITIC Securities Company.

- Offshore and onshore wind EUR650m issuance listed on the Irish Stock Exchange:

The EUR-denominated green bond will finance an offshore wind project in Germany and an onshore wind farm in Portugal.

So the assets for this bond are all wind projects which means that they are included for Certification as the underlying assets are low carbon wind energy generation, which is as green as it gets.

CTG may be better known for its hydro projects than its wind assets and we note that previous bonds issued by the company are currently pending inclusion on our green bond database as they finance large scale hydro projects. Hydro power is a contentious area, and we have a Technical Working Group examining the climate science around hydro energy.

At present, we don’t have standards in place defining which types of hydro projects are eligible. For this reason, we fall back on existing standards, such as UNFCCC or IFC hydro criteria.

The move to grow the wind portfolio is welcome.

It’s another positive example where green bonds are about the assets more than the company.

Second opinion is provided by EY.

Underwriters: Deutsche Bank, J.P. Morgan and Bank of China.

Corporate

Humlegården Fastigheter AB - SEK1.25bn (USD143m)

Humlegården is the latest in the ever-expanding list of Swedish property companies issuing green bonds.

The proceeds will finance various projects/assets under the green bonds framework, including:

- Green buildings; residential and commercial properties that:

- are certified to Miljobyggnad Silver, BREEAM-SE Very Good, BREEAM in-use Very Good or LEED Gold

- have an energy use intensity at least 40% below current building standards

- Energy efficiency investments – improving existing properties

- Renewable energy: solar or geothermal power

- Clean transportation: investments in support infrastructure, e.g. EV charging stations

The second opinion was provided by CICERO, who rated the green buildings component of the green bond framework as medium green.

Humlegaarden has committed to an annual disclosure of the use of proceeds and project details.

Underwriter: Handelsbanken.

Commercial Banks

Intesa Sanpaolo, EUR500m (USD557m)

Intesa Sanpaolo became the first Italian bank to issue a green bond with their inaugural EUR500m bond issuance, attracting book orders upwards of EUR2bn! Great stuff.

The bond will be use to fund investments in eligible projects including:

- Renewable Energy – production, transmission, infrastructure and associated assets. The main focus will be wind, solar, bio-energy, and hydro energy generation

- Additional hydro criteria: up to 25 MW or, if larger, meeting one the following: Hydropower Sustainability Protocol Published assessment report; score of 3 or above on all relevant pillars ORIFC Standards; publicly stated commitment to meet the requirements outlined by all 8 IFC performance standards

- Energy Efficiency:

- New investment in infrastructure, technology and services that reduce energy usage including energy storage, district heating, smart grids, LED lighting, and retrofitting of buildings

- Construction or renovation of buildings which meet at least LEED Gold, BREEAM Good, HQE Very Good, CASBEE A or equivalent, that have lifecycle consumption levels of <20% of city baseline

The renewables criteria are clear cut and we welcome the additional clarification on hydro assets.

For green buildings, we do not have a clear comparison for all of those building standards but note that the Climate Bond Standard requires a minimum of LEED Gold or equivalent, which is in line with the criteria above, which is great.

For city baselines, the Standard requires that buildings are in the top 15% of a city baseline (a bit more stringent than above).

Intesa has also committed to annual reporting on the use of proceeds and environmental benefits, until bond maturity, with verification and independent party.

The second opinion was provided by Vigeo Eiris.

Underwriters: Banca IMI, Crédit Agricole CIB, HSBC, Societe Generale CIB.

Nordea Bank, EUR500m (USD563.15m)

While we’ve often seen Nordea’s name mentioned as an underwriter, this is the first time it is issuing a green bond - for EUR500m with a 2022 maturity.

The following projects are eligible:

- Renewable Energy: Wind power, hydro power (smallrun-of-river and existing plants)

- Pollution Prevention and Control: Water management, waste water management, waste-to-energy

- Green Buildings: Certified commercial and residential buildings with a certification level of either, LEED “Gold”, BREEAM “Very good”, or Miljobyggnad “Silver”

The renewable energy criteria include hydro but includes only small run-of-river projects or upgrades to existing projects which is consistent with most guidelines.

On pollution control, we have yet to find or publish good guidelines around what qualifies as ‘green’ or the ‘greenest’ pollution control projects/technology but we note that these criteria are in line with what other issuers have specified.

Water management generally comes under our Water Criteria and we’ve also launched a Waste Management TWG in January, which will be considering issues around waste water and waste-to-energy. It’s due to report in early 2018. We’ll post updates in our Blog and hold some information webinars to keep you all informed.

For green buildings, the threshold of LEED Gold is in line with the view of our expert group which is great news. Because the certifications schemes are quite broad (e.g. points are given for bicycle parking, water management etc.), the higher levels of LEED certification give better certainty on the actual energy performance of a building - there is little guarantee that buildings with low certification levels are energy efficient.

The second opinion on the Nordea’s green bond framework by Oekom is available here.

Underwriters: BNP Paribas, HSBC, Nordea.

We need to see other banks moving from underwriting to issuing. Well done to Nordea for taking the next step.

Banque Centrale Populaire, EUR135m (USD150.8m) private placement with IFC and Proparco

The Banque Centrale Populaire (BCP) in Morocco has issued a private placement green bond. The EUR135m raised will be used to finance renewable energy projects in Morocco, mainly onshore wind energy.

IFC and Proparco (subsidiary of Agence Française de Développement) are the sole investors with EUR100m and EUR35m respectively. The green credentials of the bond have been subject to external review by the UK Green Investment Bank.

The Green Impact Report is available here.

BCP has committed to annual reporting outlining how the proceeds are being used, however this is relatively rare in the private placement market.

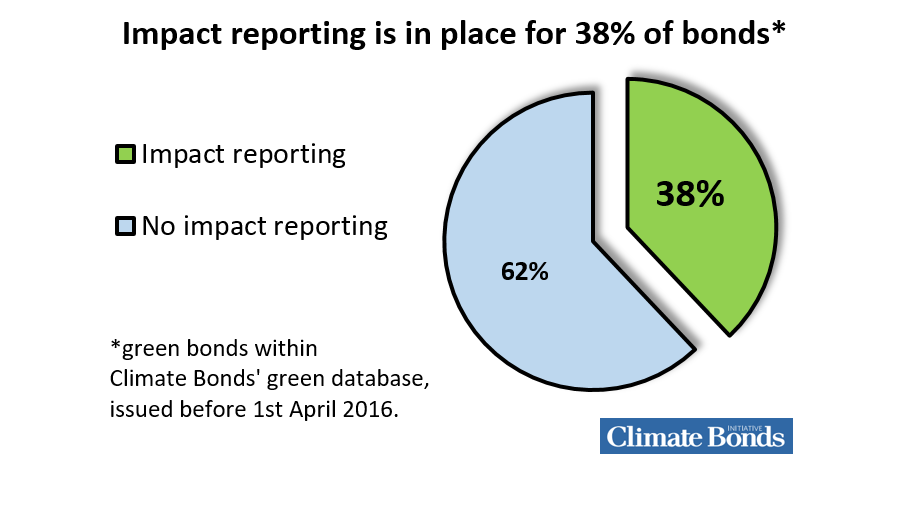

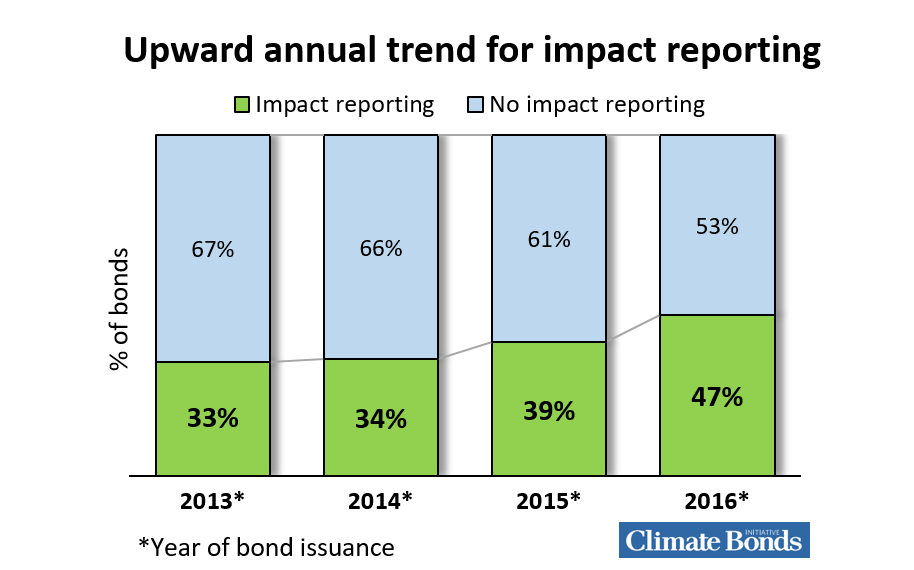

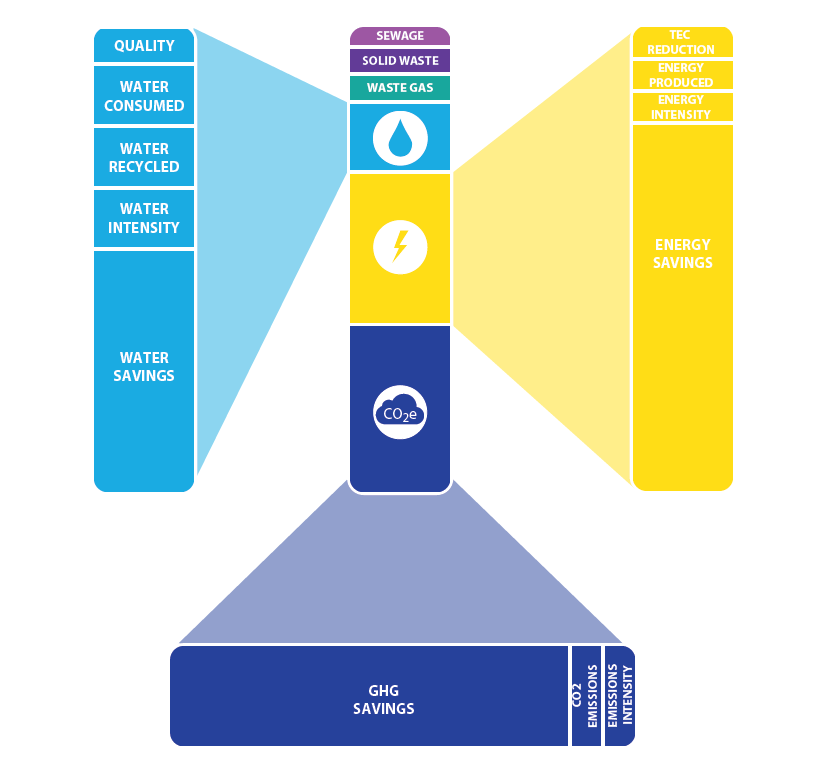

You can find out more about what levels of information green bond issuers are disclosing in our latest report Post-issuance reporting in the green bond market.

State Owned Institutions

RATP Group, EUR500m (USD559m)

The Régie autonome des transports parisiens (RATP), the French operator of Paris & Île-de-France Métro, tram, bus services, and some RER (Réseau Express Régional) trains has become the latest public transport organisation to issue a green bond.

The EUR500m 10-year bonds will be allocated to a variety of modernisation projects across the organisations operations.

Proceeds will be used for projects such as:

- Transport infrastructure maintenance and renovation

- Public transport rolling stock renovation and renewal to metros and RER (regional commuter) trains

- Other public transport low-carbon vehicles – electric or hybrid buses.

These all meet the Criteria outlined by the Climate Bonds Initiative for Low Carbon Transport.

By upgrading existing transport infrastructure, RATP is seeking to lower the carbon footprint of their current assets whilst rolling out low carbon alternatives such as electric or hybrid buses.

The group is one of the largest public transport operators in the world providing services in Europe, Asia, Africa and the Americas.

It has now taken the green bond track.

Policy makers everywhere should be urging their public transport groups to follow.

Second opinion was provided by Vigeo Eiris.

Underwriters: Crédit Agricole CIB, HSBC, Natixis.

Municipalities/Cities

King County, Washington State USD31.2m

King County in Washington State has become the latest US municipality to throw their hat into the green bond ring.

This USD31.2m issuance is the 29th green bond issued by US municipalities in 2017.

King County is committed to reducing GHG emissions from their own operations to 50% of their 2007 baseline by 2030.

In addition to these targets, the county has also developed a Strategic Climate Action Plan (SCAP) with the aim of identifying the best strategies for climate change mitigation and adaptation in the region.

The green bond will help achieve these targets by funding the following eligible projects falling under their green bond framework:

- Renewable Energy - Development of solar PV systems, wind and wholly dedicated transmission infrastructure, and bioenergy

- Energy efficient new buildings and upgrades - Net zero GHG emissions from municipal buildings, energy upgrades and retrofits, and communal heat systems

- Clean transportation - Infrastructure for urban rail systems, infrastructure for urban bus rapid transit (electric or hybrid), transit fleet conversion to electric drive buses, transportation infrastructure and logistics upgrades logistics

- Water infrastructure and efficiency upgrades

- Adaptation e.g. resilience infrastructure to reduce impacts of flooding and increased rainfall

A second opinion provided by CICERO can be found in the appendices of the official statement. They highlight King County’s comprehensive plan for climate action and have awarded it their highest rating - dark green, indicating that King County has a strong low carbon, climate resilient vision.

Proceeds will be managed and recorded in a designated account, which will track the use of funds and their allocation.

Underwriter: Citigroup.

City of Long Beach, California, USD26m

The City of Long Beach has joined fellow Californian Municipality, East Bay Municipal Utility District, in issuing a green bond this month.

This is in line with the Port’s plan to meet targets set by California’s Global Warming Solutions Act 2006 as outlined in the San Pedro Bay Ports Clean Air Action Plan.

Green bonds relating to port infrastructure are pretty new. We covered the Port of Los Angeles (POLA) green bond of Sept 2016 but that’s the only one we can find.

The proceeds of the Long Beach green bond have been designated for environmental improvements at the Port of Long Beach mainly through reducing GHG emissions by upgrading operational processes at the port to use equipment that is either electrified or zero emissions.

Eligible projects include:

- Electrified rail mounted gantry cranes

- Shore to ship power outlets which will allow ships to reduce emissions by shutting off auxiliary generators

- Developing infrastructure to assist electric automatic stacking cranes and electrified gantry cranes, removing the requirement for HGVs

We don’t have science-based criteria in place yet to define what the green port of the future looks like, and we don’t know all that much about the technologies they have outlined.

But the infrastructure upgrades are undoubtedly a step in the right direction and will improve environmental quality in the surrounding area by reducing dependence on diesel powered equipment and HGVs.

The second opinion provided by Sustainalytics is available here.

Underwriters: Citigroup, Merrill Lynch, Pierce, Fenner & Smith, and Siebert Cisneros Shank and Co.

Other Climate-Aligned Bonds

OPEN Cleantech has issued a EUR500m green bond. We have excluded it from the main section of this blog as we have yet to see a green bond framework or other information about the underlying projects.

While there is limited information to go on, a press release by OPEN Cleantech states that the proceeds for the bond will be used for “proven and innovative cleantech and renewable energy technologies, and tangible assets (for example onshore wind and solar photovoltaic plants)”.

On face value it looks good, but given the large size of the bond, we need some more transparency and disclosure around use of proceeds. And a green bond framework.

Spanish company Tradebe has recently raised EUR265m in what is believed to be the world’s first ‘green syndicated term loan’. Sustainalytics provided a second opinion and deemed it to be green on the basis that Tradebe’s income came from activities with a positive environmental impact, such as recycling and energy recovery.

Gossip and News Bites

Volvo and the end of the ICE Age for automobiles?

Volvo announced they are abandoning internal combustion engines and from 2019 they will only be producing electric and hybrid vehicles.

As highlighted in our previous market blog, last month’s green bond issuance by Volvofinans Bank allocated the proceeds to cars which met the definition of ‘environmentally friendly’ and vehicles that can be entirely or partially powered by non-fossil fuels.

The iconic Swedish brand has been owned by China based Zheijiang Geely since it was sold by Ford in 2010.

The company also announced that their first ‘all electric’ car will be produced in China.

No surprise there, as major cities are plagued by serious air quality issues and a transition to EVs as the passenger and light transport market grows being incorporated in policy directions.

Market Blog readers with good recall will have noted Zhejiang Geely issued a USD400m green bond in May 2016 to finance the development and manufacturing of the world famous London Black Cab to a new low emission model. Meeting Euro 6 emissions standards, the TX5 will be aimed at the domestic and export markets.

On the green horizon

The Rural Electrification Corp’s green bond is out! More analysis to come soon.

A green sukuk may be on the way in Malaysia from Quantum Solar Park for solar PV.

Mexican Grupo Rotoplas, specialized in water solutions such as storage, piping, purification and treatment products, just launched their inaugural Sustainability Bond.

Paris expects to launch in 2018 a dedicated green investment fund!

French Prime Minister Édouard Philippe announced the government will launch a EUR50bn investment plan to notably finance the low carbon transition, transport and agriculture sectors.

Natixis, Ivanhoe Cambridge, and Callahan Capital issue very first Green CMBS deal (more in next blog).

Axis Bank of India may be issuing green bonds in the near future. Railway operators, Eurofima and SNCF Reseau, are looking to issue green bonds in the near future.

The Indian EESL (Energy Efficiency Services Limited) is looking to raise USD100m dollars for environmental initiatives.

Sovereign and Policy News

The Fijian Government has confirmed that they plan on issuing $100 million in green bonds to combat climate change.

CBZ Bank of Zimbabwe is seeking to issue $200 million in green bonds.

Climate Bonds Q1-Q2 Policy Highlights is now available.

Reading and Reports

Climate Bonds report Post-Issuance Reporting in the Green Bond Market is available.

UNEP Enquiry Green Finance Update July 2017 is here.

PRI 10 Year Blueprint for Responsible Investment has been released.

EC HLEG Interim Report on Sustainable Finance is open for stakeholder comment. Download a copy. Give your feedback & respond to the questionnaire here.

OMFIF Monthly Bulletin: Green Finance Heats Up July 2017 is here.

CDKN & PWC have launched New Markets for Green Bonds. Understanding the building blocks of a green bonds market. We’ve only just come across this last one. It’s now on our reading list.

Moving Pictures

Take a coffee break. Catch a India, clean energy, infrastructure & green investment talk from Sean Kidney & Krishnamurthy Vijayan. 9mins. Well worth it.

Other market news

LuxFLAG (Luxembourg Finance Labelling Agency) launched their own certification scheme for green bonds.

The ICMA Green Bond Principles (GBP) have been updated. Latest version is here.

Global Capital is bullish about the prospects of green bonds.

Bank of China has become the first Chinese member of the Green Bond Principles Executive Committee.

Luxembourg Stock Exchange has launched an index which will track Chinese green bonds.

Rockefeller Foundation, Lion’s Head Global Partners, South Pole Group and Affirmative Investment Management (AIM) have pooled together to establish carbonyield.org, with the aim to quantify the climate change mitigation enabled by green bonds.

Zurich Brasil, Zurich Santander, and Brasilprev, are the latest signatories to the Brazil Green Bonds Statement coordinated by the Climate Bonds Initiative, Principles for Responsible Investment (PRI), and the Brazilian ESG body SITAWI.

The European Covered Bond Council has teamed up with the Climate Bonds Initiative to create a European Green Securities Steering Committee to drive green finance development within the EU.

Good Energy has issued a GBP10m green bond aimed at financing projects related to energy storage and electric vehicles.

Public sector institutional investors want more real estate, renewables and green bonds according to OMFIF latest survey Thomson Reuters reports.

Can't find a green bond story?

To make this blog more manageable, we're trying to report on 20 bonds at a time.

A few bonds came out as we were writing, including Korea Development Bank (KDB), Adif Alta Velocidad, Greenko, The Rural Electrification Corp, L&T Infrastructure Finance, Grupo Rotoplas and others. You’ll hear about them next time.

And Finally………

Happy Birthday EIB Green Bonds!! ![]()

The EIB has published a special newsletter this month, marking the 10th anniversary of their inaugural green bond.

Initially created with the ambition of “implementing EU objectives in the areas of energy policy and environmental protection”, to date, the EIB has issued over EUR18bn in green bonds.

The EIB just recently issued a new EUR1bn Climate Awareness bond. Yes, you read right, EUR1bn!

The press release also confirmed a new tree planting scheme.

Climate Bonds Initiative CEO, Sean Kidney, has nothing but praise:

“The EIB started this market. It continues to push and grow it, and ensures the market maintains a critical focus on climate change."

"We owe the Bank a great debt.”

Here’s to wishing the trailblazers at the EIB continued success in advancing green finance.

‘Till next time,

Climate Bonds

Disclosure: Several organisations named in this communication are Climate Bonds Partners. A full list of Partners can be found here.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.

.jpg)

.jpg)

.jpg)

.gif)

_60x85.jpg)

.png)

.png)

.png)

.png)

.png)

.png)