Golden State Makes Muni Green Finance Record - First to Reach $5 Billion

What's it all about?

Latest Climate Bonds Initiative analysis of US municipal green bond issuance shows California has just topped $5bn, the first state to reach the milestone and setting a new US record.

Issuance reached $5.03bn following the close of the $171.4m Climate Bonds Certified Transbay Transit Centre bond for the City and County of San Francisco.

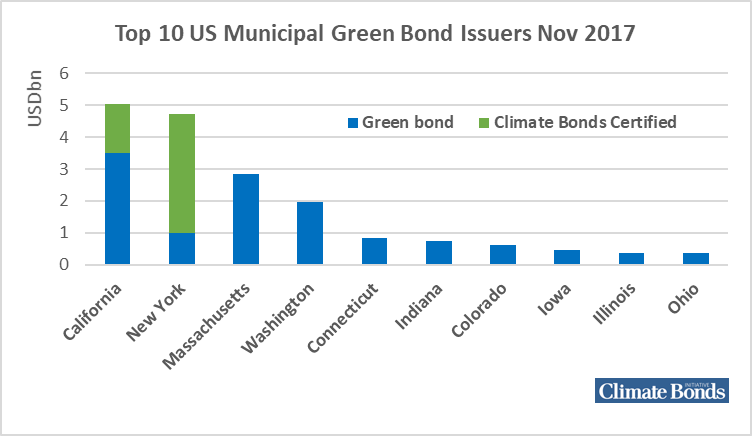

California currently leads US Municipal green issuance on bonds that have closed, followed closely by New York State on $4.73bn, Massachusetts on $2.83bn, Washington State at $1.9bn, with Connecticut, Indiana, Colorado, Iowa, Illinois & Ohio all under $1bn (Top 10 ranking below).

Green issuers have ranged from large institutions including IBank to smaller issuers such as the Trinity Public Utilities District and Midpeninsula Open Space District (Full list below).

A growing number of California issuers have also followed international best practice in gaining Climate Bonds Certification for their green issuance, including Bay Area Rapid Transit (BART), SFPUC and Los Angeles MTA.

Who's saying what

State Treasurer John Chiang:

“California has long been a national standard bearer in areas ranging from advancing civil rights to protecting our natural resources. In that same vein, the State of California and its municipalities lead the U.S. in the use of green bonds, raising more than $5 billion in affordable capital to both curb climate change and build critical infrastructure.”

“The achievement is laudable but not enough considering how the United States still lags behind Europe, Asia, and South America in taking advantage of climate-friendly green bonds to finance the conversion of a fossil-fuel based economy to a carbon-free alternative.”

“I am working to change that equation by hosting a major green bonds symposium in February. I am assembling the nation’s foremost experts to come up with ways to turbocharge this innovative, new market, with an eye toward unlocking its latent potential to pay for billions of dollars in investments to protect our planet from global warming.”

Justine Leigh-Bell, Director of Market Development Climate Bonds Initiative:

“Capital flows are moving in the right direction from diverse municipal issuers of every size across the state. The focus on water, energy and waste is very encouraging. The challenge now is to increase the number of green issuers across the state and encourage repeat issuance.”

“Our previous data at the end of Quarter 3 had New York State in front, but California has just nudged ahead to reach the landmark $5bn figure for municipal green bonds. The foundation is there to lead US states again and be first to reach $10bn."

“We expect the State Treasurer’s February 2018 Green Bonds Symposium and Governor Brown’s Global Climate Action Summit later in 2018 will both provide sub national, national and international momentum around green investment to address climate change.”

The Full Tables and Charts:

Chart 1.

Table 1.

Table 2.

California Municipal Green Bond Issuance Total: USD5.03bn as of 27.11.2017 | ||||

Issuer name | Date | Amount Issued USD | Use of Proceeds according to Climate Bonds’ Taxonomy | Climate Bonds Certified |

State of California | October 2014 | 300m | Energy Efficiency, Transport, Water, Land Use, Adaptation |

|

San Francisco Public Utilities Commission | May 2015 | 32m | Energy, Energy Efficiency |

|

City of Los Angeles | June 2015 | 188.7m | Water |

|

East Bay Municipal Utility District | June 2015 | 74.3m | Clean energy, Water, Adaptation |

|

City of Los Angeles | June 2015 | 100.8m | Water |

|

San Diego Unified School District | January 2016 | 100m | Clean energy, Energy Efficiency, Water, Waste Management, Adaptation |

|

California Infrastructure and Economic Dev Bank (IBank) | April 2016 | 410.7m | Water |

|

San Francisco Public Utilities Commission (SFPUC) | May 2016 | 240.5m | Water | Yes |

San Diego County Water Authority | June 2016 | 98.9m | Water |

|

Midpeninsula Open Space District | September 2016 | 57.4m | Land Use, Adaptation |

|

Port of Los Angeles | October 2016 | 35.2m | Energy Efficiency, Adaptation |

|

City of Napa | October 2016 | 12.5m | Waste Management |

|

Los Angeles County Sanitation District | November 2016 | 170.2m | Water, Adaptation |

|

San Francisco Public Utilities Commission | December 2016 | 259.3m | Water | Yes |

California Infrastructure and Economic Development Bank (IBank) | March 2017 | 450m | Water |

|

California Health Facilities Financing Authority | May 2017 | 408.3m | Energy efficiency |

|

City of Los Angeles | May 2017 | 450.1m | Water |

|

San Francisco Bay Area Rapid Transit (BART) | June 2017 | 384.7m | Transport | Yes |

California Pollution Control Financing Authority | June 2017 | 228.1m | Waste management |

|

East Bay Municipal Utility District | June 2017 | 185.3m | Water |

|

City of Long Beach | June 2017 | 25.9m | Clean energy, Energy efficiency |

|

Fremont Union High School District | July 2017 | 31.1m | Energy efficiency |

|

Santa Monica Public Financing Authority | September 2017 | 68.5m | Energy efficiency |

|

Los Angeles MTA | October 2017 | 471.3m | Transport | Yes |

San Diego Unified School District | November 2017 | 59m | Clean energy, Energy Efficiency, Water, Waste Management, Adaptation |

|

Trinity Public Utilities District | November 2017 | 20.8m | Clean energy |

|

City & County of San Francisco | November 2017 | 171.4m | Transport | Yes |

TOTAL cumulative issuance as of 27/11/2017 USD5.03bn | ||||

The Last Word

We can see the East Coast-West Coast effect we noted in our Quarter 3 Newsletter is set to continue, with more Certified muni green bond issuance slated for California and a huge Certified green issuance from New York MTA due to close in Mid December.

Meantime there's some 2018 momentum brewing on the West Coast. California State Treasurer John Chiang is convening a two day Green Bond Symposium on Feb 27-28, 2018 in partnership with the Milken Institute and Environmental Finance, in Santa Monica. He's been an active voice on green finance for some time now.

Later in the year Governor Gerry Brown will hold a Global Climate Action Summit in conjunction with the UNFCCC & other climate action leaders from September 12-14, 2018 in San Francisco.

We're hoping the February event in Santa Monica will spur a wider understanding and commitment to green municipal issuance, not just in California but across more of the lower 48.

There's no doubt the Global Climate Action Summit will also have an impact. Blog readers who watch the calendars closely will have noted that Governor Browns' event coincides with around 1,200 signatories to the PRI in Person 2018 conference being in town.

That's a lot of asset owners and managers to push the climate investment action message at.

Well done to California for leading the league ladder in November 2017 and leaders like Chiang and Brown for setting up the US sub-national agenda in 2018.

'Till next time,

Climate Bonds

Note: Green Bond Figures: All figures quoted are for labelled municipal green bonds that have closed and are accurate as of 30/11/2017.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.

****************************************************